📱 Ethereum — король стейблкоинов: Новые рекорды и доминирование!

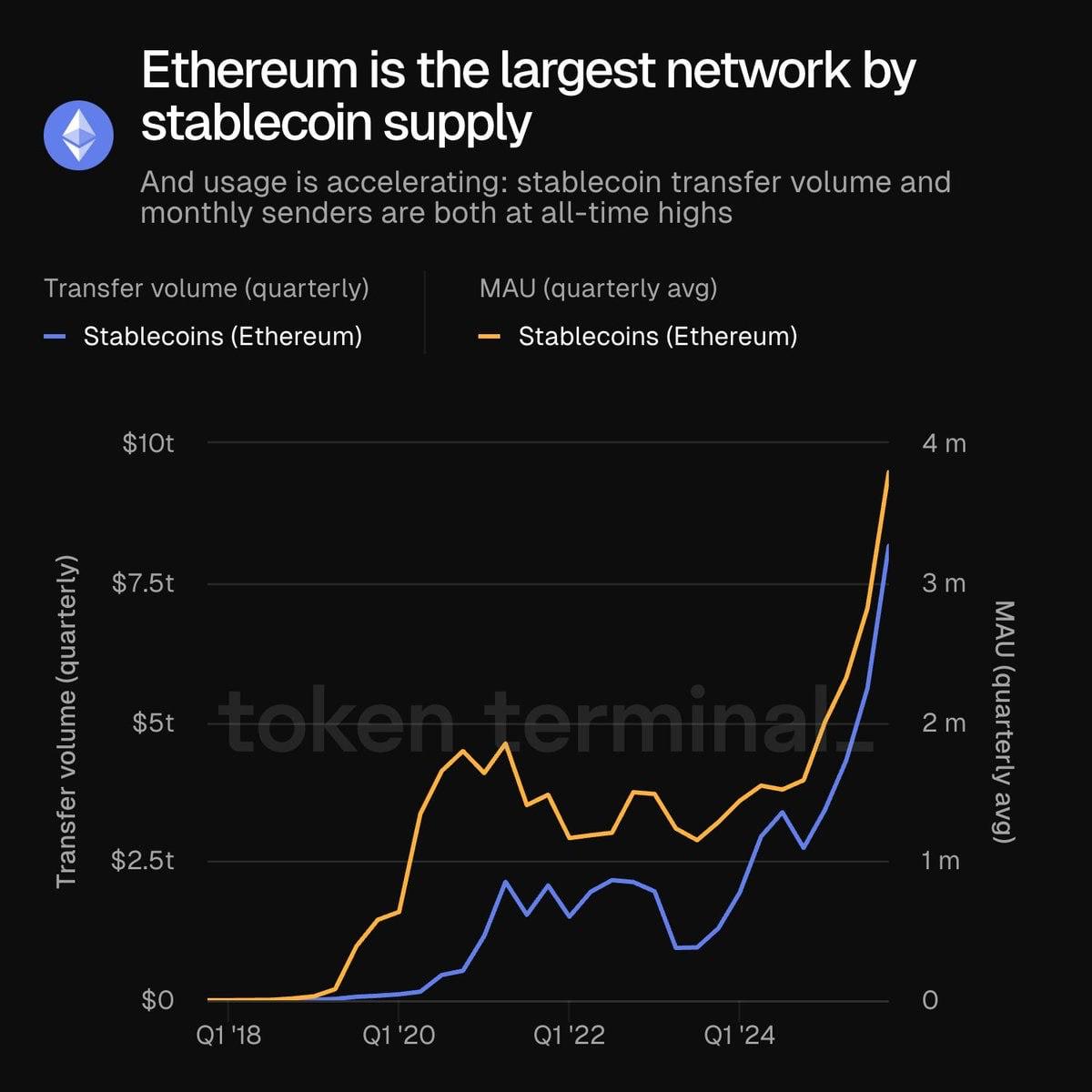

Пока все смотрят на цену $ETH, под капотом сети происходят исторические вещи. По данным Token Terminal, Ethereum официально закрепил статус №1 среди всех блокчейнов по объёму стейблкоинов. Это уже не просто спекуляции, а реальная финансовая магистраль.

Цифры, которые впечатляют (на начало февраля 2026):

📈 Рекордный объём: В IV квартале 2025 года объём переводов стейблкоинов превысил безумные $8 трлн — это почти в два раза больше, чем в середине года.

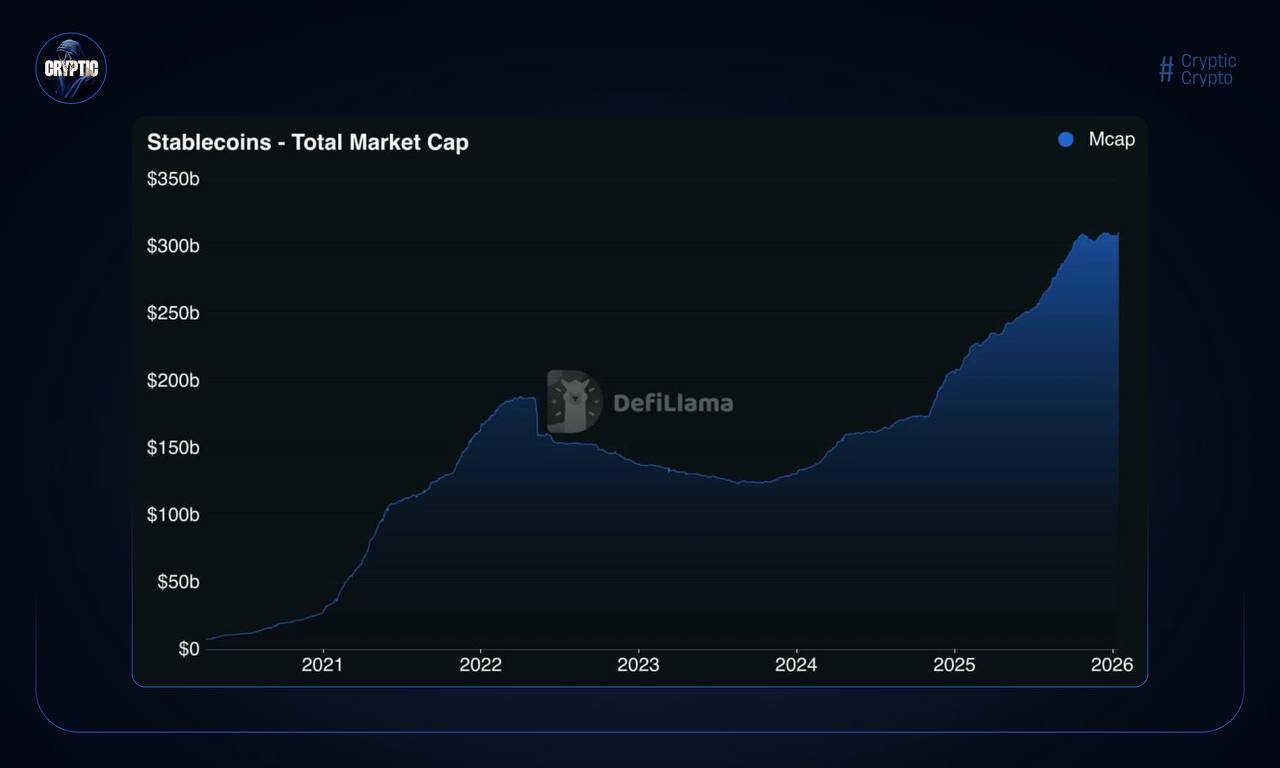

🏦 Предложение: Общий объем стейблкоинов в сети достиг $166 млрд. Лидируют USDT ($87,8 млрд) и USDC ($48 млрд).

👥 Активность: Число активных отправителей и ежемесячных адресов обновило исторический максимум (более 10,4 млн в декабре), и в феврале тренд только ускоряется.

🌍 Доминирование: Ethereum удерживает 57% всего рынка стейблкоинов и более 70% рынка токенизированных активов (RWA), оставляя Tron и Solana далеко позади.

Деньги в сети не просто «лежат» в ожидании пампа — они работают. Рост числа активных транзакций до 2,88 млн в день показывает, что Ethereum превратился в глобальный расчетный слой. Пока рынок волатилен, стейблкоины на эфире становятся фундаментом, который не даст экосистеме просесть.

#ethereum #stablecoins #analytics

➡️ Торговать лучше на ByBit 📈

➡️ Bybit.com/b/CryptoLadyX

📱 Youtube 📱 Telegram 📱 X 📱 TikTok