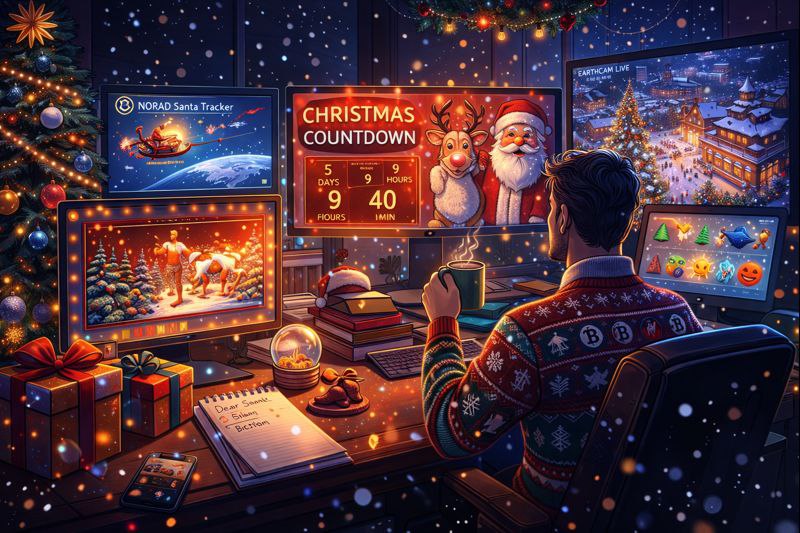

2025-й был шумным, местами нервным и очень насыщенным. Иногда полезно просто выдохнуть, переключиться и напомнить себе, что мир чуть шире графиков

Вот несколько новогодних сайтов — лёгких, уютных и немного ироничных:

🔸

NORAD Santa Tracker — наблюдать за маршрутом Санты и на пару дней перестать следить за цифрами

🔹

Google Santa Tracker — игры, музыка и ощущение, что дедлайн всё-таки можно подождать

🔸

Christmas Countdown — таймер, который приятно тикает и никуда не торопит

🔹

Xmas Radio — фоновая музыка для вечеров без новостей и ленты X

🔸 Elf Yourself — иногда полезно увидеть себя не слишком серьёзным

🔹

Snow Days — немного снега на экране, даже если за окном его нет

🔸

Write a Letter to Santa — формулировать желания аккуратно — полезный навык

🔹

Winter Wallpapers — обновить фон — иногда этого достаточно

🔸

Radio Garden — рождественское радио из любой точки мира, без геополитики

🔹

Santa Call — неожиданный звонок, который не несёт новостей

🔸

Snow Simulator — визуальный шум, от которого не устаёшь

🔹

Christmas Quotes — цитаты, которые приятно читать медленно

🔸

Emoji Kitchen — немного визуальной игры для настроения

🔹

EarthCam Christmas — праздник в разных городах мира в реальном времени

🔸

TickCounter — любой отсчёт — хороший повод остановиться

🎅 Иногда лучший апдейт — это пауза. Пусть праздники пройдут спокойно, а новый год начнётся без спешки и лишнего шума

🎄 С наступающим Новым Годом, Друзья!!!

Crypto 🍋💲