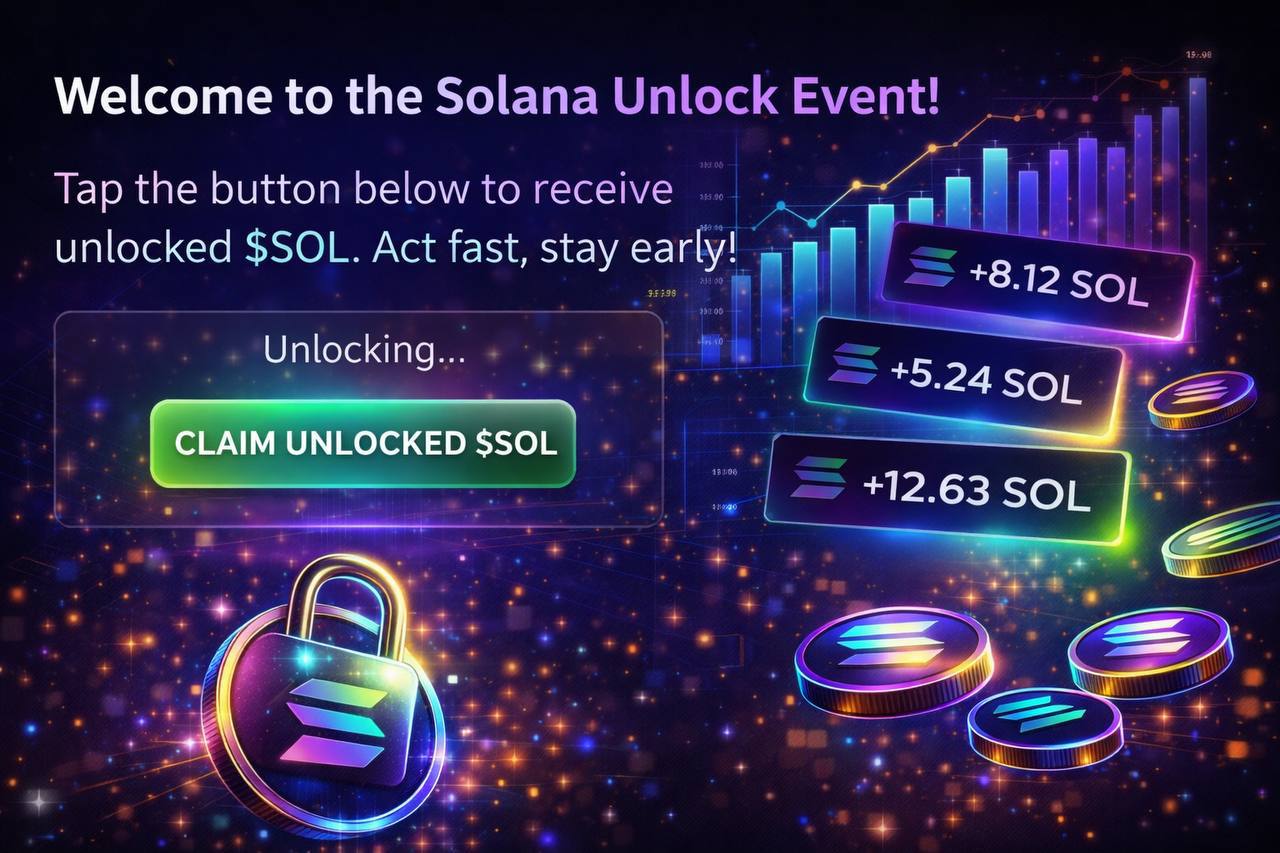

Криптомошенничество в 2025 году вышло на новый уровень.

Подмена личности стала самым быстрорастущим вектором атак в криптоиндустрии. Рост подобных преступлений оценивается примерно в +1400% за год, а средний ущерб на одну схему вырос более чем в 6 раз.

🤔 Что изменилось:

– Мошенники больше не действуют «в лоб».

– Они копируют биржи, фонды, инфлюенсеров, топ-менеджеров.

– Используют ИИ для писем, голосов, видео, чатов и фейковых саппортов.

– Комбинируют социальную инженерию и технические атаки.

✅ Результат:

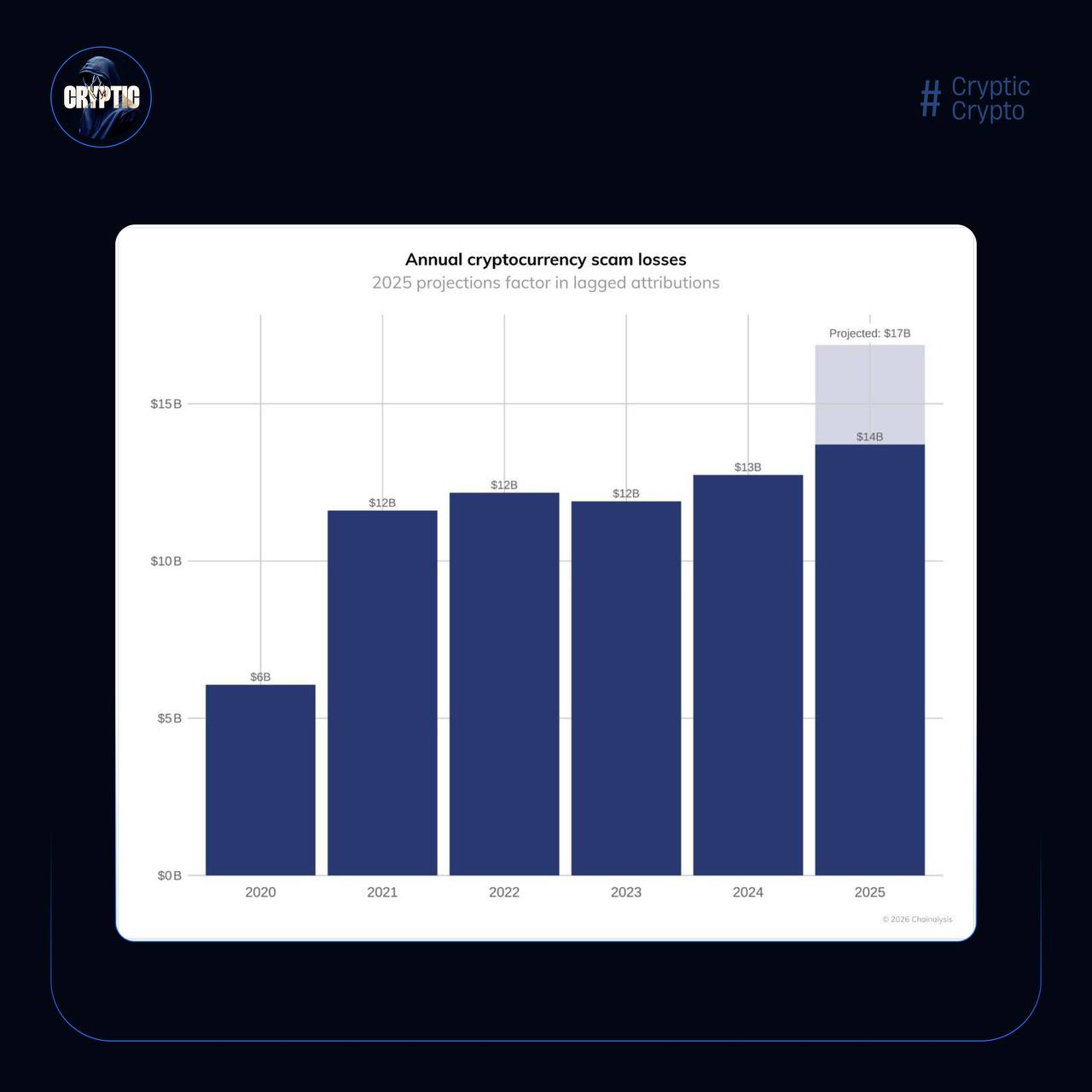

Общие потери от криптомошенничества в 2025 году оцениваются примерно в $17 млрд. Значительная часть этих денег ушла именно в схемы с подменой личности.

Вывод простой и неприятный:

В 2026 году безопасность в крипте — это не только кошельки и приватные ключи. Это проверка источников, холодная голова и ноль доверия «по умолчанию».

Вы как думаете, сможет ли рынок сам адаптироваться, или без жесткого регулирования этот тренд уже не остановить?

English 🇺🇸

Crypto fraud has reached a new level in 2025.

Identity substitution has become the fastest growing vector of attacks in the crypto industry. The growth of such crimes is estimated at about 1400% per year, and the average damage per scheme has increased by more than 6 times.

What has changed:

– Scammers no longer act "head-on".

– They copy exchanges, funds, influencers, top managers.

– They use AI for emails, voices, videos, chats, and fake support.

– Combine social engineering and technical attacks.

Result:

Total losses from crypto fraud in 2025 are estimated at about $17 billion. A significant part of this money went into identity substitution schemes.

The conclusion is simple and unpleasant:

In 2026, security in the crypt is not just about wallets and private keys. This is a source check, a cool head, and zero trust by default.

Do you think the market will be able to adapt on its own, or will this trend not be stopped without strict regulation?