🗝Lucky Rooms🗝

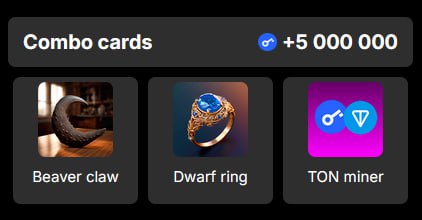

🆕Комбо на 31.12.2024🆕

👉Инструкция к игре👈

👉Начать играть👈

📏📏📏📏📏📏📏📏📏📏📏

#Chick_Coop #Blum #cornbattles #cityholder #notcoin #notcoinbot #notmeme #bcoin2048 #luckyrooms

📏📏📏📏📏📏📏📏📏📏📏

🔥🔥Boost канала🔥🔥

📈Обучение | 🤑Майнинг

😎Bybit | 🧐Mexc | 🤑OKX