📌 Sport.fun - ончейн-фэнтези платформа + рынок долей (shares) на игроков из ТОП футбольных лиг, американского футбола, а вскоре баскетбола и др. видов спорта. Пользователь покупает/продает shares реальных футболистов, собирает «squad» и играет турниры; доходность/награды зависят от реального перформанса (голы/ассисты/сейвы и т.п.) и от рынка спроса/предложения на доли.

🔵️ посути это гибрид трейдинга, игры и псевдо-предикшн-рынка (твоя ставка завязана на матч/успехи игрока);

🔵️ важно заметить, что никаких официальных партнерств и коллабораций с реальными игроками и лигами нет.

▶️ Проект начал билдиться в феврале '25, а полноценный запуск платформы состоялся в августе

📊 Что по цифрам (

выделяют в статье):

➡️ Перепроверка по

Dune 1,

Dune 2,

DefiLama

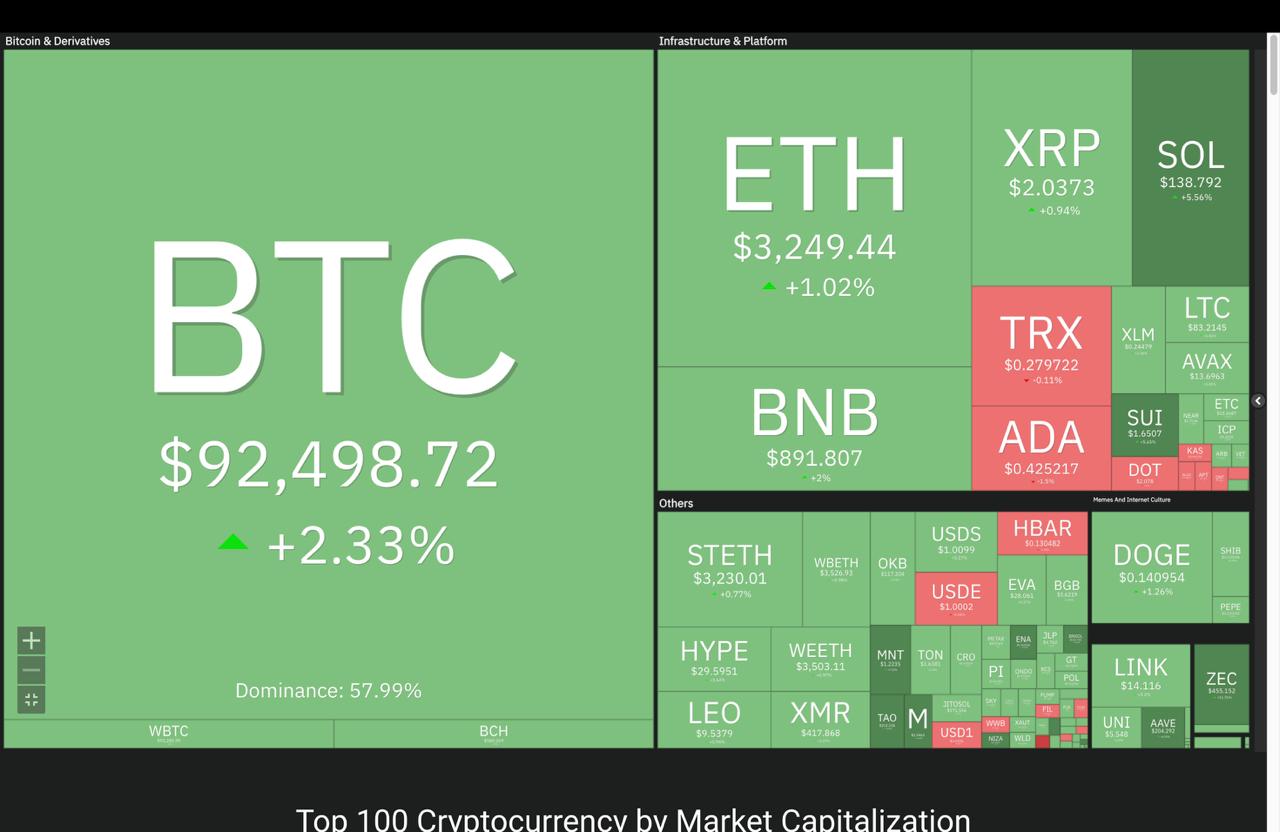

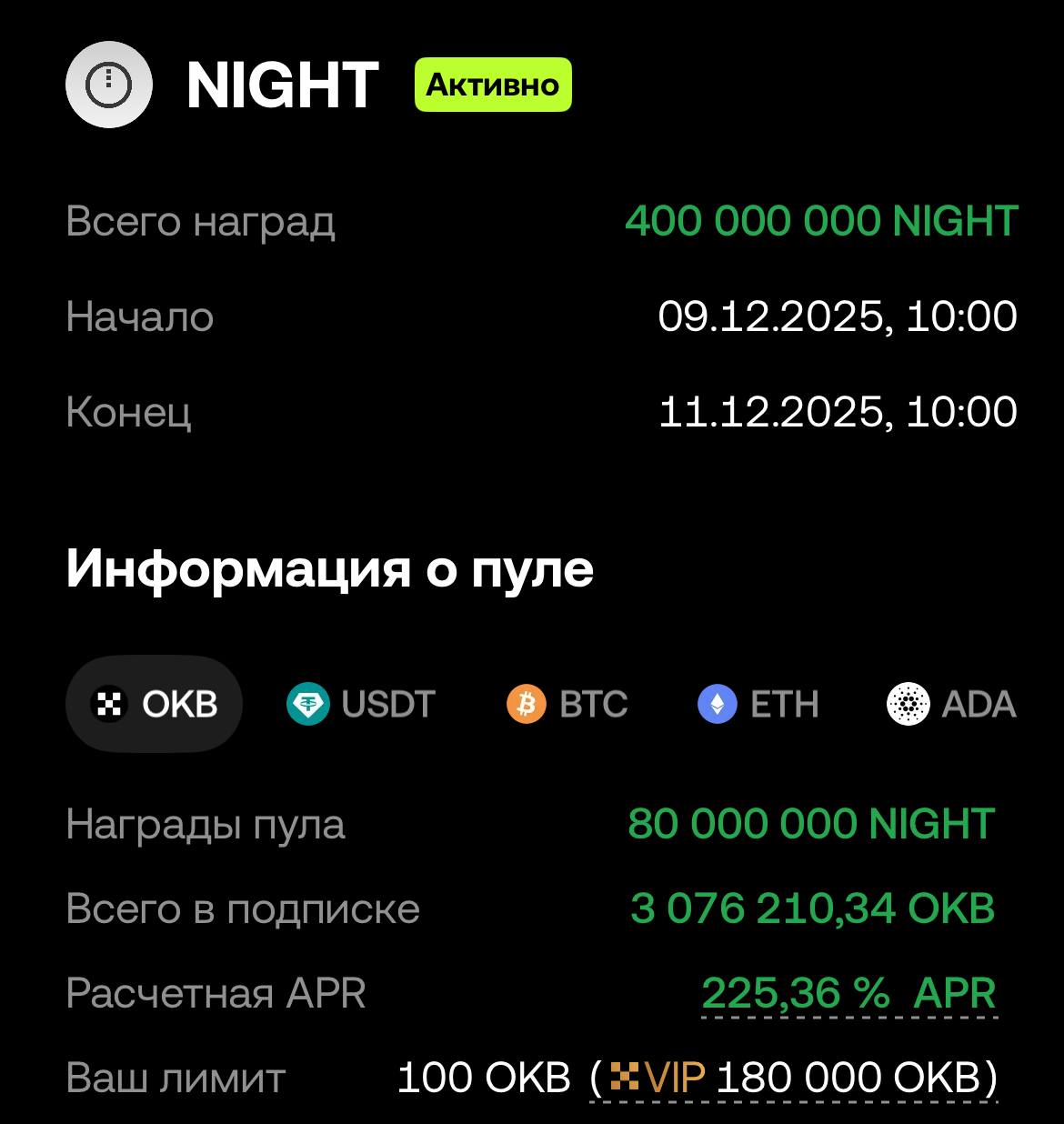

🔵️ Декларируют $90m торгового объема за прошедшие с запуска 4 мес (накопленным итогом ) ➡️ похоже на правду

🔵️ Декларируют $10m выручки➡️ выручка в августе - $2,6m, далее по месячно $900k, $484k, $667k и за неполный декабрь $224л. $10m - манипуляция, т.к. взяли текущие 4 мес с учетом пиковой выручки в момент запуска и экстраполировали на 12 мес. Выручки как на запуске - никогда не будет, ее нельзя так считать и, как минимум, надо скорректировать.

🔵️ Текущий TVL: $5,8m

🔵️ Число пользователей: 20k, но большая часть (15k) пришли именно в момент запуска в августе. К слову тогда многие активно

лудили этими shares как мем-коинами или как shares на инфлов (friend.tech) в свое время. С августа по конец октября пользователи не росли, и с ноября пошел плавный рост до текущих 20k на слухах о выпуске токена, айрдропе, анонсах турниров и интеграции в base mini-app.

👥 Команда: Фаундер -

Adam - ранний криптодеген со стажем, который участвовал во всех крипто-нарративах разных лет и параллельно пытался что-то под эти нарративы строить. Является участником

WolvesDAO - крипто-гейминг комьюнити, но иной публичной информации касательно опыта и мест работы не раскрывается.

💲

Инвестиции: $2m привлечено в июле '25 от Tier-2/3 фондов во главе с 6th Man Ventures

🔵️ Также есть нераскрытый по сумме

инвест (грант) от Base Ecosystem Fund

📝

Сейл на Legion:

🔵️ Старт: 16 декабря

🔵️ FDV: $60m;

🔵️ Собирают $3m, что соответствует 5% Total supply;

🔵️ Разлоки: 50% на TGE, остальные 50% в 6-мес вестинге.

🔵️ Даты TGE нет: были

намеки на 4Q, но возможно уже не успеют и будет в январе.

▶️ Сейл проходит одновременно на Legion и Kraken площадках. На обоих площадках будет merit-based система, т.е. аллока на базе вашего Score, сопроводительного письма.

🔍 Монетизация и Utility токена:

🔵️ Governance;

🔵️ Скидки на комиссии на платформе;

🔵️ До 80% прибыли будет направляться на байбеки.

🤓 Участвовать или нет?

▶️ Мое, непредвзятое мнение - я пропускаю, т.к.:

🔵️ Реальные метрики проекта - у меня вызывают вопросы;

🔵️ Актуальность в продукте - аналогично. Сейчас спал интерес на торговлю shares на celebrity / инфлов / nft, а ставки на Polymarket позволяет отыгрывать достижения как команд, так и отдельных игроков;

🔵️ FDV в $60m - завышенная для текущего рынка и реальных финансовых метрик (TVL $5,8m, нормализированная выручка ~$700k/мес). В августе могли выйти по такой оценке, но сейчас это выглядит переоценено.