$KERNEL is positioned as the next major rotation in DeFi and it’s not just price action, it’s flow.

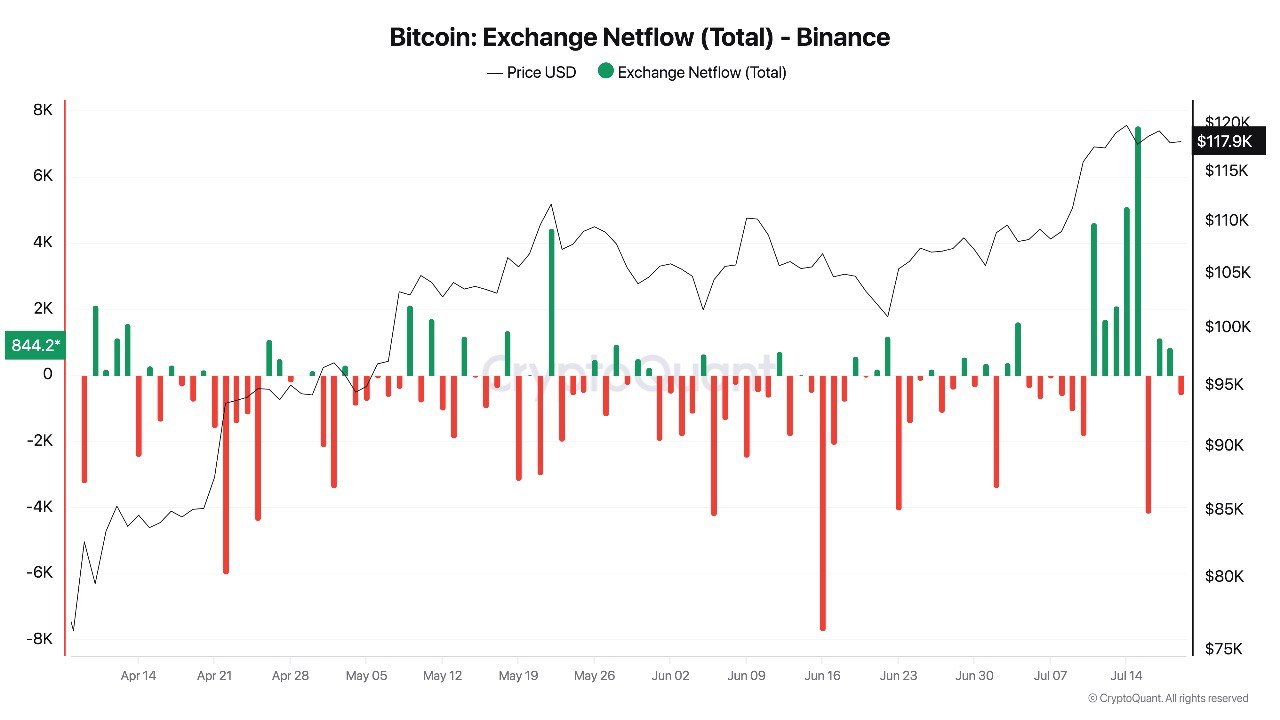

Most of the market’s in pullback mode:

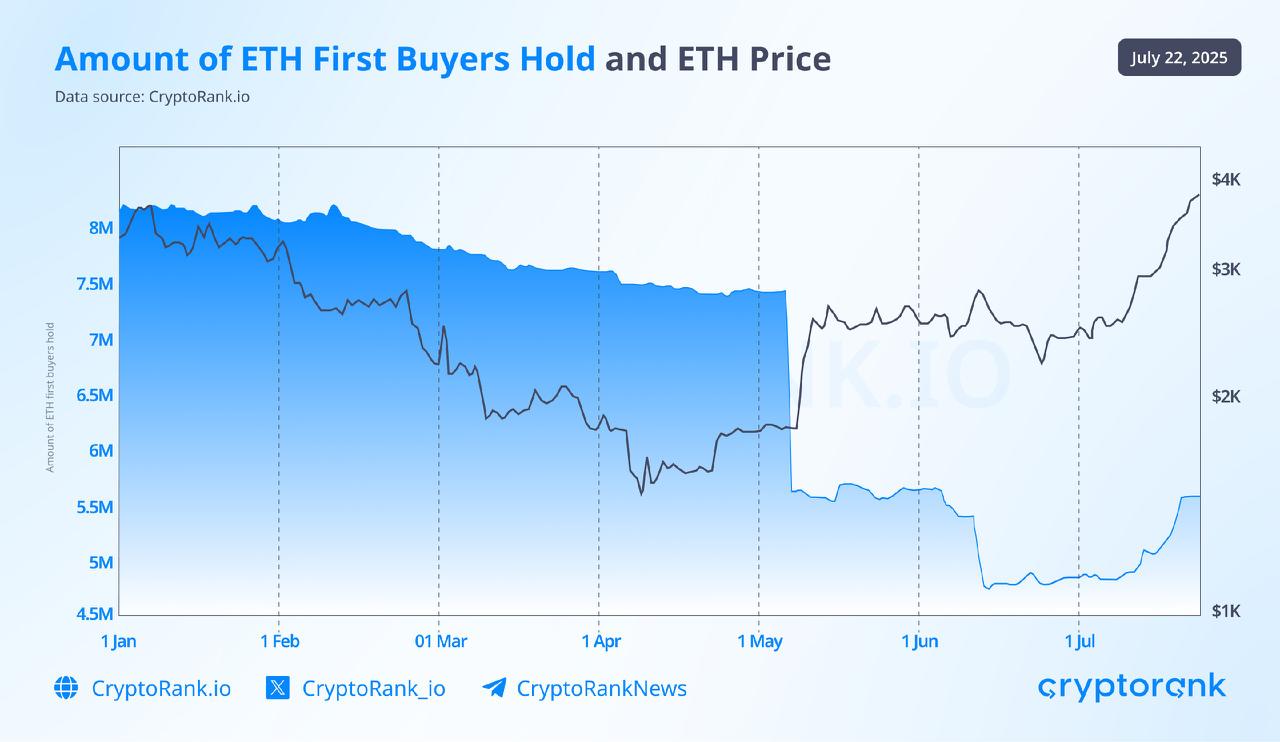

- ETH, SOL, and majors are range-bound or down.

- LRTs like EigenLayer are down 13–15%.

- Memes are retracing across the board.

But a few assets are doing something different.

$KERNEL is one of the only DeFi tokens posting a +7% move in this chop and it’s not hype-driven. It’s capital rotation.

Why? Look at what’s behind it:

- Kernel already has $2B+ in TVL across its ecosystem, that’s not speculative.

- It’s the #1 restaking infra on BNB Chain, and #2 LRT infra on Ethereum, real traction across chains.

- 25+ AVS/DVN integrations, 50+ protocols secured.

- 8 major exchange listings already live.

- About to go live with stablecoin vaults + RWA exposure, real yield, not narrative play.

What this tells me:

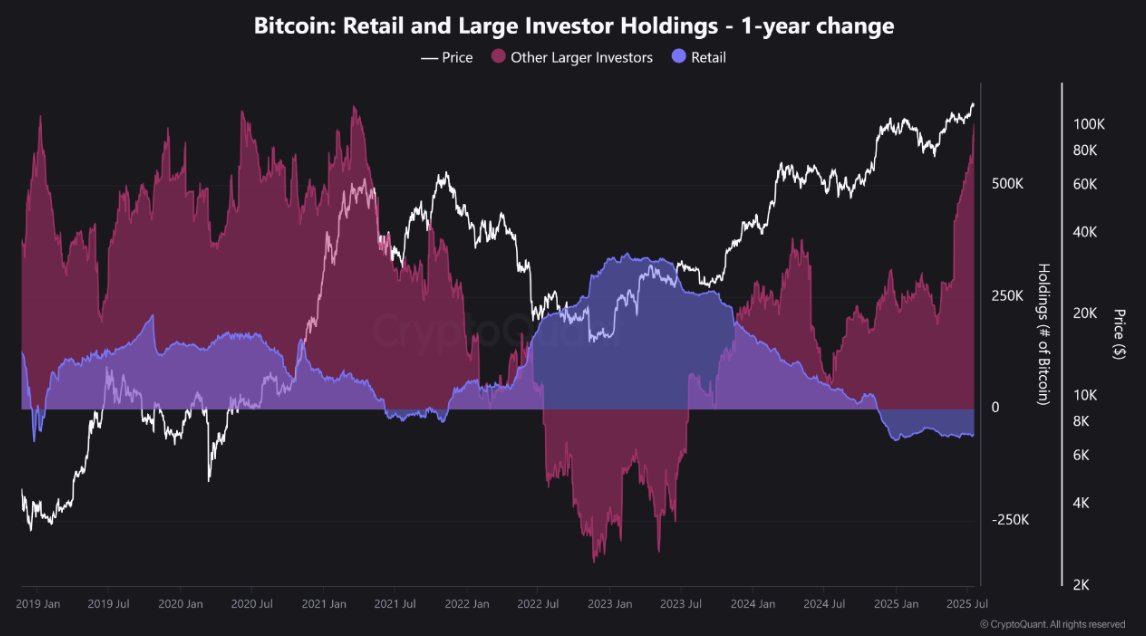

Big players are rotating into Kernel because it has distribution, product-market fit, and infra dominance on chains others aren’t even building on yet.

This isn’t “next EigenLayer”. It’s something different.

Kernel is expanding restaking to an entirely new surface area - BNB, RWA, infra apps. All secured by a shared base layer.

You’re not early to restaking anymore.

But you’re still early to the next restaking layer that scales beyond Ethereum.

If you missed EigenLayer at $100M TVL — this is your replay button.

https://kerneldao.com/restake/?utm_source=Mountains