⚖️ Global Markets and Cryptocurrencies: A Delicate Balance

🌍 Global markets are currently facing significant challenges due to potential U.S. tariffs and the looming debt ceiling. Despite this, cryptocurrencies are showing unexpected stability, bolstered by institutional inflows, as highlighted by QCP Capital, a digital asset trading firm based in Singapore.

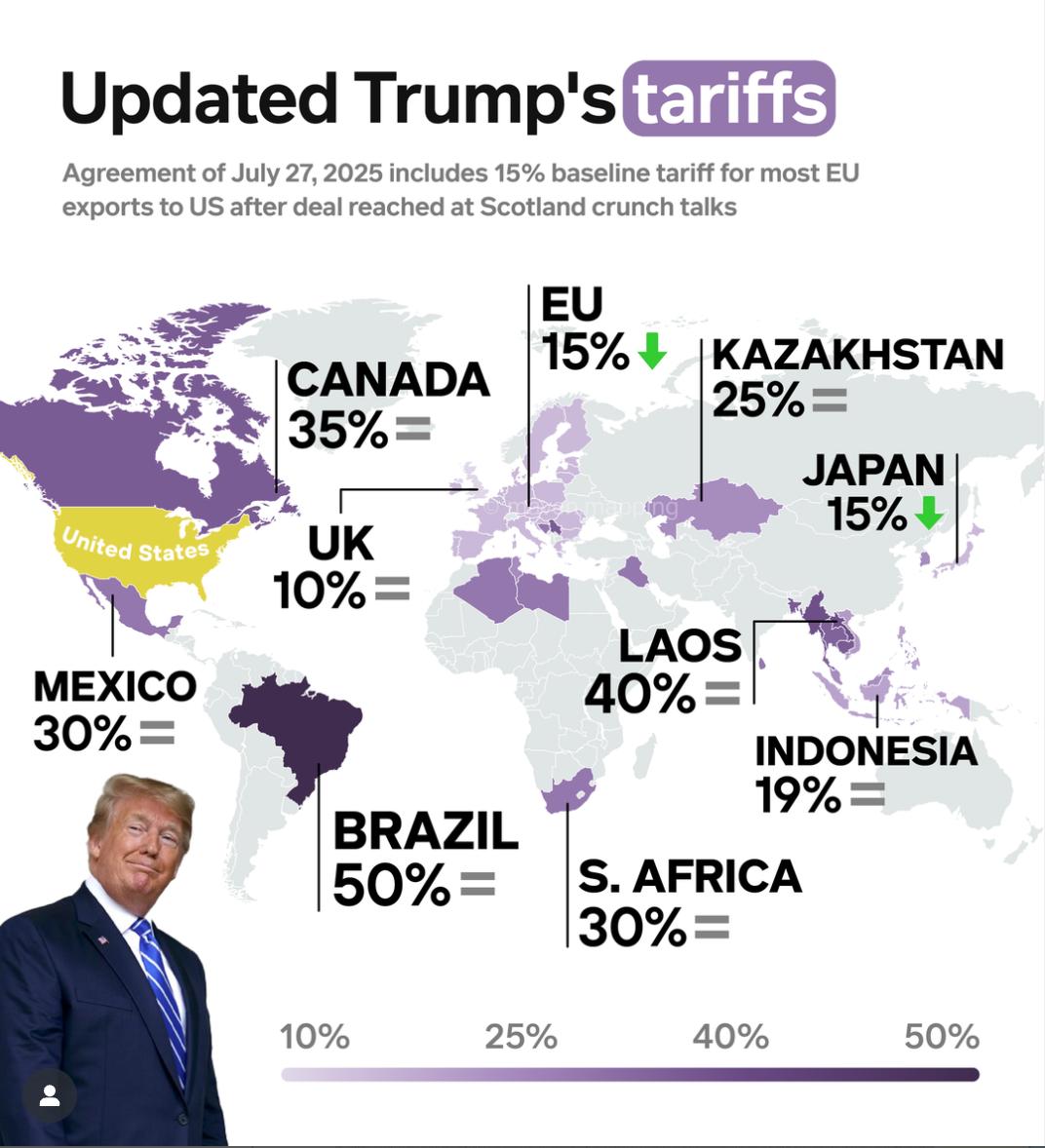

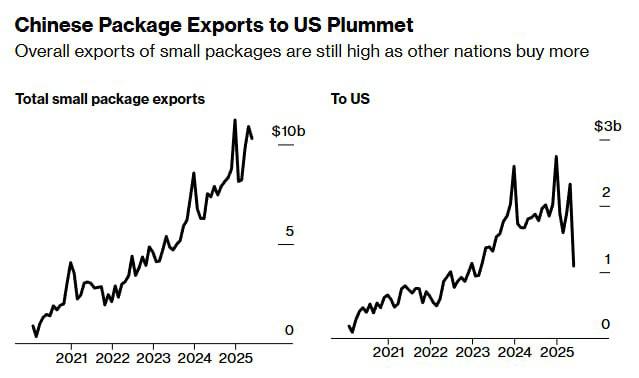

🗓 President Trump has imposed an August 1 deadline for trade deal progress, threatening 25% tariffs on Japan and South Korea. This move has effectively reset months of negotiations. QCP notes that the “TACO” narrative continues, with Trump leaving a “narrow window for delay.” While markets currently expect rhetoric without action, QCP researchers warn that implementation would be “materially anti-growth.”

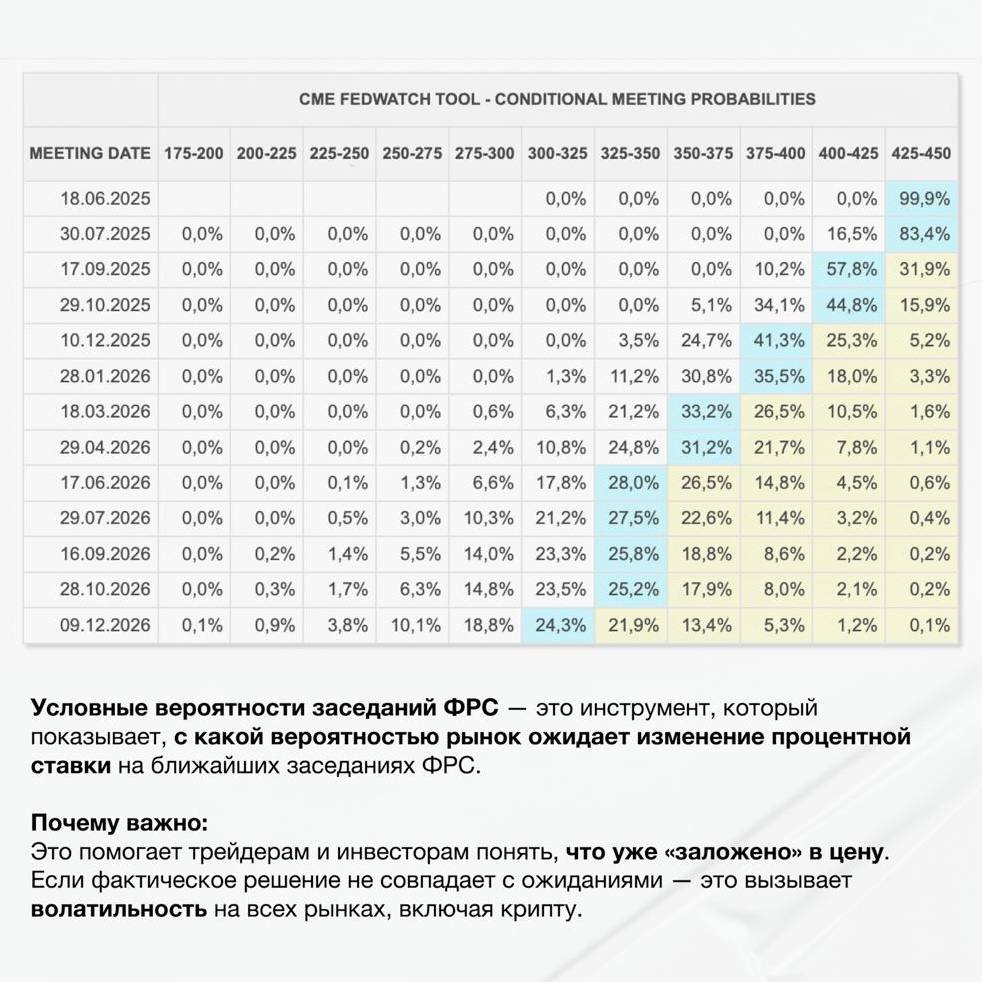

💰 This trade pressure coincides with the upcoming U.S. debt ceiling deadline in late August. QCP points out a paradox: fiscal spending, including debt interest, supports corporate profits and personal income, creating an illusion of a robust economy despite underlying risks. Federal Reserve Chair Jerome Powell remains cautious, citing concerns over tariff-driven inflation while continuing quantitative tightening.

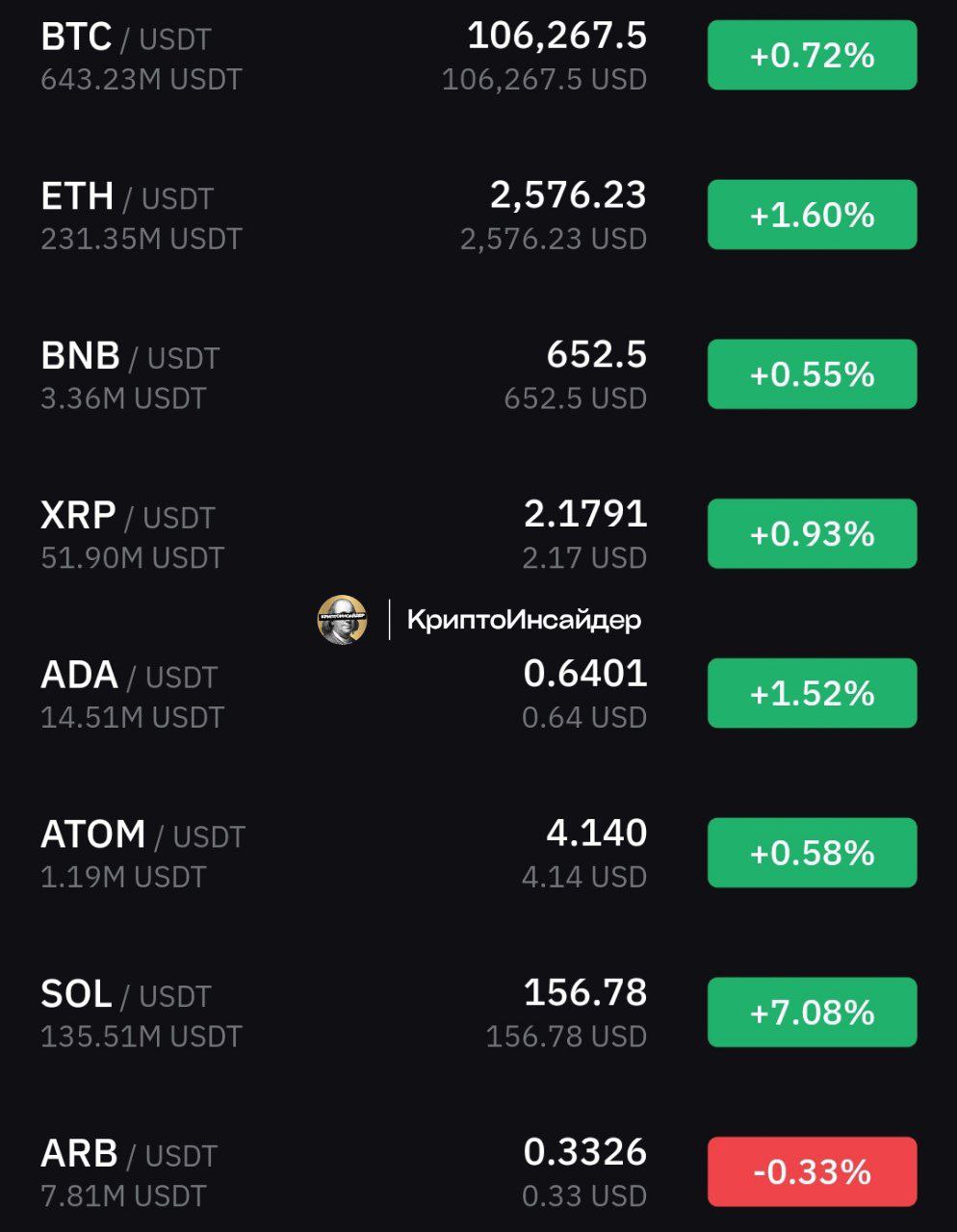

📈 In the crypto market, institutional adoption is deepening. QCP notes that Strategy has paused massive BTC buys but raised $4.2 billion for future accumulation. Other firms like Metaplanet plan to use BTC as collateral. Additionally, the U.S. Securities and Exchange Commission (SEC) is requesting revised filings for spot solana (SOL) ETFs by the end of the month, suggesting potential approval before the October 10 deadline.

📊 Currently, crypto volatility is near historic lows. Bitcoin (BTC) remains within 2-3% of all-time highs, supported by steady exchange-traded fund (ETF) and corporate treasury inflows. Equities are rallying and credit spreads are tightening as markets anticipate delayed tariffs, future rate cuts, and sustained fiscal deficits with global liquidity.

⚠️ QCP Capital concludes that while seasonal trends indicate mid-July stability, the convergence of U.S. policy decisions in Q3 and Q4 could trigger significant market volatility. They caution that the current calm may be the “calm before the storm.” Established in 2017 and headquartered in Singapore, QCP Capital provides institutional-grade digital asset trading and investment solutions globally.