Five years ago, Pavel Durov openly called the App Store a "medieval fortress" for its draconian 30% tax that kills innovation and puts digital startups under threat.

He urged regulators worldwide to take notice of the obvious monopoly held by Apple and Google:

"You pay more for every digital product. You keep paying even after you've paid. Apple censors content, restricts privacy, delays releases, and destroys the business models of independent developers." said Pavel Durov.

For those who haven’t read

Pavel’s post titled "7 reasons why Apple’s 30% tax is bad for every iPhone user", it's a good read. And now in 2025, the ice has broken - a

U.S. court has sided with developers.

Apple can no longer:

- Ban external links within apps

- Block alternative payment methods

- Most importantly: charge a 30% commission on purchases made outside the App Store

This was a landmark decision in the Epic Games vs. Apple case that lasted nearly five years. Epic challenged Apple by implementing direct payments in Fortnite - and got banned. A long legal war followed, with appeals, Apple’s 27% “workaround” commissions, and fierce resistance. But this is the finale: Epic has won. Apple is required to allow external payments within the U.S.

Pavel Durov

responded on X:

"Well fought, TimSweeneyEpic - an epic victory. Thanks to you, the US is now free from Apple’s 30% yoke, which has stifled innovation for 17 years. Now, let’s help liberate the rest of the world. You have my support - and the support of telegram ’s 1 billion users."

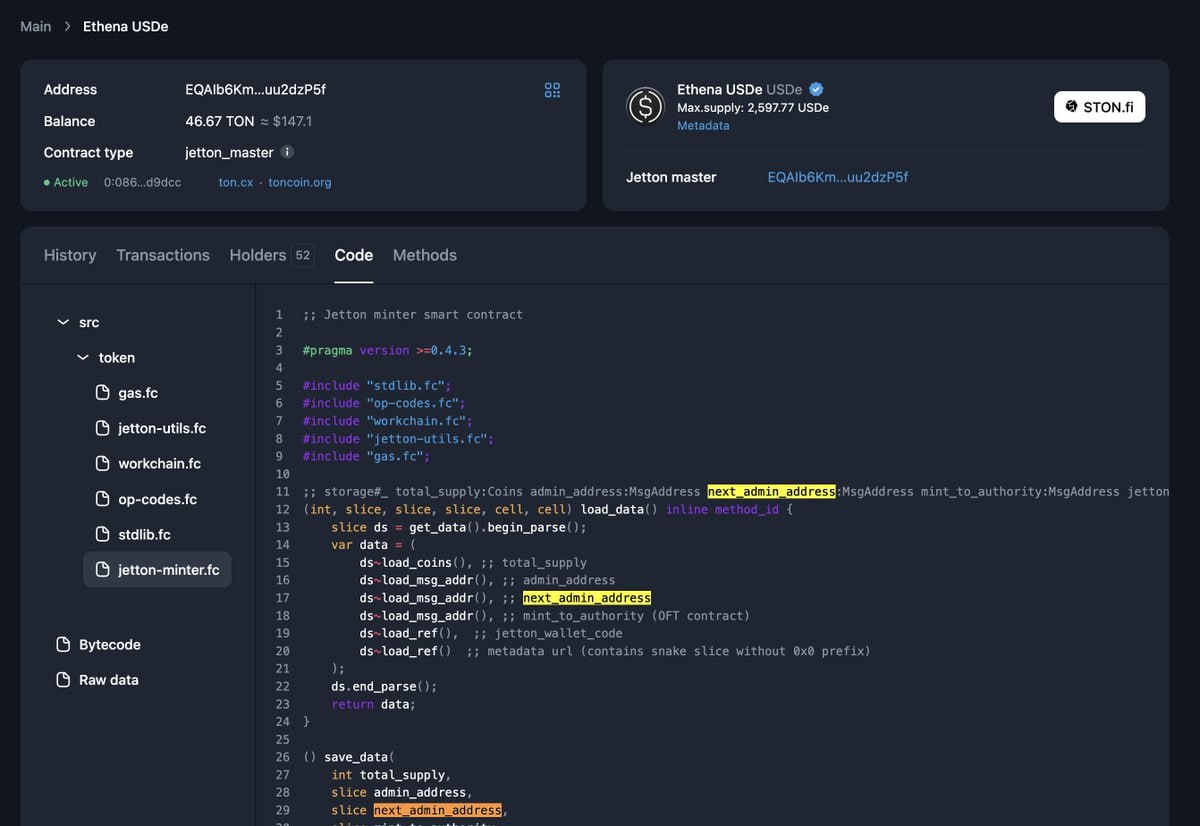

Telegram Mini Apps are the future of the messenger: smart bots, built-in services, marketplaces, games - all of this can now run on TON without needing to buy “stars” through Apple Pay with a 30% fee.

In June 2024, Telegram introduced Telegram Stars as a workaround: In-app purchase via App Store/Google Play → Telegram Stars → TON → content creators.

Now, we could see changes or even a return to the old model: direct TON payments through wallets (Tonkeeper, Wallet, MTW) or in-app sites.

This opens the door to:

- Reintroducing TON payments in Telegram apps

- Launching the

long-promised NFT stickers, collectibles, and memes

- A full Web3 economy built into the messenger

Stars might remain as a simple fiat gateway, familiar to millions. But they won’t be the only option. TON can return to the game.

After Epic’s victory, Spotify immediately

updated its iOS app, adding a subscription button via its website. Apple has been blocking such updates for two years - now it can’t.

Microsoft, Patreon, Meta, Telegram - all publicly supported Epic in the fight against Apple’s monopoly. This wasn’t about Fortnite, it was about the freedom to monetize on the internet, especially in Web3.

Yes, for now it’s just in the U.S., but...

- U.S. court ruling sets a precedent

- In common law, such a precedent can influence other countries

- Europe’s Digital Markets Act has already forced Apple to allow external stores and payment systems

- The rest of the world will follow, as their regulators got a clear signal: Apple is vulnerable.

No bold predictions, but let’s think about it:

- TON payments in Telegram are only a matter of time (at least for U.S. users)

- Web3 features in mini-apps become the norm

- NFT, DeFi, and similar tech legally integrated into the Telegram experience

- Telegram Stars and TON will compete, accelerating innovation

Apple can no longer hold a monopoly on digital payments. Pavel Durov and Telegram are among the main beneficiaries. TON could get a second life - and this time, the rules finally work in its favor.

Make TON Great Again

@TonPost