↗️ Probability of a Crisis in the U.S. | Part 2

Continuing...

📊 Problems in the Structure of the Debt Market

The situation in the automotive sector also plays a significant role in the current environment, where almost simultaneously, Tricolor Holdings and First Brands Group — major players closely tied to the non-bank financial institutions (NDFI) system — have gone bankrupt.

Why is this dangerous for the economy? A company like Tricolor, for instance, issues auto loans to thousands of clients, which become assets backed by their future payments.

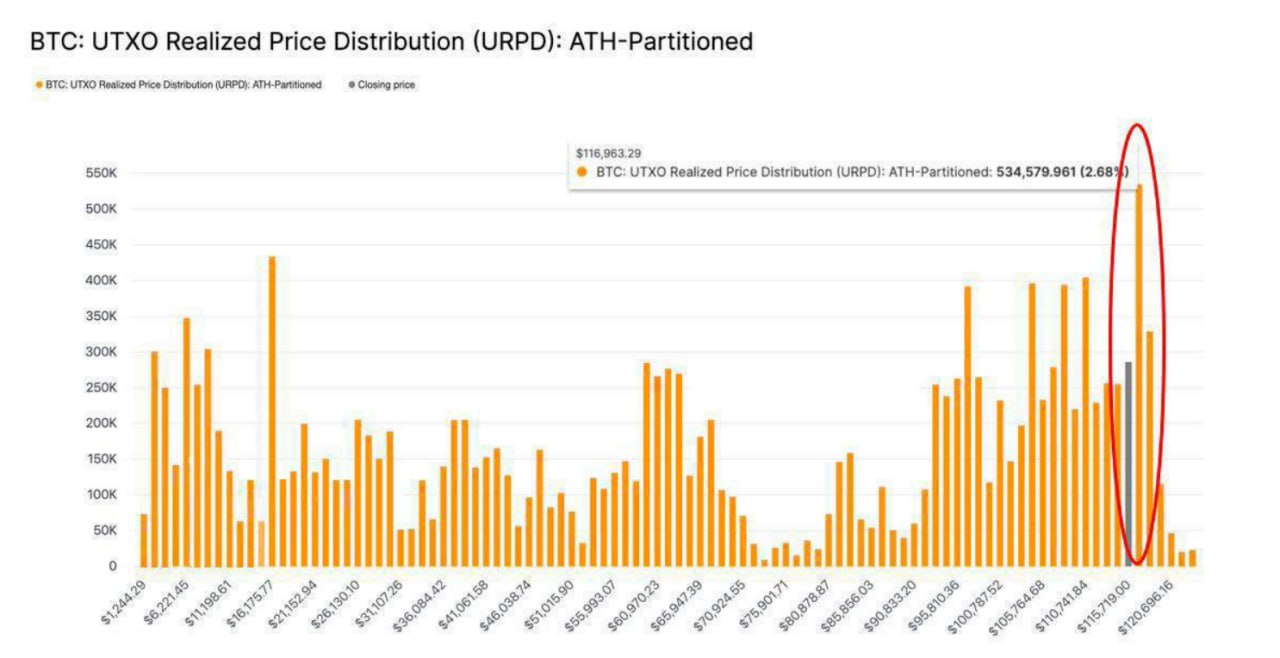

These loans are then bundled into a single pool and turned into bonds, which are subsequently sold to banks and investment funds.

However, the bonds that were previously considered high-rated have now plummeted in value. Large banks, including JP Morgan, are preparing to record hundreds of millions in losses. If similar cases continue, the entire securitization system could be at risk.

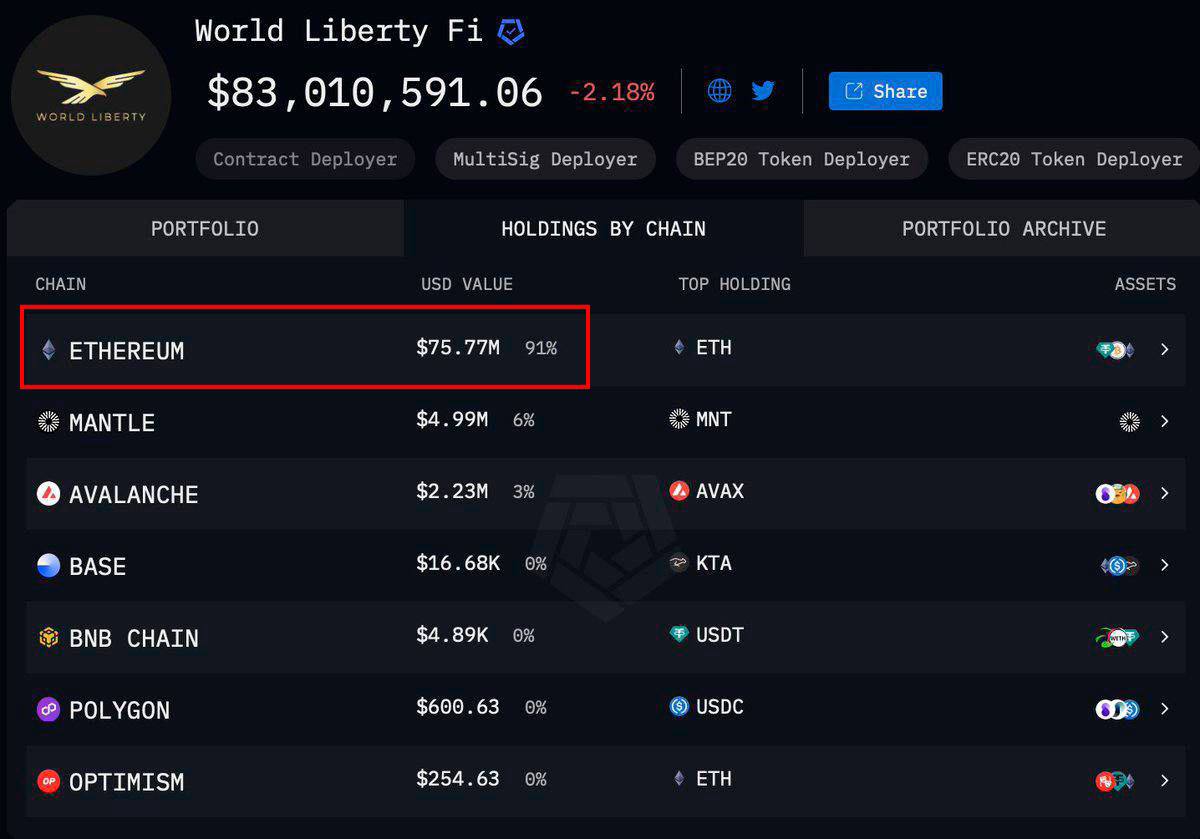

📥 It is also important to note the situation in the AI sector, where companies are currently undergoing a serious revaluation — attracting massive amounts of capital, yet their revenues do not justify the inflated multiples.

It is the hype around AI that has supported much of the stock market over the past year — for instance, NVIDIA alone accounts for 7–8% of the entire S&P 500,

And if we consider the 10 largest tech giants connected to this sector, they already make up around 40% of the index.

If any local shock occurs within the AI sector, it could drag down the entire market.

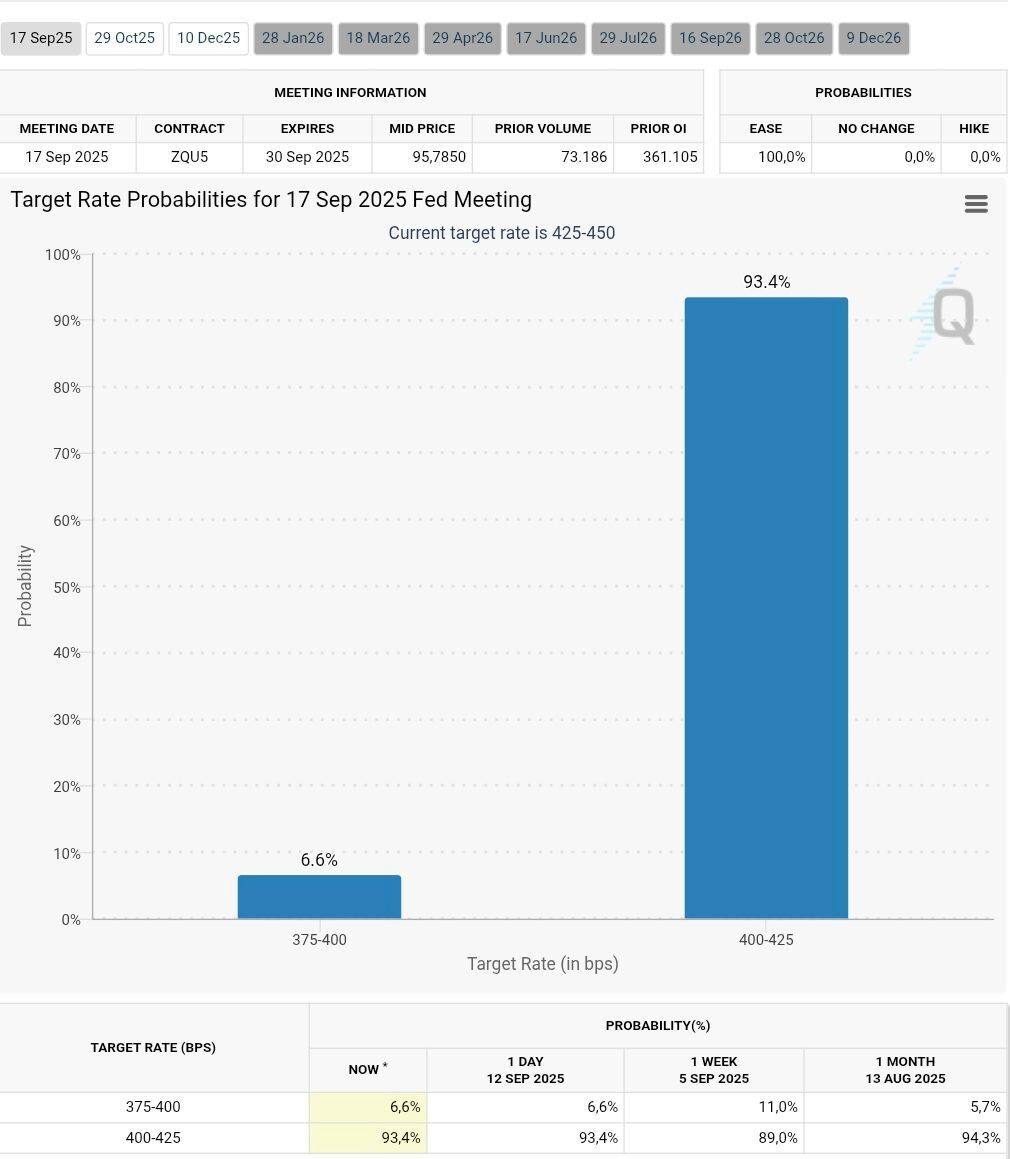

There are indeed signs of potential deterioration, but for a full-scale crisis to unfold, several negative events would need to occur simultaneously or within a short period of time.

❕ The emergence of just one of these factors could trigger a market correction, but it is unlikely to cause a deep recession 🔥

CRYPTO TREYSI | Subscribe