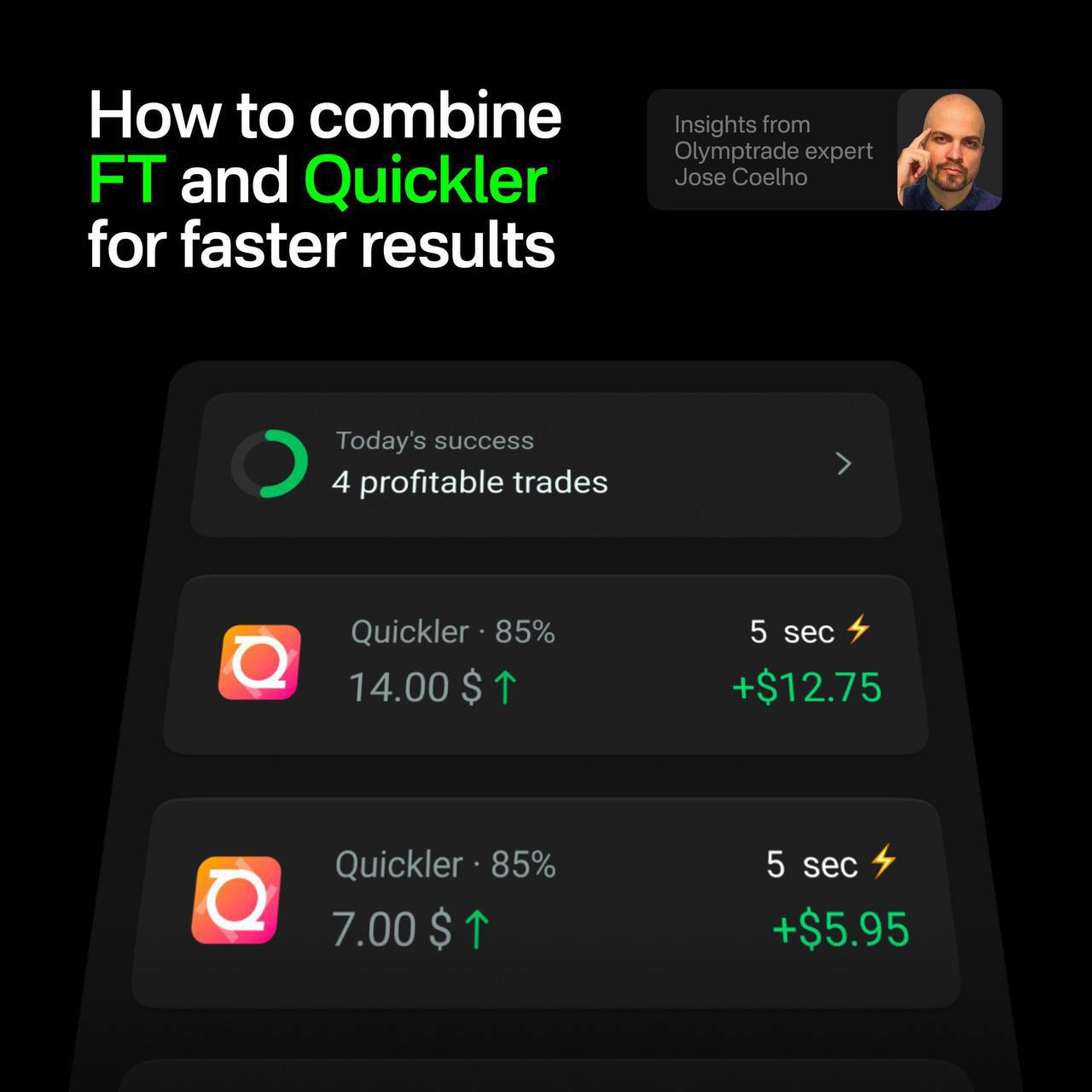

📊 Copy my trades in real-time on Olymp Trade and earn together with the team.

🌱 IT'S SIMPLE:

- Choose your amount.

- Connect.

- Earn profit. 💻

✅ WHAT ELSE YOU GET:

- Real-time copying of all my trades

- Easy setup for the amount you want to invest

- A tool for passive income 📈

🛡 Earn on autopilot — join and copy my trades while I do all the work!

🎁 A PERSONAL PROMO CODE for a

1️⃣0️⃣0️⃣🔤 🔤🔤🔤🔤🔤 ON YOUR DEPOSIT comes with Social Trading.

🚀 My Contact: @olymptradersignal

💬 Message me: « I want VIP »