☄️ США ударили по крипто-инфраструктуре Ирана.

Что произошло? И связано ли это с текущим падением? Давайте разбираться:

30 января 2026 года Управление по контролю за иностранными активами (OFAC) Минфина США ввело санкции против двух крупных криптобирж — Zedcex и Zedxion.

✖️ Это историческое событие, так как впервые США наложили санкции не просто на отдельные кошельки, а на целые торговые платформы за их работу в финансовом секторе Ирана.

Ключевые детали:

➖Обвинения: Платформы использовались для обхода санкций и финансирования Корпуса стражей исламской революции (КСИР).

➖Масштабы: Только одна из бирж, Zedcex, с момента регистрации в 2022 году обработала транзакции на сумму более $94 млрд.

➖Связи: Обе биржи связаны с иранским бизнесменом Бабаком Занджани, ранее судимым за хищения в нефтяном секторе Ирана.

➖Активы: Под прицел попали инфраструктурные кошельки бирж, включая минимум 7 адресов в сети Tron (TRX).

📉 Влияние на рынок: Почему крипта падает?

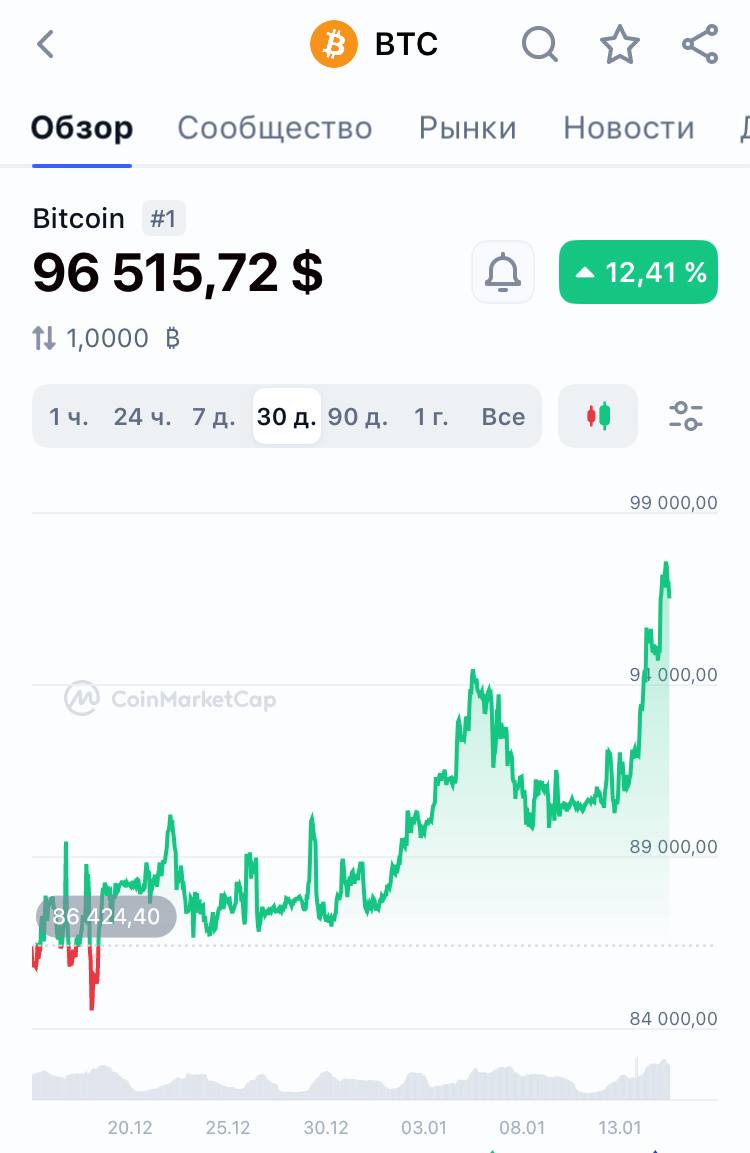

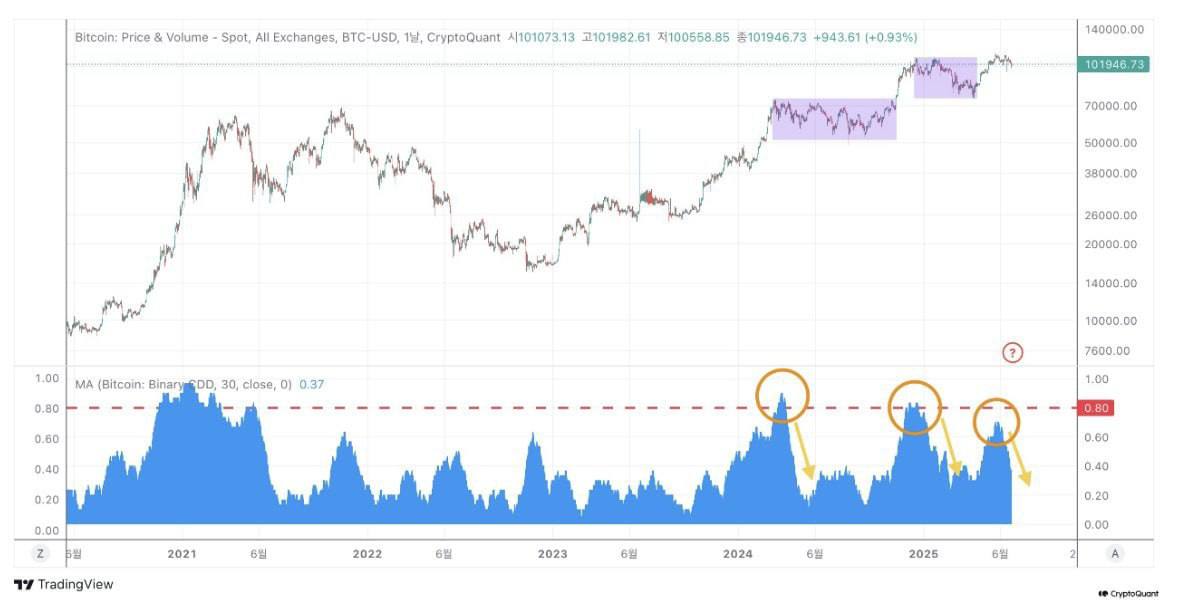

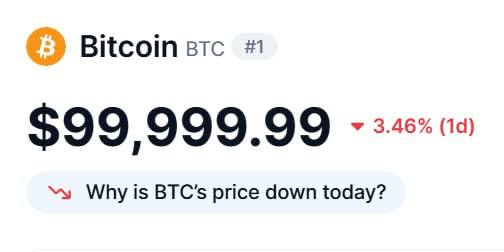

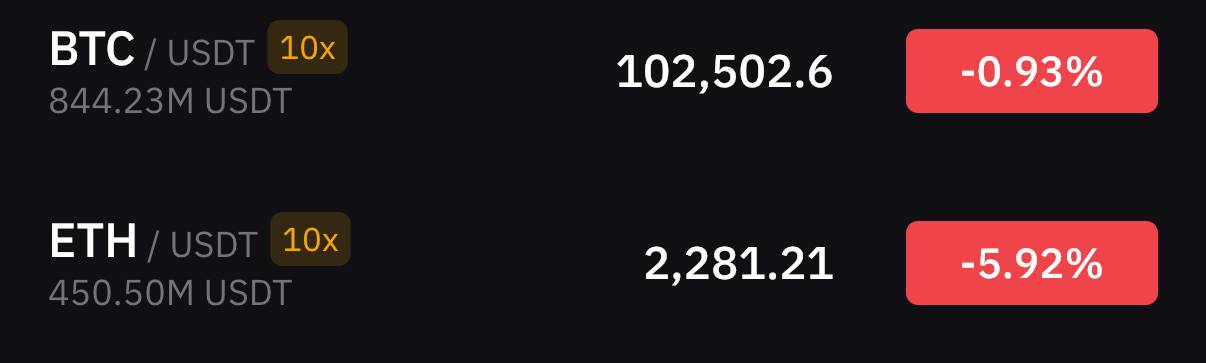

Текущее снижение рынка (BTC опускался ниже $80,000 в зону $75,000, как и отмечал ранее в своих обзорах Vilarso) вызвано комплексом причин, где санкции стали лишь одним из «черных лебедей»:

➖Геополитический риск: Новости о санкциях совпали с сообщениями о взрывах в Иране, что спровоцировало классический уход инвесторов в защитные активы (risk-off).

➖Макроэкономика: ФРС США сохранила высокие процентные ставки, а ожидания их снижения в марте резко упали.

➖Ликвидации: Падение цены вызвало каскад ликвидаций маржинальных позиций на сумму более $100 млн в час.

➖Сток в IT: Обвал акций Microsoft (более 10%) также потянул за собой высокорисковые активы, включая крипту.

🔍 Насколько это критично?

Для мирового крипторынка ликвидность конкретно этих бирж не является определяющей, но прецедент крайне важен:

➖Ликвидность Ирана: Общий объем криптоэкосистемы Ирана оценивается примерно в $7.8 млрд (по данным Chainalysis на 2025 год). Прямой удар по Zedcex и Zedxion затрудняет вывод капитала для элиты, но рядовые граждане продолжают использовать крипту для спасения от инфляции риала.

➖Масштаб: Переход OFAC от блокировки кошельков к блокировке инфраструктуры означает, что любая биржа с сомнительным комплаенсом теперь под прицелом.

🔮 Чего ожидать дальше?

➖Давление на стейблкоины: Основной объем обхода санкций шел через USDT, что может привести к усилению давления регуляторов на Tether.

➖Проверки кошельков: Крупные аналитические сервисы (Elliptic, Chainalysis) уже добавили санкционные адреса в свои базы. Это значит, что любые средства, прямо или косвенно связанные с Zedcex/Zedxion, будут помечаться как «грязные» на крупных биржах (Binance, OKX).

➖Миграция в DeFi: Ожидается, что подсанкционные субъекты еще активнее уйдут в децентрализованные протоколы и миксеры, что спровоцирует новые попытки их регулирования.

💡 Резюме для трейдера: Санкции против иранских бирж — это сигнал о начале «охоты на инфраструктуру». Рынок сейчас находится в фазе консолидации и высокой чувствительности к любым геополитическим новостям. Многие бегут за ранее из крипто в другие активы, чтобы потом конвертировать их снова в крипто, но уже без последствий санкционного преследования.

Материал подготовил для вас Vilarso на основании официальных источников в интернете и СМИ, чтобы вы не утруждали себя в поисках причины падения рынка.✖️

#News #USA #Iran #Sanctions #Crypto #Важно