📌 С начала марта '26, в X полноценно вступают в силу новые правила раскрытия рекламы/платных интеграций, затрагивающие всех крипто инфлюенсеров. Нижеуказанная выжимка сделана мной на базе X

Paid Partnership Policy и публичных постов и комментариев

Nikita Bier (Product Lead X)

1️⃣ Хронология событий:

🤩 24 Февраля: официально

объявлено о запуске функции раскрытия платного продвижения Paid promotions, которая станет доступна со 02 Марта

🟦 Введен ультиматум: скрытая реклама = блокировка аккаунта;

🟦 22 Февраля от Никиты уже начали появляться публичные

предупреждения “добавь disclosure, иначе будет блокировка" (за скрытую рекламу Kalshi, но касается также и Polymarket).

🤩 24 Февраля Платформа Kalshi превентивно

удалила Affiliate Badges у всех внешних партнеров и инфлюенсеров, чтобы не подставлять их под новые санкции X

🤩 Со 02 Марта ожидается запуск встроенных инструментов маркировки: «Paid Promotion», «Made with AI»

2️⃣ Главные правила раскрытия рекламы / AI:

🤩Обязательная маркировка: любой контент, за который автор получил выгоду, должен быть помечен через Paid promotions функцию X

🟦 Выгода - теперь это не только оплата в USD/USDT, но и любая форма вознаграждения: токены или будущие аллокации токенов, подарки (мерчи), реферальные отчисления, доли в проекте (equity) и др.

🤩Прозрачность для всех: Жалобу на скрытую рекламу теперь может подать любой человек (даже без X аккаунта).

🟦 Если на ваш пост часто вешают примечание сообщества о том, что это «скрытая реклама». Это может стать триггером для автоматической проверки аккаунта.

🟦 Если у вас несколько аккаунтов и один из них забанят за «undisclosed ads», X может применить санкции ко всей группе связанных аккаунтов.

🤩AI-контент: Тег «Made with AI» обязан накладываться пользователем в случае использования AI. Но также метка будет накладываться автоматически (через анализ метаданных или паттернов). Если вы используете AI для генерации рекламных постов и не ставите тег, это также может считаться нарушением прозрачности.

3️⃣ Запрещенные категории (Prohibited Industries)

❕ Даже если вы поставите пометку о рекламе, продвигать эти направления через обычные посты нельзя:

🟦 Гэмблинг и ставки: Онлайн-казино, ставки на спорт, лотереи.

🟦 Рынки предсказаний (Kalshi, Polymarket и др.). Они теперь классифицируются как «нерегулируемый гэмблинг/финансы»

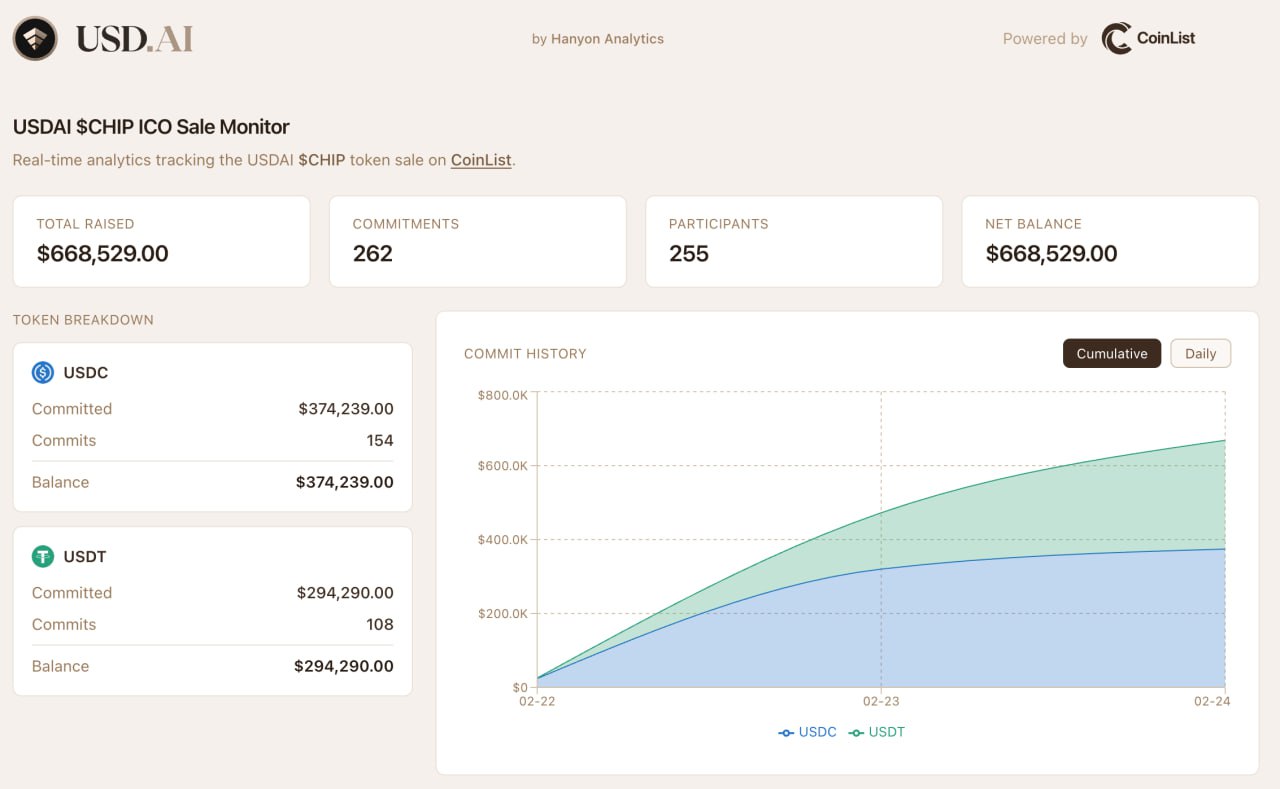

🟦 Спорные финтех-продукты: ICO, IDO, пресейлы токенов, облачный майнинг. Шиллинг типа «Покупай $TOKEN, он даст x100» - теперь тоже запрещен.

🟦 Серые зоны: Нелицензированные медицинские препараты, табак/вейпы, товары для взрослых.

4️⃣ Примеры разрешенных категорий с отметкой о рекламе (Allowed with Disclosure):

🟦 VPN (легальные), софты, гаджеты, приложения, игры (не азартные)

🟦 Образование: курсы, вебинары (включая крипто-обучение без призывов к покупке токенов)

🟦 Легальные Web3-сервисы: Кошельки (без встроенных казино), аналитические инструменты, DEX/CEX (если они соответствуют локальным законам и не продвигают запрещенные ICO)

🟦 Реферальные ссылки: Ссылка на регистрацию на бирже или в сервисе - это всегда платное партнерство. Ее нужно помечать, но она разрешена.

5️⃣ Последствия нарушений (Enforcement):

🤩 Удаление поста: За первое или единичное нарушение.

🤩 Блокировка аккаунта: Если аккаунт систематически нарушает правила или создан в основном для публикации скрытой рекламы.

🤩 Удар по всей сетке: Если один аккаунт забанен за нарушение рекламной политики, под угрозой оказываются все связанные профили (по IP, устройству или номеру телефона).

😨 Походу приходит конец эпохе проплаченных инфлов в Твиттере...