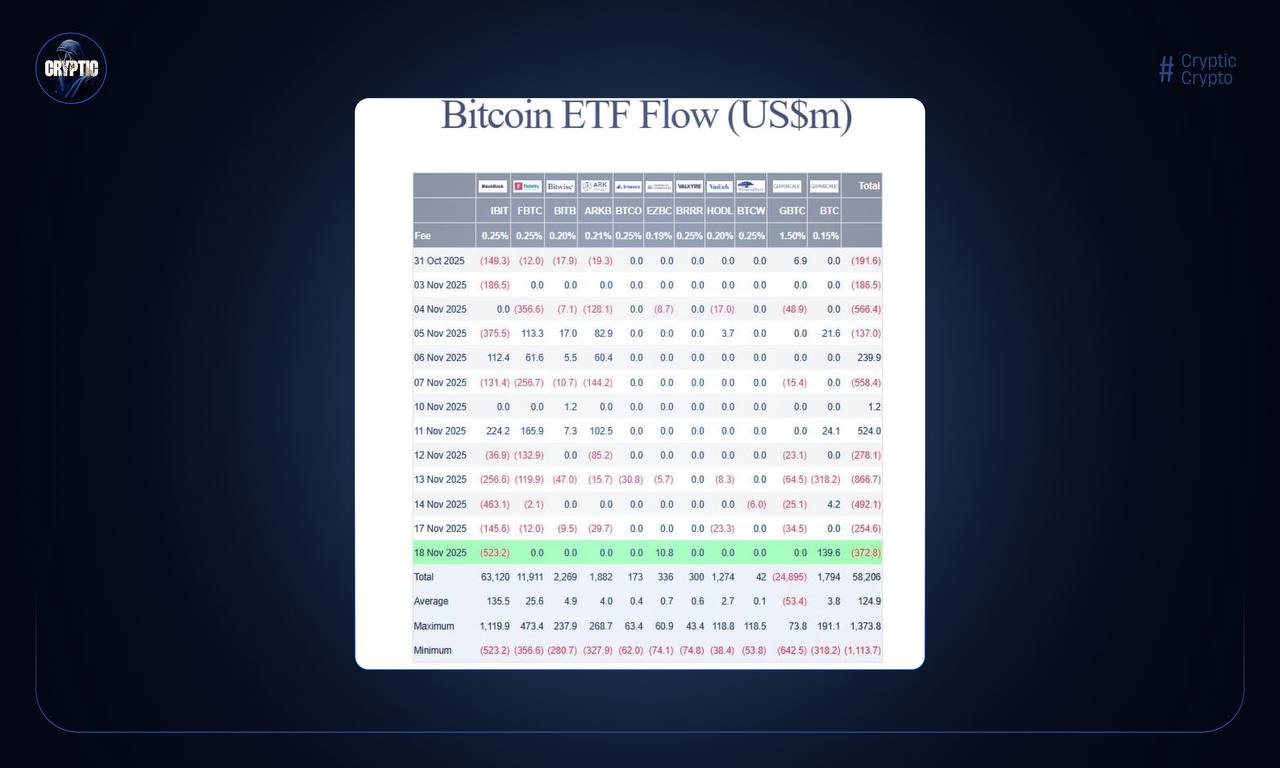

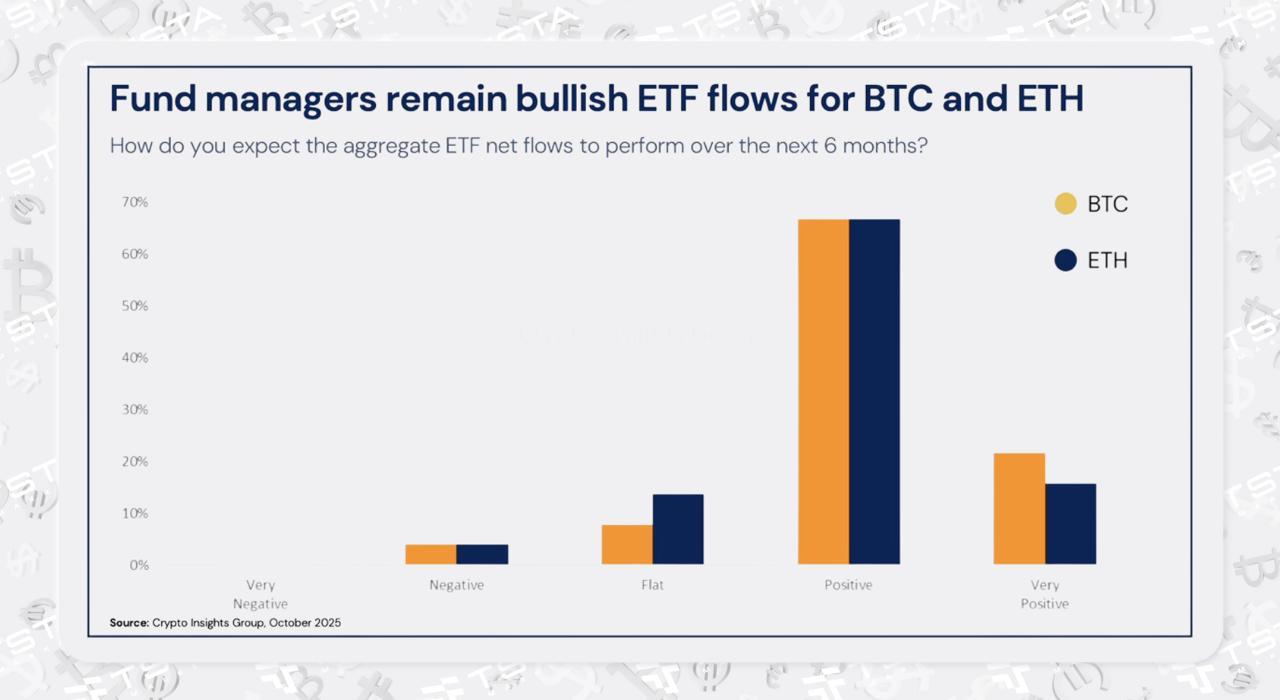

📈 Маржинальная жара по BTC бьёт рекорды — и это не просто цифра.

За последние четыре месяца объёмы фьючерсов улетели на исторический максимум.

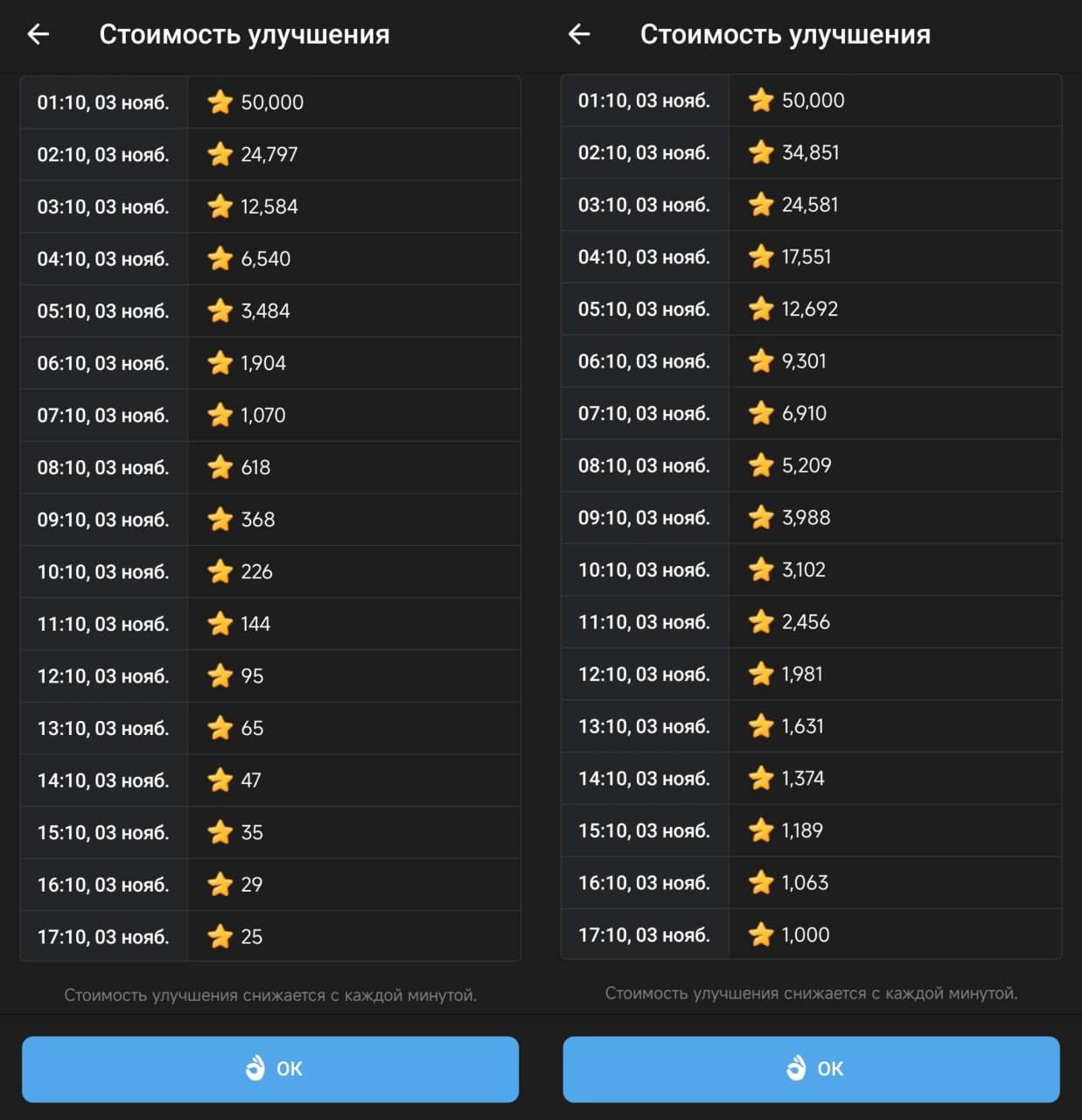

Люди массово заходят в плечи, потому что рынок снова пахнет быстрыми деньгами, удачей и той самой «ещё чуть-чуть — и я в дамках»

☝️ Но есть нюанс

Маржиналка — это казино, где крупье улыбается, пока ты сам приносишь свои монеты на стол.

Когда всё растёт — плечи делают из 100 долларов тысячу.

Но когда свеча идёт против тебя — та же тысяча превращается в ноль быстрее, чем ты успеешь нажать «Закрыть позицию».

Так что если вокруг шум, свечи скачут, а друзья рассказывают, как взяли x7 на фьючах — помни:

Самые спокойные деньги всегда делают те, кто не ставит квартиру на красное.

Вы сами заходите во фьючерсы или предпочитаете спот?

English 🇺🇸

The margin heat on BTC is breaking records — and it's not just a number.

Over the past four months, futures volumes have soared to a historic high.

People are getting into the shoulders en masse, because the market again smells of fast money, luck and that "just a little more — and I'm in the ladies"

But there is a caveat

Marginalka is a casino where the dealer smiles while you bring your coins to the table.

When everything grows, the shoulders make a thousand dollars out of 100.

But when the candle goes against you, the same thousand turns to zero faster than you can click "Close position".

So if there's a lot of noise around, candles are jumping, and friends are telling you how they took x7 on futures, remember:

Those who don't put an apartment on red always make the quietest money.

Do you go into futures yourself, or do you prefer a quiet spot?