💰

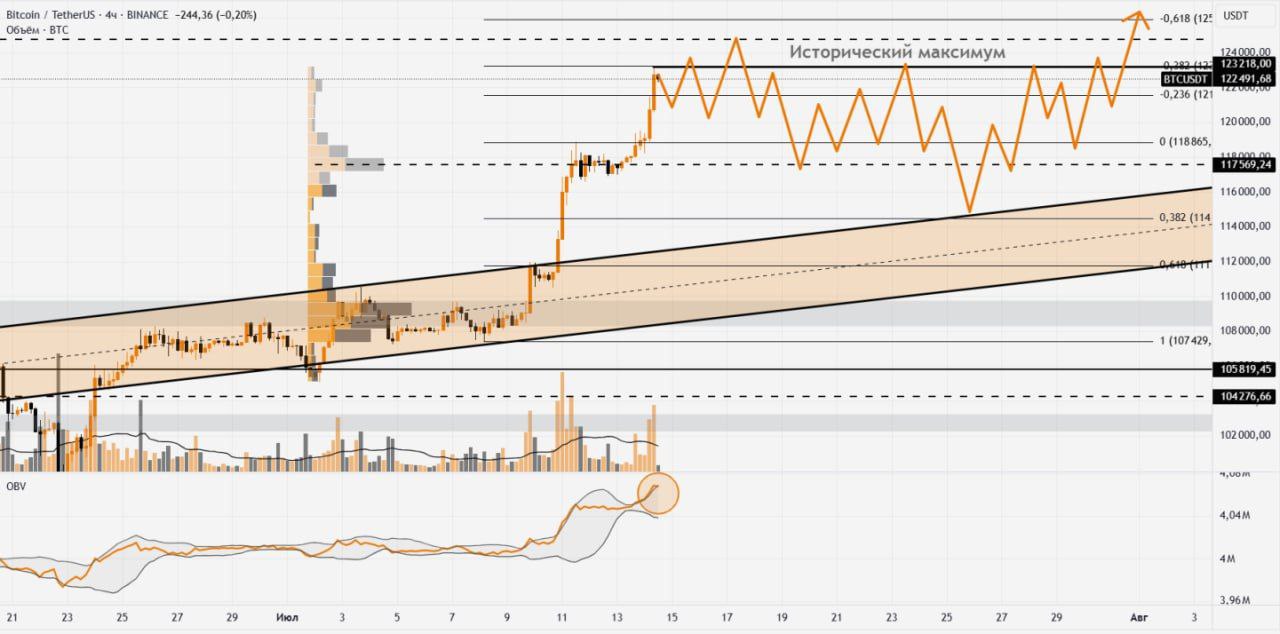

#BTC (4H).

Как и ожидалось, биткоин пошёл в атаку на зону $119 000, но спрос превзошёл прогнозы. В итоге актив обновил исторический максимум, достигнув $123 218 на Binance.

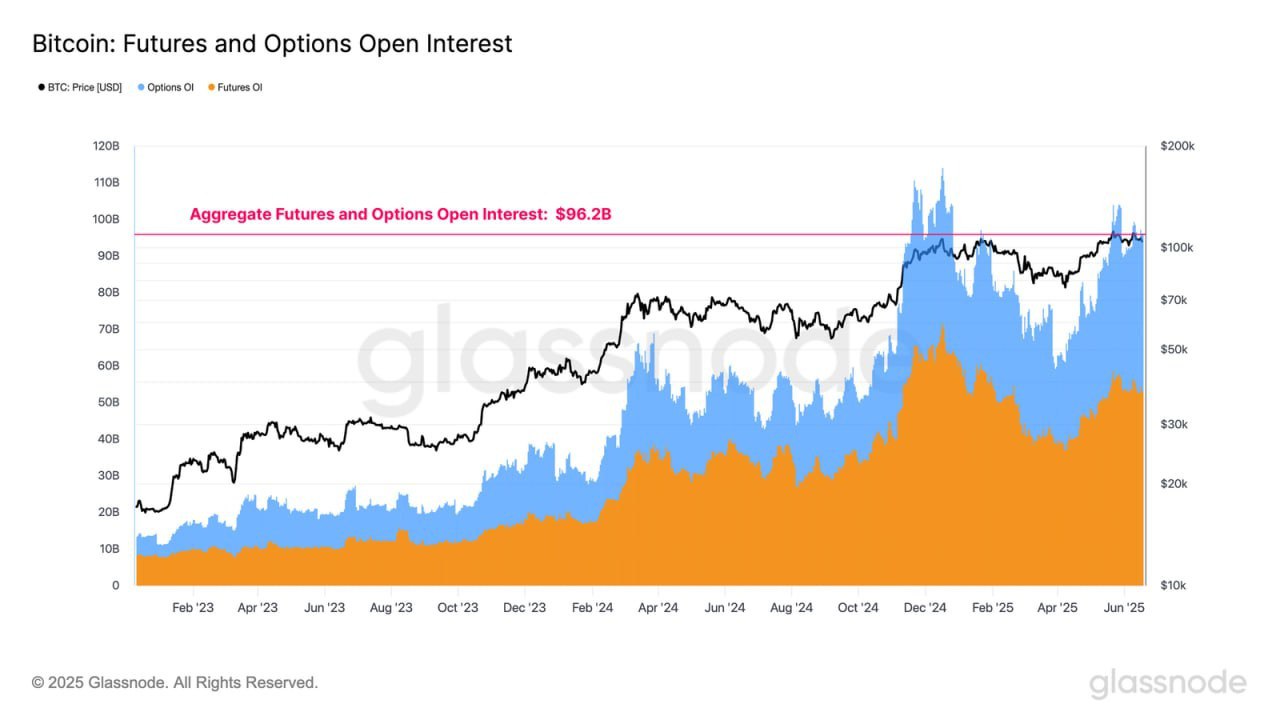

Примечательно: на росте OBV пробил верхнюю границу Полос Боллинджера — сигнал повышенной активности крупных игроков. Обычно за таким всплеском следует консолидация или краткосрочная коррекция, пока индикатор не вернётся внутрь диапазона.

Биткоин приблизился к цели в $125 000, озвученной в прошлых обзорах. В ближайшее время ожидаю тест этой зоны с возможным откатом. Поддержкой выступает объёмный уровень $117 500 — оттуда вероятна новая попытка переписать максимум. Если не удержится, следующая опора — верх канала в районе $115 000.

💰

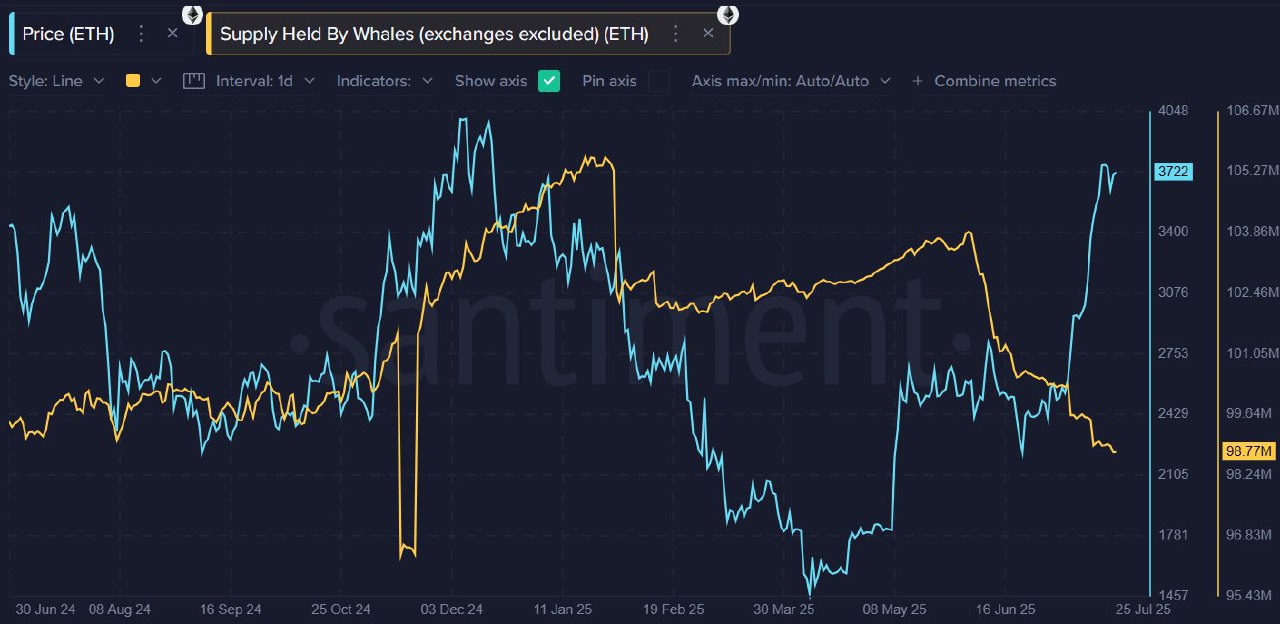

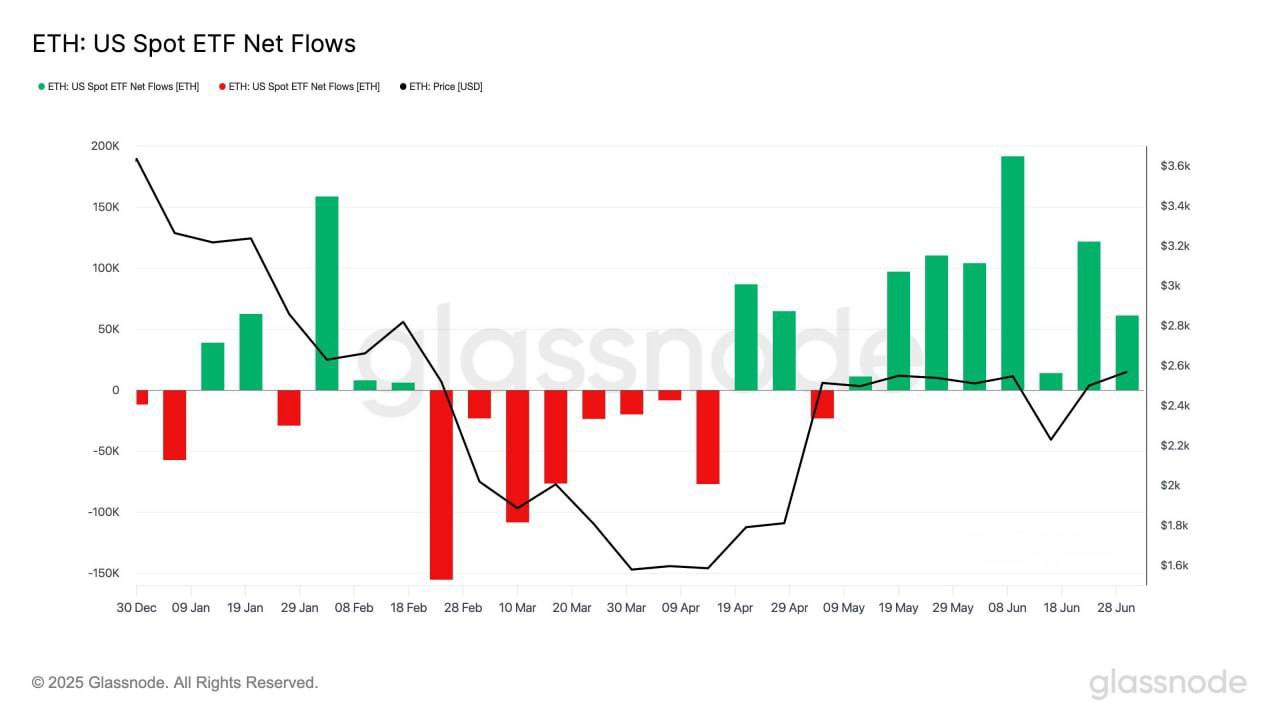

#ETH:

Эфир продолжает рост следом за биткоином. Текущий замедление — вблизи $3 070. После отката к $2 990 жду импульс к блоку продавца на $3 150.

▫️Дубайский регулятор финансового рынка (DFSA) одобрил запуск QCD Money Market Fund (QCDT) — первого фонда денежного рынка, основанного на токенизации активов (

1).

Проект реализуют Qatar National Bank из Катара и технологическая компания DMZ Finance. Согласно поданной в DFSA документации, QCDT будет переводить в цифровой формат традиционные финансовые инструменты — прежде всего казначейские облигации США, — а также инвестировать в стейблкоины и развивать связанные платежные решения. Банк QNB возьмёт на себя формирование инвестиционного портфеля, а DMZ Finance обеспечит техническую основу блокчейн‑архитектуры.

Представители фонда отмечают, что одобрение со стороны DFSA укрепляет репутацию Дубая как мирового хаба для цифровых финансов и подчёркивает готовность эмирата к масштабному внедрению токенизированных реальных активов (RWA). Ранее австрийская криптовалютная биржа Bitpanda получила в VARA лицензию брокера‑дилера, став первой строго регулируемой европейской платформой цифровых активов на территории ОАЭ.

Инициативы подобные QCDT создают прямой канал между обычными банками и блокчейном. Традиционные активы, выключая казначейские облигации США, переводятся в цифровой формат, что обеспечивает прозрачность и лёгкость проверки транзакций. Интеграция стейблкоинов и банковского сектора позволит мгновенно рассчитываться и получить круглосуточный доступ к средствам. Такая схема снизит издержки и уменьшит влияние бюрократии. Регуляторная поддержка DFSA придаёт проекту надёжность и демонстрирует готовность эмирата к цифровым инновациям. Думаю, со временем такие платформы станут основой глобального рынка RWA, который к концу десятилетия может вырасти до двузначных значений в триллионах долларов США.

▫️Альты: в преддверии запуска нового RWA-продукта от платформы PinLink (

#PIN) стоимость

#PIN увеличилась на 28% (к

#USDT).

Новость о том, что компания AP+, являющаяся членом Hedera Governing Council платформы Hedera (

#HBAR), была отобрана для участия в токенизационном пилоте ЦБ Австралии стала причиной роста

#HBAR на 25% (к

#USDT).

Стратегическое партнерство Chintai (

#CHEX), заключенное с компанией R3 Sustainability, привело к удорожанию

#CHEX на 23% (к

#USDT).

▫️Совокупная капитализация цифровых активов увеличилась на 3,6% за последние 24 часа, доля главной криптовалюты поднялась на 0,25%. На днях Трамп пообещал обложить пошлинами 30% товары из Евросоюза и Мексики, начиная с 1 августа. Примечательно, что на этом фоне вместо коррекции биткоин обновил свой исторический максимум, что говорит о силе нового класса активов.