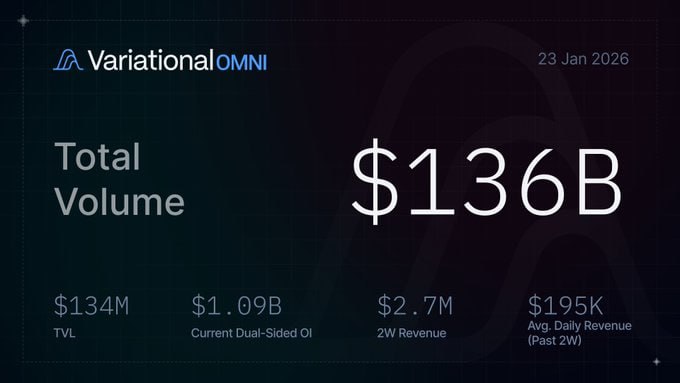

Важные апдейты по Variational

Как и ожидалось, с момента первого поста месяц назад активность на данном дексе значительно выросла, но кампания по фарму идёт относительно не долго (активна 7 неделя), поэтому смысл залетать точно есть.

Что изменили за месяц?

🔵️Допилили версию мейннета

🔵️Улучшили интерфейс

🔵️Переработали страницу тиров и наград

Фулл репорт можно глянуть по ссылке.

Если вы не знакомы с проектом, то рекомендую к прочтению данный пост, т.к. там собрана вся базовая инфа, которую нужно знать для отработки.

Напомню важную деталь: у проекта предусмотрена система рефанда из Lost Refund Pool. 10% от заработка OLP идут в пул рефанда (#tokentxns">адрес), из которого уже идут выплаты юзерам на основании тиров:

🔵️Bronze — 0.5% вероятность рефанда + заработок 0.5% с рефанда рефов

🔵️Silver — 1% вероятность рефанда + заработок 1.25% с рефанда рефов

🔵️Gold — 2% вероятность + заработок 2.5% с рефанда рефов

🔵️Platinum — 3% вероятность + заработок 5% с рефанда рефов

🔵️Diamond — 4% вероятность + заработок 7.5% с рефанда рефов

🔵️Grandmaster — 5% вероятность + заработок 10% с рефанда рефов

Сейчас у вас есть возможность сразу же получить Bronze тир за регистрацию с данным кодом: OMNIHINKOK (коды ограниченны, так что успевайте).

Что даёт данный тир:

🔵️0.5% буст к поинтам

🔵️0.5% шанс рефанда

🔵️0.5% от рефанда ваших рефов

🔵️Соответствующая роль в Discord

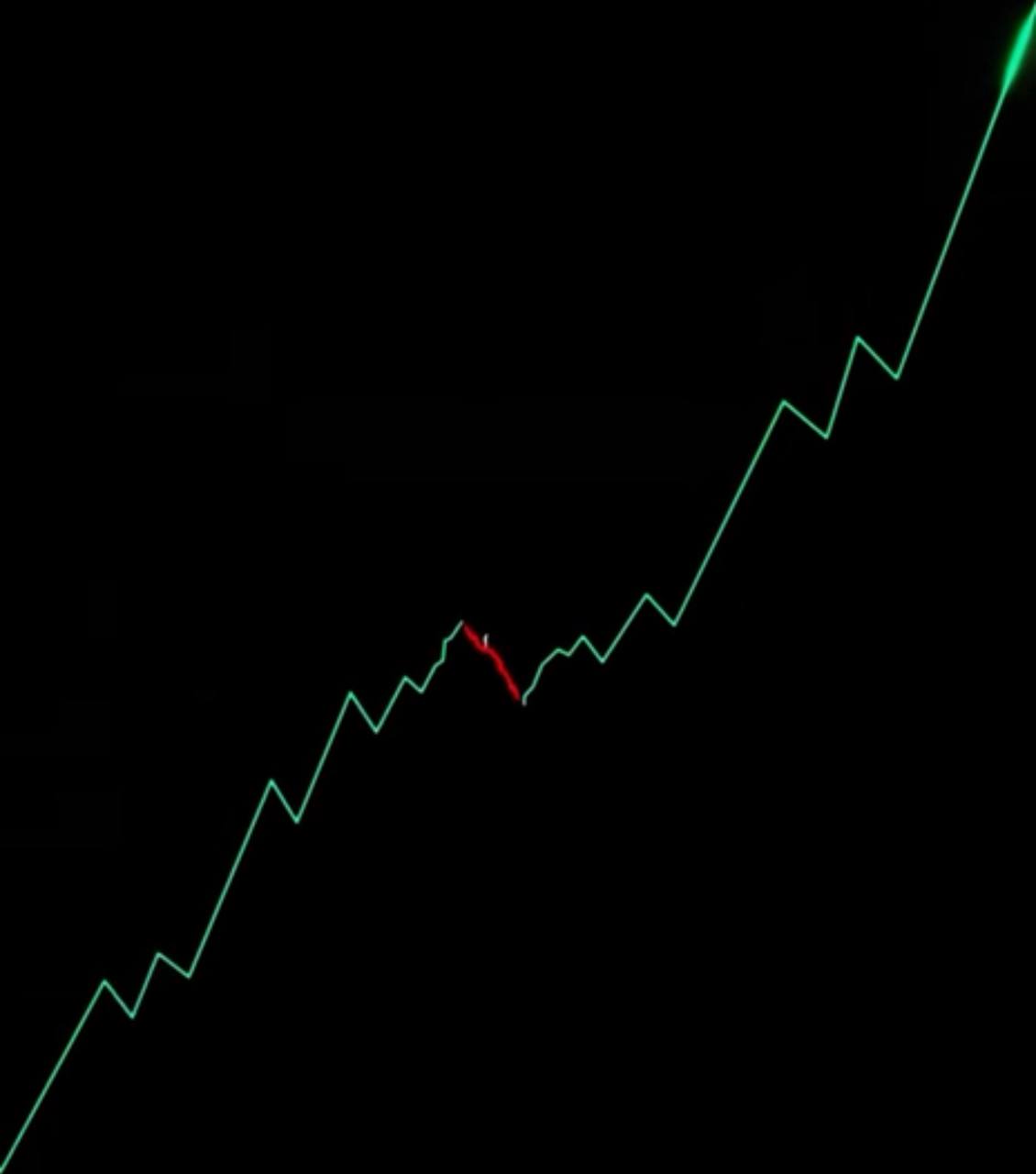

🔵️Кастомные вещи в виде PnL графики и карточки

Что известно по дропу на данный момент: токен точно будет, на комьюнити будет выделено около 50% саплая. Кампания с поинтами будет длиться до Q3 2026.

Я сейчас тестирую различные стратегии и по первым наблюдениям могу сказать, что больше всего поинтов сыпят за удержание сделок. Учитывая, что сейчас здесь нулевые комиссии (обратите внимание на Liquidation Penalty в 0.5% к цене закрытия для шортов и лонгов), то при грамотном хеджировании можно и нужно отрабатывать данный проект.

😎 HinkoK | Telegram | Chat | HinkoK Soft | Best Proxy