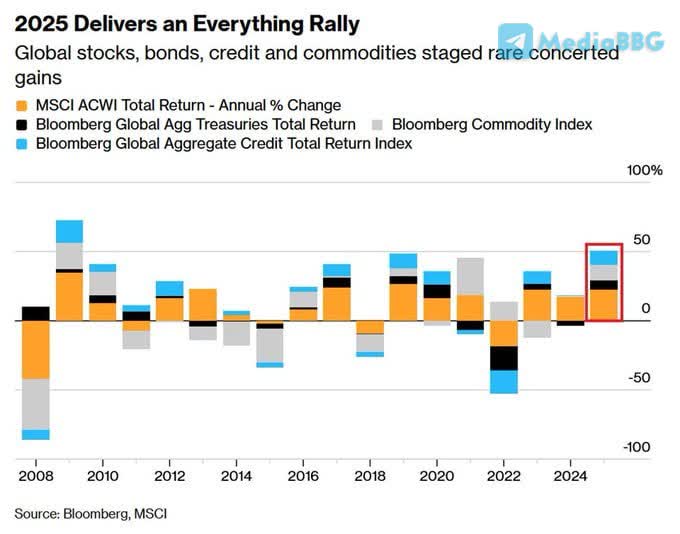

📊💵В 2025 году глобальные активы достигли исторического максимума:

.............................................................

Совокупная доходность мировых фондовых рынков, сырьевых товаров, государственных облигаций и кредитных инструментов в 2025 году составила +50,7%, что является самым высоким показателем с 2009 года.

Это произошло на фоне того, что индекс MSCI All-Country World Index (ACWI) показал доходность +22,3%, что является лучшим результатом с 2019 года.

Затем последовал рост товарного индекса Bloomberg на +11,1%, что стало лучшим результатом с момента роста на +27,1% в 2021 году.

Кроме того, индекс Bloomberg Global Aggregate Credit Total Return Index вырос на +10,5%, а индекс Bloomberg Global Agg Treasuries Total Return Index — на +6,8%.

❗️Это первый год с 2019 года, когда мировые фондовые рынки, облигации, кредитные рынки и сырьевые товары завершили год с положительной динамикой.

💵В выигрыше оказываются все владельцы активов.

.............................................................

Bloomberg Terminal✅