❌ Криптаны в X снова разгоняют интересную тему.

По слухам, правительство США может начать закупать BTC в свой баланс. Поводом стал загадочный пост сенатора Синтии Ламмис: «₿ig things coming for Franklin!» Некоторые уже уверены, что речь идет о первых намеках на государственные покупки биткоина.

👆 Если это подтвердится, рынок может получить один из самых сильных фундаментальных импульсов за последние годы.

Мое мнение по этому поводу:

Прямые покупки BTC государством пока выглядят маловероятно. Но то, что риторика американских политиков меняется в сторону принятия крипты — факт. И даже такой «криптофрендли» намек способен подогреть ожидания рынка и создать новый ростовой хайп.

Как думаете, это реальный инсайд или просто фраза, которую все восприняли слишком буквально?

English 🇺🇸

Cryptans in X are once again spreading an interesting topic.

According to rumors, the US government may start purchasing BTC into its balance sheet. The reason was a mysterious post by Senator Cynthia Lummis: "ig things coming for Franklin!" Some are already convinced that we are talking about the first hints of government purchases of bitcoin.

If this is confirmed, the market may receive one of the strongest fundamental impulses in recent years.

My opinion on this:

Direct purchases of BTC by the government still look unlikely. But it is a fact that the rhetoric of American politicians is changing towards the adoption of cryptocurrencies. And even such a "crypto friendly" hint is able to warm up market expectations and create a new growth hype.

Do you think this is a real insider or just a phrase that everyone took too literally?

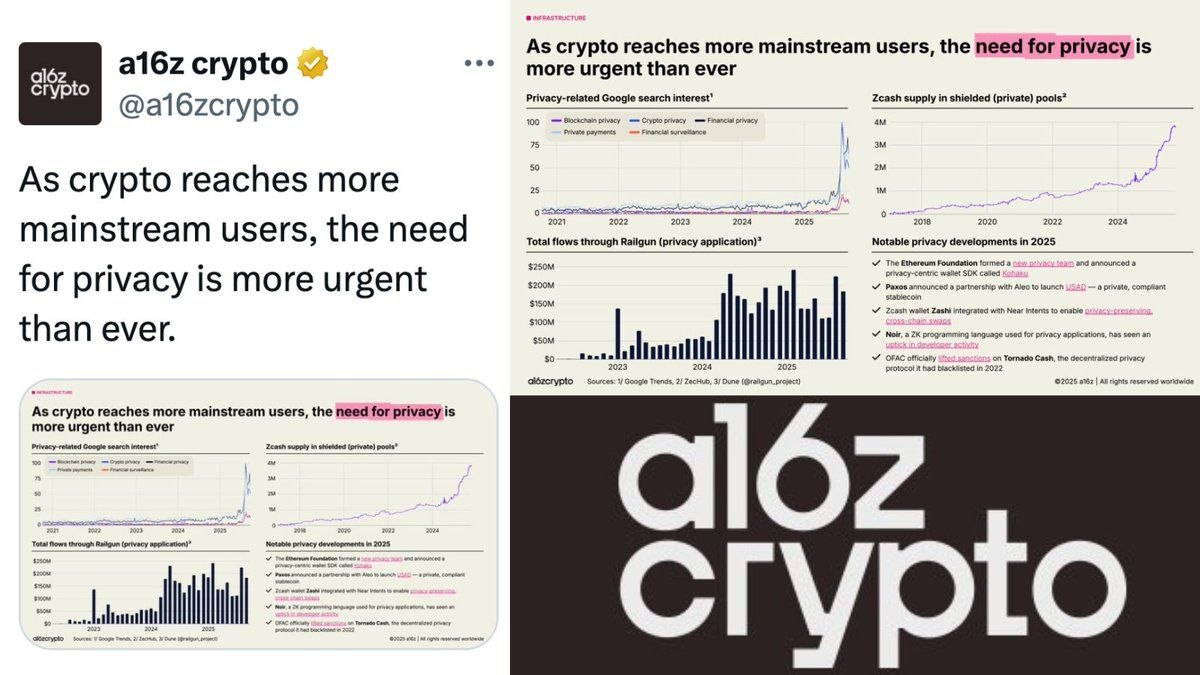

JUST IN: a16z Crypto states that as cryptocurrency gains more mainstream adoption among users, the urgency for enhanced privacy features has never been greater.

🚀 What should I launch this week?*

Our trader-analyst Egor has prepared a market analysis and recommendations for you on the current instruments👇

On Monday, in our weekly analysis, we expected a continuation of the decline, which is exactly what happened. When the $105,600-$104,500 (volume anomalies) buy zone was tested, there was a sharp increase in volumes. At the moment, there was a sale absorption, but when the price was retested, it easily passed this level without much resistance.

At the moment, we’ve tested the lower boundary of the global flat at $102,000-$116,000. Here, we see strong volume anomalies that could lead to a correction. However, this isn’t enough for a full-fledged reversal, as the structure remains downward, and there is a wide area of seller-driven volumes above the current values.

Until the end of the week, we can consider a sideways movement between two volume zones: the level of ~$101,000 and the range of $103,700-$106,700. However, shorts are the priority. If the buyer doesn’t show activity today, the next reference point will be the volume zone of $97,000-$93,000.

💡 What should we pay attention to?

The dominance of the first cryptocurrency remains high, so long-term strategies will require careful selection of coins. Of the TOP 50 by capitalization, $DASH and $ZEC have maintained a steady trend.

🤖 What should I launch?

Futures bots

The most conservative and secure option in the current conditions is to use futures trading bots:

• Crypto Future;

• High Volumes;

• Mean Reversion.

*This post is not financial recommendation. Make decisions based on your own experience.

#algotrading

🌐CryptoRobotics 💬Chat

👍X 💬Discord 🎥YouTube

😵💫США СВОРОВАЛИ У НАСЕЛЕНИЯ $35M ???

Не совсем так..

На днях США конфисковали очередную партию в размере ~127 000 🪙 BTC у мошенников из Камбоджи, что помогло нарастить бюджет на $13 млрд долларов.

Всего у США на балансе теперь 326 373 BTC или 1.5% всего возможного количества монет.

На втором месте Китай в своём бюджете они хранят —190.000 BTC, Россия официально не накапливает биток, однако..

🇷🇺 Генпрокурор РФ подтвердил, что в России прорабатывается введение ответственности за незаконный оборот криптовалют, включая порядок их изъятия и обращения в доход государства.

Уже создана правовая база для контроля за майнингом и транзакциями, связанными с отмыванием денег, коррупцией и терроризмом — ожидается, что новые меры также коснутся уголовной и административной ответственности за незаконные операции с цифровой валютой.

⬇️English Version⬇️

⚡️The US Seized $3.5B in Crypto? Here's What Really Happened.

Not exactly.

Recently, US authorities confiscated another batch of approximately 127,000 BTC from Cambodian scammers. This seizure has contributed an estimated $13 billion to the state budget.

The US government now holds a total of 326,373 BTC, which is about 1.5% of the total possible supply.

China holds second place with 190,000 BTC in its reserves. Russia, officially, does not accumulate Bitcoin. However...

🇷🇺Russia's Prosecutor General has confirmed that the country is developing legislation to establish liability for the illegal circulation of cryptocurrencies. This includes procedures for their seizure and transfer to state revenue.

A legal framework has already been created to control mining and transactions related to money laundering, corruption, and terrorism. New measures are also expected to introduce criminal and administrative liability for illegal digital currency operations.

💎@Multilangcrypto🌉

7 октября 2025 года S&P Dow Jones Indices объявил о запуске индекса S&P Digital Markets 50, который объединяет 15 криптовалют (выбранных из существующего индекса S&P Cryptocurrency Broad Digital Market Index) с 35 публично торгуемыми компаниями, занимающимися криптовалютными операциями, инфраструктурой, блокчейн-приложениями, финансовыми услугами и связанными с ними технологиями.

👉 S&P внезапно представила крипто-индекс DM50.

💵 Новый индекс Digital Markets 50 (DM50) смешивает цифровые монеты с бумагами компаний, имеющих какое-то отношение к блокчейну (15 монет и 35 акций от Coinbase до производителей железа для майнинга).

🍆 В 2021-м S&P уже выкатывала гигантский Cryptocurrency Broad Digital Market на 240 токенов с кучей левой хуйни, DM50 — умная выжимка без непонятных щитков.

Точка G входа для крупных консервативных инвесторов? 💩

🚀 What to launch this week?*

Our trader-analyst Egor has prepared a market analysis and recommendations for you on relevant instruments👇

Last week, Bitcoin showed an explosive growth, breaking through all key selling zones. However, as we expected, the price failed to consolidate after reaching ATH. Despite weak market sell, we previously observed the absorption of purchases by limits and a decrease in the buyer's performance.

This week, we can expect a rebalancing, a trend reversal, and a correction with targets of $120,000 and $116,000. An alternative scenario is the formation of a sideways trend with a subsequent confident breakout. In this case, a long entry from current levels can only be considered during a correction.

At the global level, the low Fear and Greed Index (62) and the high value of Bitcoin, along with the low activity of sellers, indicate that there is still potential for growth within this month.

Although the first cryptocurrency set a powerful trend for the entire market, its dominance has hardly changed. It remains high, and in the event of a strong correction, it’s likely to pull most altcoins with it.

💡 What to pay attention to?

Longs are now acceptable, but with special caution. Projects from the TOP-50 or TOP-100 can show the greatest potential. Their correlation with Bitcoin during the sideways period is lower, which gives a chance for an independent movement.

🤖 What to launch?

Spot bots

You can take a look at the spot bots on our platform, but with careful selection of coins.

Futures bots

And to play on a probable correction, we hedge with futures bots on CryptoRobotics.

*This post is not a financial recommendation. Make decisions based on your own experience.

#algotrading

🌐CryptoRobotics 💬Chat

👍X 💬Discord 🎥YouTube

The Power of Unchained Transactions

Imagine a world where cryptocurrency transactions aren't limited by blockchain borders. Unchained transactions make this a reality, enabling seamless transfers between different blockchain networks and off-chain solutions. This innovation unlocks interoperability, scalability, and efficiency, breaking free from the constraints of a single chain.

Think of it like international travel. Just as you can journey between countries without being tied to a specific airline or route, unchained transactions allow you to move assets between blockchain networks without restrictions. This freedom lets users access a wider range of services and opportunities, maximizing the potential of cryptocurrency.

The importance of unchained transactions lies in their ability to enhance the efficiency and functionality of cryptocurrency transactions. By leveraging cross-chain and off-chain solutions, users can enjoy faster, more secure, and scalable transactions.

📈Crypto_whales

Во имя отца, сына и QE

В пятничном интервью New York Post Эрик Трамп сказал очень интересную вещь:

Лидия: How do you think Bitcoin's going to go?

Как вы думаете, что будет с биткоином?

Эрик: I've always said that in time bitcoin surpasses $1 million with quantitative easing starting tomorrow when all signs point unless he gets laughed at but starting tomorrow we'll see what happens happening with M2, which is the money supply around the world, which is skyrocketing right now. Fourth quarter has always historically been generally the best quarter for cryptocurrencies...

Я всегда говорил, что со временем биткоин превысит $1 млн. А с запуском количественного смягчения уже завтра… ну, все признаки указывают… если только всё не сорвётся, но начиная с завтрашнего дня мы посмотрим, что будет происходить с M2 — это мировая денежная масса, которая сейчас буквально взлетает. Четвёртый квартал всегда исторически был лучшим кварталом для криптовалют...

▫️Естественно, никакого QE в субботу не планировалось. Забавно, что ведущая рубрики NYNext Лидия Мойнихэн не стала уточнять, что Эрик имеет в виду под этой кашей из слов. Хотя она должна была бы включить Билла Мясника из фильма Банды Нью-Йорка:

Да что ты, чёрт побери, такое несёшь!?

➡️ Самая странная часть в словах Эрика — “unless he gets laughed at”. Мы перевели, как «если только всё не сорвётся», хотя дословно это «если его не высмеют» или ближе к контексту «если только это не окажется шуткой». В любом случае, звучит как шизофазия.

▫️В субботу Дональд Трамп делает очередной наезд на Пауэлла, несмотря на то, что ФРС в последнее время удовлетворяет все запросы президента. Кто не видел: Донни опубликовал картинку, на которой он говорит Пауэллу “You are fired!” (ты уволен). Это, кстати, одна из коронных фраз Трампа еще со времен передачи The Apprentice.

✔️ Складываем теперь месседжи отца и сына и получаем намек на ускорение печатного станка в 2026 🤑. Похоже, семья Трампов намерена любой ценой пампить рынок и своё портфолио.

◽️Осталось только удержать рейтинг одобрения президента на более или менее приемлемых значениях к моменту назначения Стивена Мирана (самый вероятный кандидат) новым главой ФРС. В настоящий момент Трамп справляется лучше своего первого срока (тогда к сентябрю 2017 его работой были недовольны ≈55%, сейчас ≈53%). Но до мая 2026 ещё много испытаний, включая геополитические. Постоянное переобувание Трампа влияет на его рейтинг однозначно: поддержка Донни снижается более быстрыми темпами, чем у среднестатистического президента США в прошлом.

P.S. Котик, живущий в районе старого пирса, наблюдает, как мечты о низкой долларовой инфляции уходят в закат.

Crypto Transaction Fees

When you send cryptocurrency, you'll encounter a small but important cost: the transaction fee. This fee is paid to miners, who collect and validate transactions into blocks. The fee amount varies depending on the cryptocurrency, transaction data size, and network congestion.

Think of it like sending a package: the bigger the package (transaction data), the more it costs to ship (higher fee). And if the postal service (miners) is busy (network congestion), they prioritize packages with higher shipping costs (transactions with higher fees).

Miners earn fees for the blocks they mine, in addition to the block reward. This incentivizes them to prioritize transactions with higher fees, ensuring faster processing and confirmation. Understanding transaction fees helps you navigate the crypto landscape and make informed decisions when sending cryptocurrency.

In short,transaction fees are a small price to pay for the convenience and security of cryptocurrency transactions.

📈Crypto_whales

Как новичкам избежать распространённых ошибок при торговле криптовалютой

Торговля криптовалютой — это не только возможность заработать, но и множество подводных камней. Многие новички совершают одни и те же ошибки, которые могут дорого обойтись. Как их избежать и что нужно учитывать с самого начала? Вот несколько советов:

1️⃣ Не использовать всё своё время на одну сделку. Один из самых популярных фатальных ошибок новичков — это попытка «поймать» каждую волну. Часто из-за страха пропустить прибыль, новички открывают позиции без должного анализа.

Начинай с маленьких позиций, чтобы понять рынок и учиться на реальных примерах, не рискуя всем сразу.

2️⃣ Игнорирование стоп-лоссов. Не устанавливать стоп-лосс — это путь к большим потерям. Многие начинают торговлю без защиты от убытков и теряют всё, как только рынок идёт против их позиции.

Всегда устанавливай стоп-лосс для ограничения потерь. Это поможет тебе контролировать риски и избежать внезапных убытков.

3️⃣ Пропуск анализа рынка. Иногда новичкам кажется, что рынок криптовалют — это исключительно удача. Торговля без анализа и стратегии ведёт к случайным результатам.

Используй технический анализ, следи за новостями и изучай тренды. И главное — придерживайся своей стратегии.

4️⃣ Не контролировать эмоции. Торговля криптовалютами — это сильные эмоции: страх, жадность, эйфория. Без контроля над эмоциями легко потерять деньги, поддавшись панике или чрезмерному оптимизму.

Следи за своими эмоциями, не принимай решений импульсивно. Понимание своих чувств в процессе торговли поможет тебе избежать большого числа ошибок.

5️⃣ Пренебрежение рисками и неправильное использование плеча. Многие новички начинают использовать высокий кредитный рычаг в стремлении увеличить свою прибыль. Но это также увеличивает и риски.

Используй небольшое плечо на начальных этапах. Понимание того, как работает плечо, поможет тебе избежать серьёзных потерь.

6️⃣ Не учитывать комиссионные сборы. Невнимание к комиссионным сборам может привести к тому, что сделка не принесёт прибыль, а в худшем случае — окажется убыточной.

Всегда учитывай комиссию за торговлю и вывод средств, особенно на централизованных платформах. Используй платформы с выгодными условиями, чтобы минимизировать затраты.

7️⃣ Отсутствие диверсификации. Многие новички вкладывают все свои деньги в одну криптовалюту, что увеличивает риски.

Диверсифицируй портфель. Даже небольшие инвестиции в разные активы могут помочь снизить риски.

8️⃣ Попытка "поймать" дно или пик рынка. Ставки на то, что цена обязательно пойдёт вверх или вниз, часто приводят к потерям. Предсказать поведение рынка с точностью невозможно.

Лучше воспользоваться стратегией усреднения или продать постепенно, чтобы не попасть в ловушку на пиках и падениях.

❗️Торговля криптовалютами может быть прибыльной, если подходить к ней разумно. Избегание распространённых ошибок, таких как игнорирование анализа, использование стоп-лоссов и контроль эмоций, поможет тебе строить успешную стратегию.

Для начала торговли криптовалютой и получения всех необходимых инструментов для анализа и защиты сделок, можешь попробовать Bybit.

#Cryptocurrency #Трейдинг

How to Identify Undervalued Cryptocurrencies with Long-Term Potential?

In the cryptocurrency market, finding undervalued projects with long-term potential is the key to significant returns. Knowing how to identify promising coins and when to invest can fetch you life-changing money in just a few years or even months.

Here are some tips to help you spot promising coins and make informed investment decisions:

▪️Check Market Capitalization: Low market cap coins often present more growth opportunities compared to higher market cap coins.

▪️Research Backers and Partners: Look into the project's backers, partners, and notable investors, including VC funds and angel investors.

▪️Evaluate the Team and Social Media Presence: Confirm if the project has a strong team and an active social media presence, which indicates ongoing development and community engagement.

▪️Examine Tokenomics: Scrutinize the tokenomics of the cryptocurrency, including its supply, distribution, and inflation rate.

▪️Assess Use Case: Evaluate the real-world use case of the cryptocurrency and its potential for adoption and utility.

Remember, it's important to do your own research (DYOR) and not to be discouraged by short-term market volatility. Focus on long-term profitability and informed decision-making.

📈Crypto_whales

🐋 BloFin Futures — new exchange on CryptoRobotics!

Great news: futures trading on one of the most actively growing cryptocurrency exchanges, BloFin, is now available on our platform 🔥

Why should you pay attention to BloFin Futures?

• More than 530 futures pairs

• Trading with leverage up to X150

• High liquidity

• Reliability and security: integration with Fireblocks and Chainalysis

• Transparency and compliance with standards: Proof of Reserves and ISO 27001 certification

📂 Instructions for creating API keys for BloFin Futures.

Start trading on BloFin with CryptoRobotics 💎

#algotrading

🌐CryptoRobotics 💬Chat

👍X 💬Discord 🎥YouTube

📚 What Is Tokenomics? | The Master Plan Behind Every Token

🍿 Tokenomics is the blueprint of every cryptocurrency, it defines how tokens are created, distributed, and given value.

In this video, we explore the fundamentals of Tokenomics, using Bitcoin and HPO as clear examples.

#hipolearn

Buy HPO ││ Stake TON ││ Join Hipo Club ││ Follow Hipo ││ Watch & Learn ││ Hipo Chat

Leveraging cutting-edge technology and a customer-centric approach, Hash Miners Social Committee offers a sustainable approach to cryptocurrency mining in 2025. Whether you're a seasoned investor or a beginner, the platform ensures profitability and ease of use.

https://hashedmining.com/">Become a new member and receive $100 in platform credit. This bonus serves as a welcome bonus and a testament to your earning potential.

Join Cloud Mining and receive a free airdrop to kick-start your journey to cryptocurrency wealth! This limited-time airdrop and free mining rigs will help you mine effortlessly and earn profits every day!

**High-Yield Contract Plans Available**Looking for higher returns? Join a more profitable contract plan for long-term growth. These flexible plans can help you steadily increase your income while optimizing your financial planning. Official Website https://hashedmining.com/">https://hashedmining.com

➡️ На рынках продолжается рост) Биток обновляет хаи, а Эфир к ним вплотную приближается!

➡️ Однако, несмотря на стремительное ралли эфира, настроения мелких инвесторов в отношении перспектив второй по капитализации криптовалюты ухудшились, рассказали эксперты ончейн-платформы Santiment

🟢 «Трейдеры демонстрируют страх, неуверенность, сомнение и недоверие, несмотря на то, что актив обновляет локальные максимумы. Медвежьи комментарии в социальных сетях относительно эфира перевешивают оптимистичные высказывания»

🟡 Самое время идти против "толпы"?)

➡️В это-же время звучат прогнозы о том, что курс Эфира к концу года может достичь $7500, а позже, к 2028 году, превзойти $28 000 - об этом заявляют аналитики британского банка Standard Chartered

➡️ Международный брокер FBS спрогнозировал наступление долгожданного сезона альткоинов, выделив три криптоактива с наиболее сильной динамикой цены и значительным потенциалом роста

🟢 По мнению экспертов FBS, сейчас биткоин постепенно отдает доминирование на рынке криптовалют эфиру и топовым альткоинам, занимающим высокое положение в рейтинге криптоактивов.

🟢 Эфир превосходит биткоин по скорости роста цены, сигнализируя о начале цикла сезона альткоинов, который может развернуться в полную силу уже в конце августа, верят брокеры

🟢 «Признаки очевидны: эфир набирает силу, доминирование стейблкоинов падает, а капитал крупных компаний перемещается в альткоины. Исторически эти сдвиги были ранними признаками наиболее динамичных циклов крипторынка. Сезон альткоинов не просто приближается — он уже в разгаре», — заявили аналитики FBS

➡️ Нейросеть Grok, созданная компанией Илона Маска xAI, назвала биткоин лучшим криптоактивом для инвестиций на ближайшие десять лет. Запрос к чат-боту сформулировал сооснователь венчурного фонда CMCC Crest Вилли Ву. И этим активом оказался... DOGE Биткоин)

🟢"Прогнозы экспертов указывают, что к 2035 году актив может подорожать до $1 млн. Росту стоимости криптовалюты могут способствовать дефицитность актива, интерес институционалов, а также популярность биткоина как хеджа против инфляции на фоне сдвигов в мировой экономике"

➡️ Банковские ассоциации Америки очень сильно переживают за сохранность своих банковских систем в виду популярности стейблкоинов. О чём даже начали пописывать письма в Конгресс.

➡️ Согласно Chainalysis Global Crypto Adoption Index 2024, Россия занимает седьмое место в мире по уровню криптоактивности, Казахстан входит в топ-20, а Белоруссия и Грузия показывают двузначные темпы роста числа транзакций

🟢 По данным Triple A Cryptocurrency Ownership Data 2024, криптовалютой владеют около 14,6 млн россиян (10,2 % населения), 1,5 млн казахстанцев (7,8 %) и 800 тысяч жителей Азербайджана (7,3 %)

➡️ В Казахстане на Международной бирже Астаны (AIX) начались торги акциями (паями) спотового биткоин-ETF под тикером BETF. Биржевой фонд создан казахстанской инвестиционной компанией Fonte Capital, его бумаги доступны всем категориям инвесторов, включая неквалифицированных и иностранных ;)

➡️ Telegram исполнилось 12 лет — мессенджер был официально запущен 14 августа 2013 года (вышла первая версия для iOS)

➡️ Вероятно в качестве подарка - Роскомнадзор сообщил об ограничении звонков через Telegram и WhatsApp в РФ

➡️ Сам-же Телеграмм по имеющейся информации на кануне через продажу ТГ-звёзд собрал более 3 млн долларов с людей ожидающих выход новых подарков

🟡 Однако подарки пока так и не вышли - такой вот подарочек)) Впрочем, ничего нового)

☁️ А чем вам запомнилось 13 августа 2025 года?

Начни свой день с огонька 🔥

- - - - - - - - - - - - 🤓 Ton Cryptans | Чат | MRKT

- - - - - - - - - - - -

content in your language / فارسیفارس

🔄 CEXiO | Link: JOIN

➖➖➖➖➖➖➖➖➖➖➖

What moves crypto prices? Bitcoin, news and order books

1. What makes technical analysis somewhat predictable?

✅ Thousands of traders act on the same chart patterns

2. What role does psychology play in crypto prices?

✅ Emotions like fear and FOMO drive buying and selling decisions

3. Why do you see different Bitcoin prices on different exchanges?

✅ Each exchange has its own trading activity and order book

4. What happens when some cryptocurrencies burn tokens?

✅ Supply shrinks, which can push prices up

5. What do price trackers like CoinMarketCap show?

✅ An average of prices from multiple exchanges

6. When does the crypto market trade?

✅ 24 hours a day, 7 days a week

7. What is an order book?

✅ Where buyers list what they’ll pay and sellers list what they want

8. What determines crypto prices at their core?

✅ Supply and demand

9. What is liquidity in crypto trading?

✅ How easily you can buy or sell without affecting the price much

10. What happened when Tesla announced it would accept Bitcoin?

✅ The price usually jumped

11. Which exchange was mentioned alongside Binance and Coinbase in the video?

✅ Kraken

12. How many Bitcoin will ever exist?

✅ 21 million

➖➖➖➖➖➖➖➖➖➖➖➖

💬Chat ❕ 📹AllCode❕

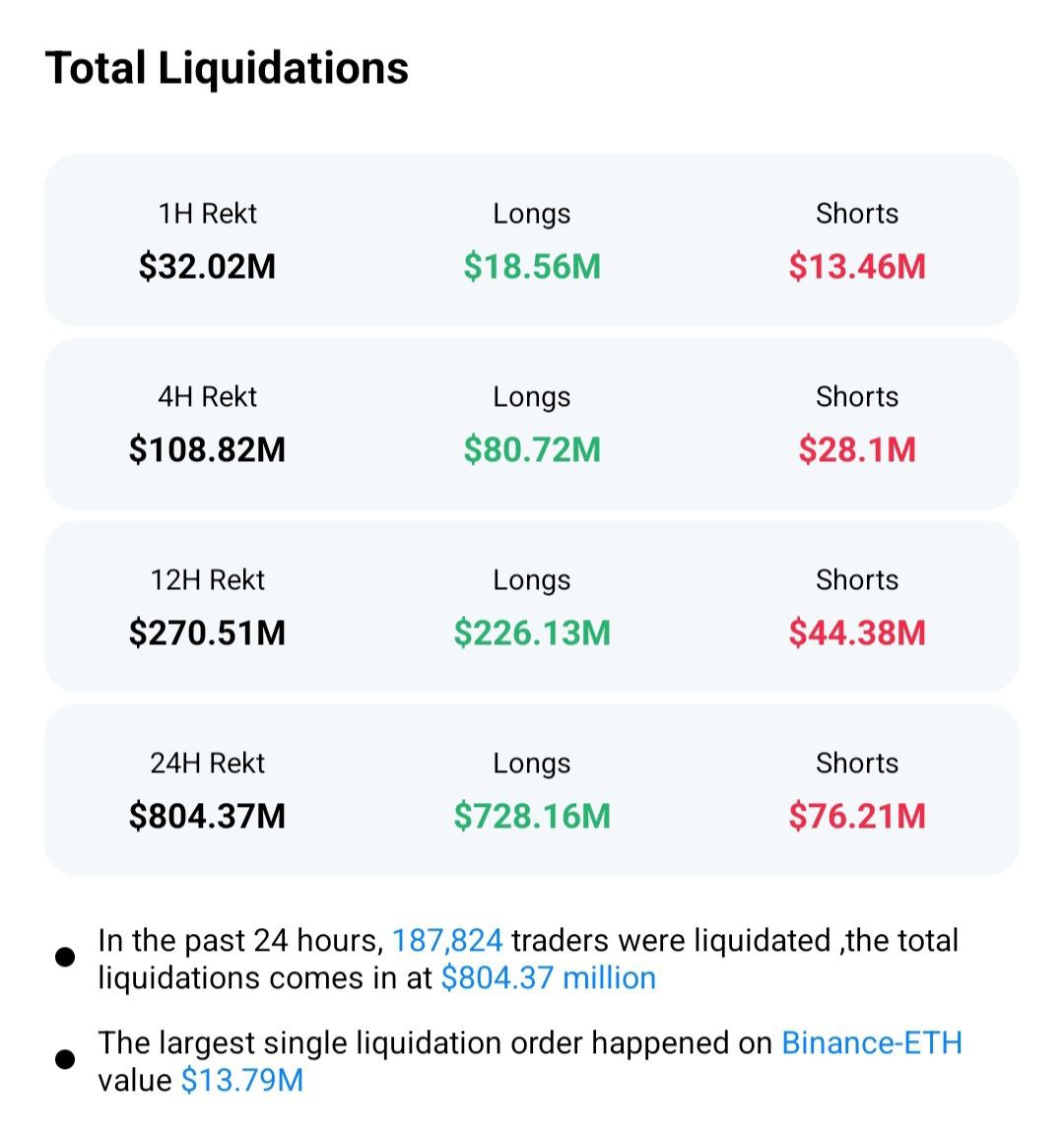

$804,000,000 liquidated from the cryptocurrency market in the past 24 hours !!!

📱STON.fi and TON Wallet Now Officially Available in the US

STON.fi and TON Wallet have partnered to launch decentralized finance (DeFi) services for U.S. users directly on Telegram.

Americans can now securely swap cryptocurrencies using TON Wallet. This integration opens DeFi access to approximately 87 million Telegram users nationwide.

😃 Key Features:

• Execute token trades in just a few taps (via STON.fi or TON Wallet).

• The Omniston smart aggregator ensures optimal exchange conditions.

• STON.fi is the #1 protocol on the TON network, powering about 80% of all activity, which indicates high user trust.

Start swapping seamlessly: STON.fi and TON Wallet

Learn more 👉 here

Ваша CryptaPepka 💃 | Chat