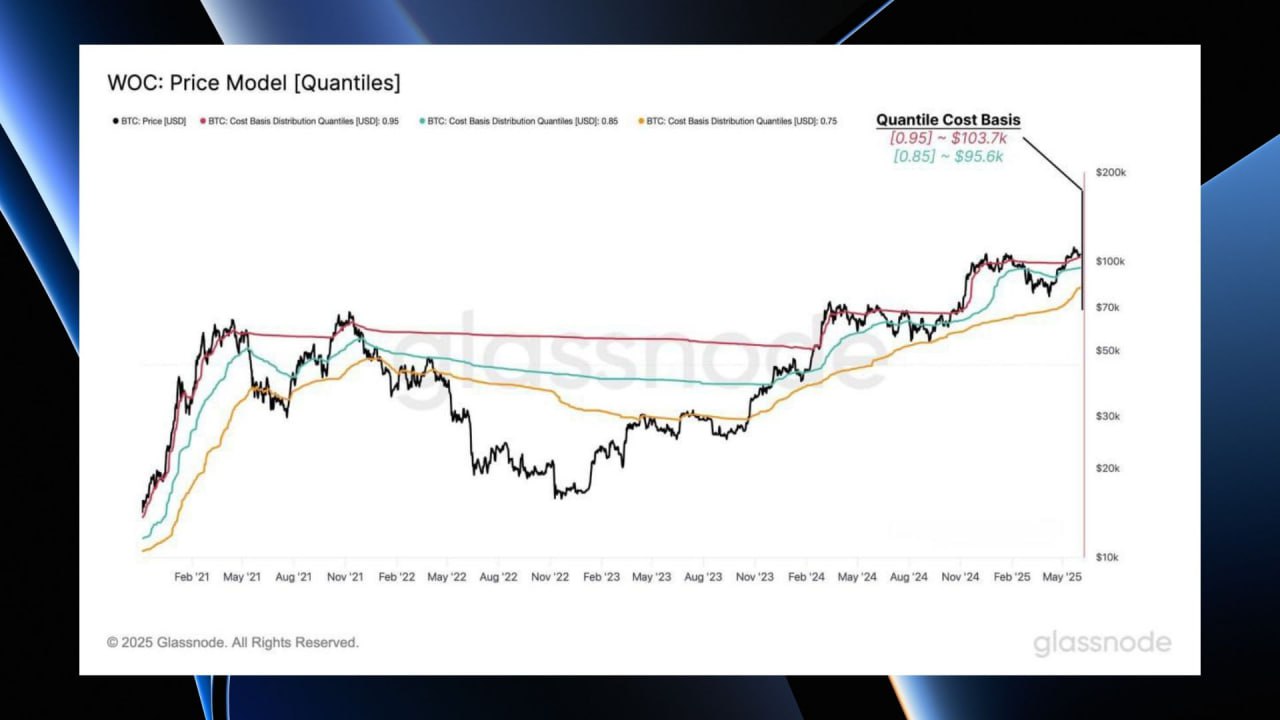

📊 График, который шепчет «Цикл ещё не закончен»

Интересный паттерн обнаружили в CryptoQuant - годовая доходность BTC с 2011 года чётко укладывается в структуру:

три зелёных года → один красный

И да, эти фазы подозрительно хорошо совпадают с ритмом халвингов.

🪧 Если доверять истории:

📈 2013: +5,549%

📉 2014: -59,2%

📈 2015–2017: последовательный рост

📉 2018: -72,2%

📈 2019–2021: снова рост

📉 2022: -64,4%

📈 2023–2024: два зелёных года подряд

- Что это говорит о 2025-м?

Если модель не даст сбой (а пока она работает, как швейцарские часы), 2025 год должен стать третьим годом роста, как это было в 2017 и 2021.

Потенциальная доходность (+120%)

То есть от условных $93,226 в направлении $200,000+ за BTC.

На фоне:

> накоплений китов

> ослабления давления со стороны регуляторов

> запуска Ethereum-ETF

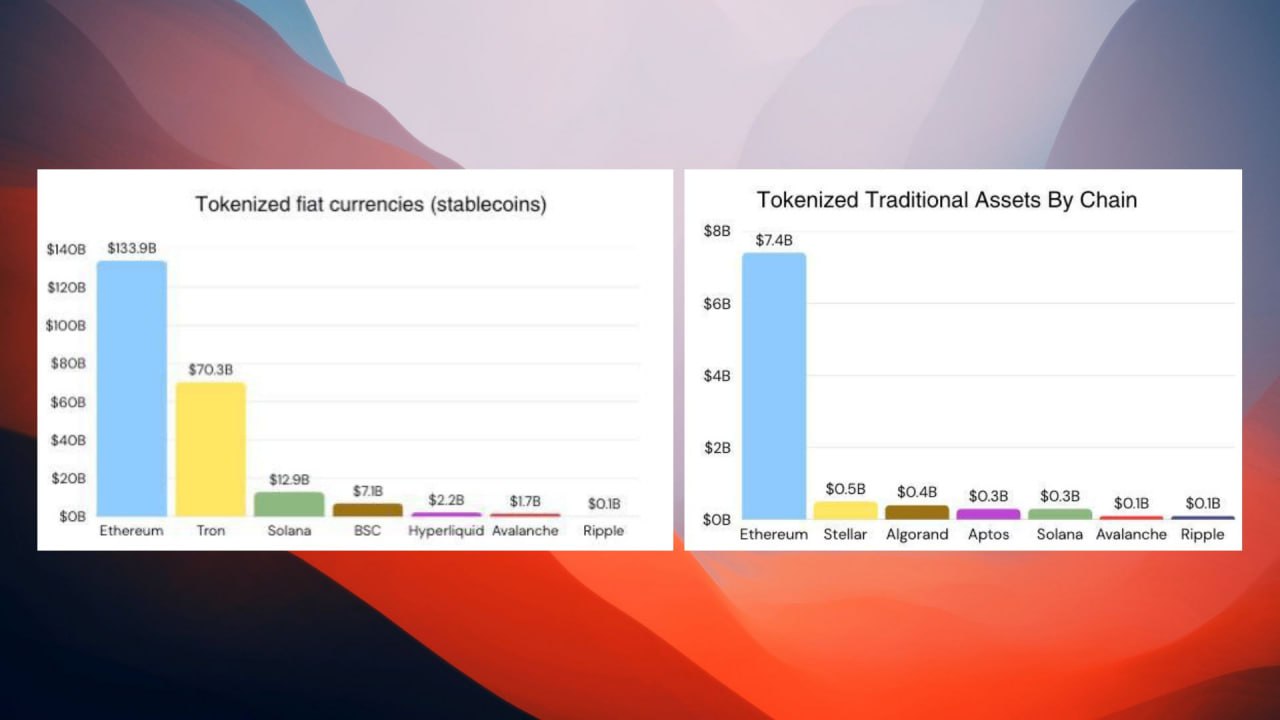

> институциональной экспансии через stablecoins

- мы получаем техническое и фундаментальное подтверждение, что вечеринка ещё не закончилась.

- Да, в 2022 был спад и он был болезненный. Но после каждого красного года три зелёных и пока мы только на втором.

Если 2023 и 2024 разогрев, то 2025 может стать кульминацией. Главное не выйти до того, как зазвучит финальный взлёт. Удачи на рынке!

English 🇺🇸

The chart that whispers “The cycle is not over yet”

CryptoQuant found an interesting pattern - annual BTC returns since 2011 clearly fit into the structure:

three green years → one red

And yes, these phases coincide suspiciously well with the halving rhythm.

If you trust history:

2013: +5,549%

2014: -59,2%

2015-2017: consistent growth

2018: -72,2%

2019-2021: growth again

2022: -64,4%

2023-2024: two green years in a row

- What does this say about 2025?

Unless the model fails (and so far it's working like a Swiss watch), 2025 should be the third year of growth, as it was in 2017 and 2021.

Potential Yield (+120%)

That is from a notional $93,226 towards $200,000+ per BTC.

Against the backdrop of:

> whale accumulation

> easing regulatory pressure

> Ethereum-ETF launch

> institutional expansion via stablecoins.

- we get technical and fundamental confirmation that the party's not over yet.

- Yes, there was a downturn in 2022 and it was painful. But after every red year there are three green years and so far we're only on our second.

If 2023 and 2024 are the warm up, 2025 could be the high point. The important thing is not to get out before the final climb sounds. Good luck in the market

⭐️ Crypto Chat | Exchange | ADS