SVIATOSLAV GUSEV

@gusevlife162 666 подписчиков

16 постов

Посты

⚡️ President Trump officially sings The GENIUS Act into law

Consistency is the only shortcut.

Compounding interest.

Never missing a lucky day because you try every single day.

Perma trying and perma ready to try again.

It's the fastest way to the top.

And as the world gets more competitive, it's soon becoming the only way.

The #1 hack to snag Telegram Stars cheap without KYC

Hop into the bot every hustler loves (yeah I’m talking about @SMOFastBot), hit up the “My Bots” section to launch your own bot, top up your balance and boom… Boosts, TG Premium and Telegram Stars come out way cheaper than buying straight from Telegram or even Fragment ⭐

Oh and there’s a sweet referral program in the bot and on the site too.

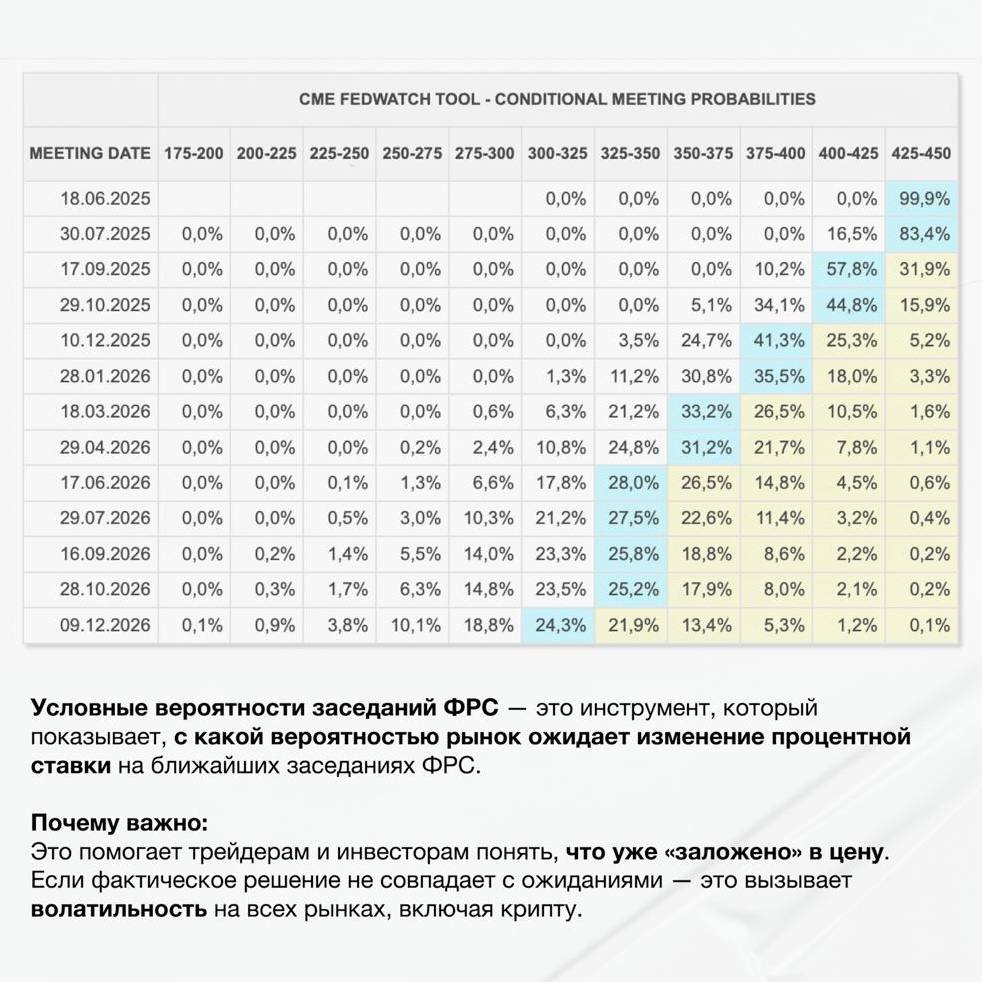

The Fed kept rates unchanged. But the show goes on 🍗

On June 18, the Fed held rates steady, giving no signal of easing to the markets. The QT (liquidity tightening) program also continues.

The statement was neutral, but the tone is getting tougher: Powell made it clear that rates won’t be cut “at Trump’s request.”

💬 Political backdrop:

Trump lashed out at the Fed chair again, calling him a “drag” and “dumb,” demanding an urgent rate cut and claiming he’d do a better job himself.

What did Powell say?

⦁ The rate stays,

⦁ No rush to cut,

⦁ Waiting for more confidence that inflation is really falling,

⦁ New risk factor — tariffs that could push prices up.

🔍 What does the Fed actually look at when making decisions?

⦁ Inflation (CPI and Core CPI)

⦁ Labor market (unemployment rate, non-farm payrolls)

⦁ Economic growth (GDP)

⦁ Personal Consumption Expenditures Index (PCE) — the main inflation gauge

Right now, all these indicators are borderline — the numbers don’t give a clear reason for either easing or tightening.

📈 Updated Fed forecasts:

⦁ GDP: 1.4% (lowered)

⦁ Inflation: 3% (up)

⦁ Unemployment: 4.5% (up)

⦁ Still projecting 2 rate cuts in 2025, but Powell stressed: “this is just a scenario, not a promise.”

📌 What this means for traders: 3 scenarios

1. Base (stable):

Fed waits for data → rate unchanged until fall → markets move sideways, volatility on data releases.

2. Bearish:

Inflation stays high or rises → Fed stays hawkish longer → pressure on stocks and crypto, dollar and Treasuries rise.

3. Bullish (unlikely):

Inflation drops sharply, economy slows → Fed cuts rates → markets rally, including crypto.

There’s only one Fed meeting left before the end of summer — August is traditionally a break. This means any statements from Fed officials in the coming month will be extra significant: even a slight shift in tone could either push markets higher or crush the current bullish mood.

The Fed makes decisions based on data, not emotions. Traders should do the same — don’t guess, calculate your options. Be ready for multiple scenarios and keep an eye on what and how Fed officials are saying.

If you are unafraid of the problems,

Money can do a lot of good for the world.

The world needs more rich brave men with big hearts.

Get rich, use the money to equip agents of good.

Everybody understands that it's okay to fail if you've tried your best.

What almost nobody understands is that if you ACTUALLY try your best...

TRULY try your best with EVERYTHING you've got...

You never fail.

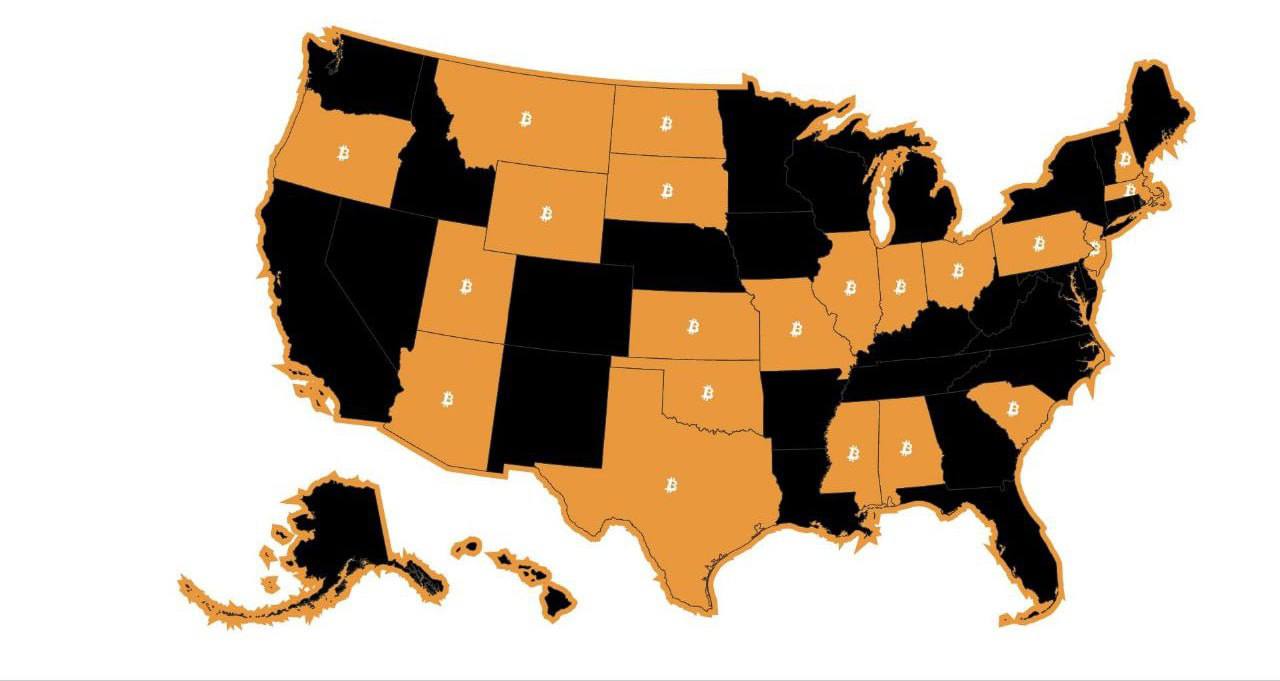

Altcoins next leg up has started.

USDT MCap is going up, while USDT dominance is going down.During the same time, BTC dominance is also dropping.

This means liquidity is moving to alts, which often happens during the start of an Altseason.

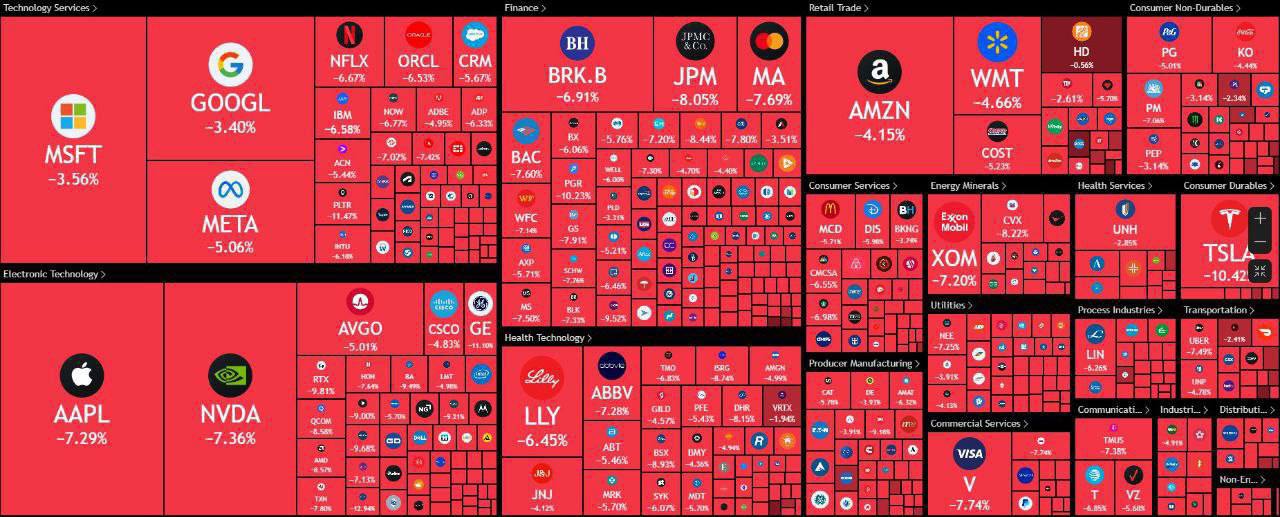

The world is on fire,

Most people are screaming and yelling, arguing over whose fault it is.

Some people sit by and distract themselves, pretending it's all fine.

While a very small group of people are walking around with a bag,

And picking up everything important.

Which one are you?

It's get-rich time