Hello everyone.

The last post here was on September 24.

I rarely write just for the sake of writing — there’s already too much noise everywhere.

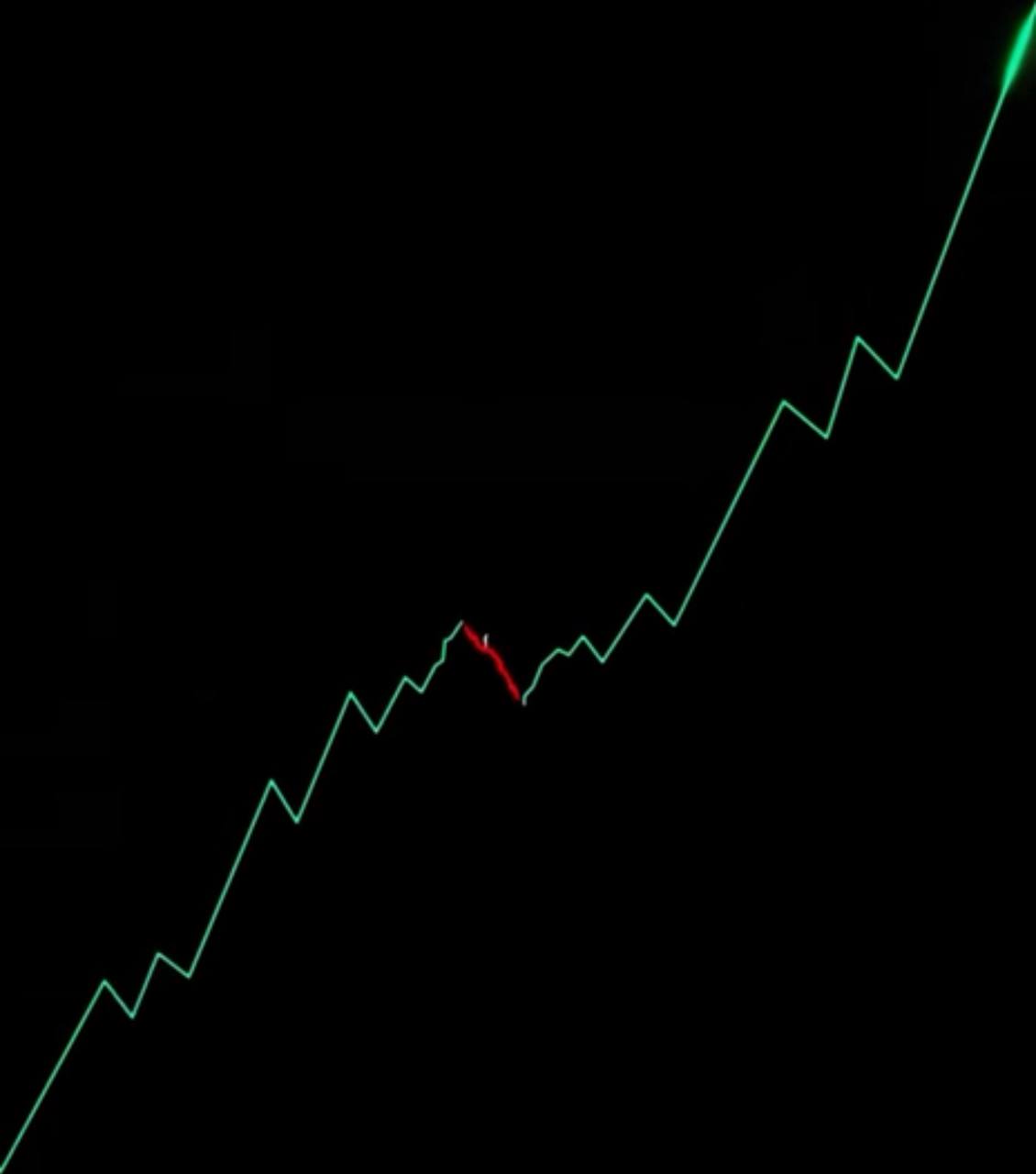

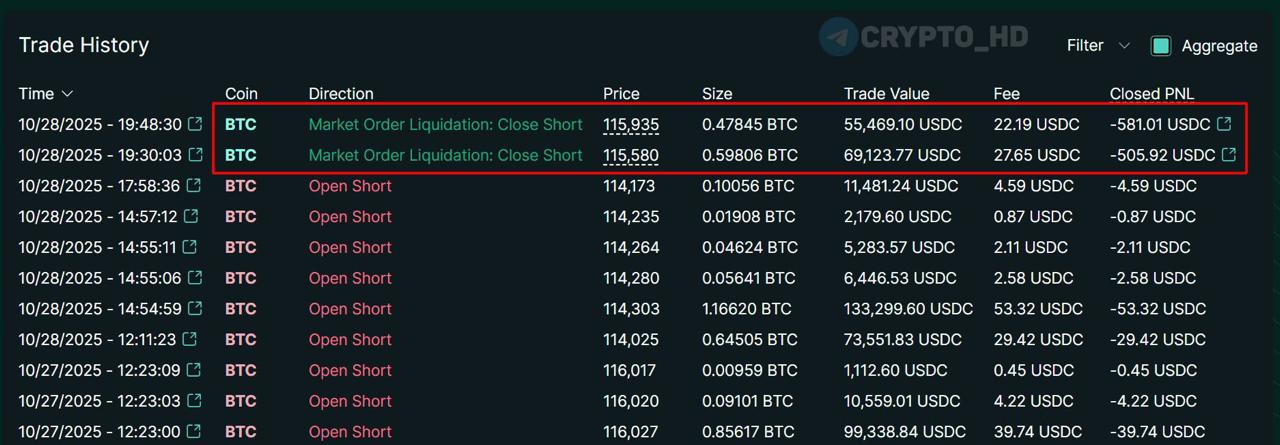

Starting from September 29, I went through a difficult period.

One thing after another — when it feels like it can’t get any worse, and life keeps proving that it can.

This time literally broke me into thousands of pieces.

And every day, all I do is try to put myself back together.

Just when you start to regain balance — everything collapses again.

I gather my strength, get back up, and try once more.

No one can even come close to understanding what’s happening inside me.

This is a real test of resilience.

A test of whether you truly want what you’re striving for.

And I’ve been through too much to give up now.

So what if you give up — will it get easier? No.

That means there’s only one way: forward.

It’s hard psychological work and pain that doesn’t fade until you make it through.

There’s a simple truth:

when things go well, you’re a genius.

When something goes wrong, there’s no one worse than you in your own eyes.

But I know one thing for sure:

there is no endless chain of failures.

I haven’t lost because I haven’t given up.

You lose the moment you decide that you’ve lost.

I will get through this. And I will return.

And since we’re on the threshold of a new year, I want to wish you simple but truly important things:

inner calm, a clear mind, and the strength to walk your own path.

Appreciate what you already have.

Do what you truly love.

Focus on what is working for you, not on what hasn’t happened yet.

You will get there.

But if you live constantly thinking “not yet,” you might quietly miss life itself.

Happy New Year.

May it become a point of renewal and inner support.

Be happy.