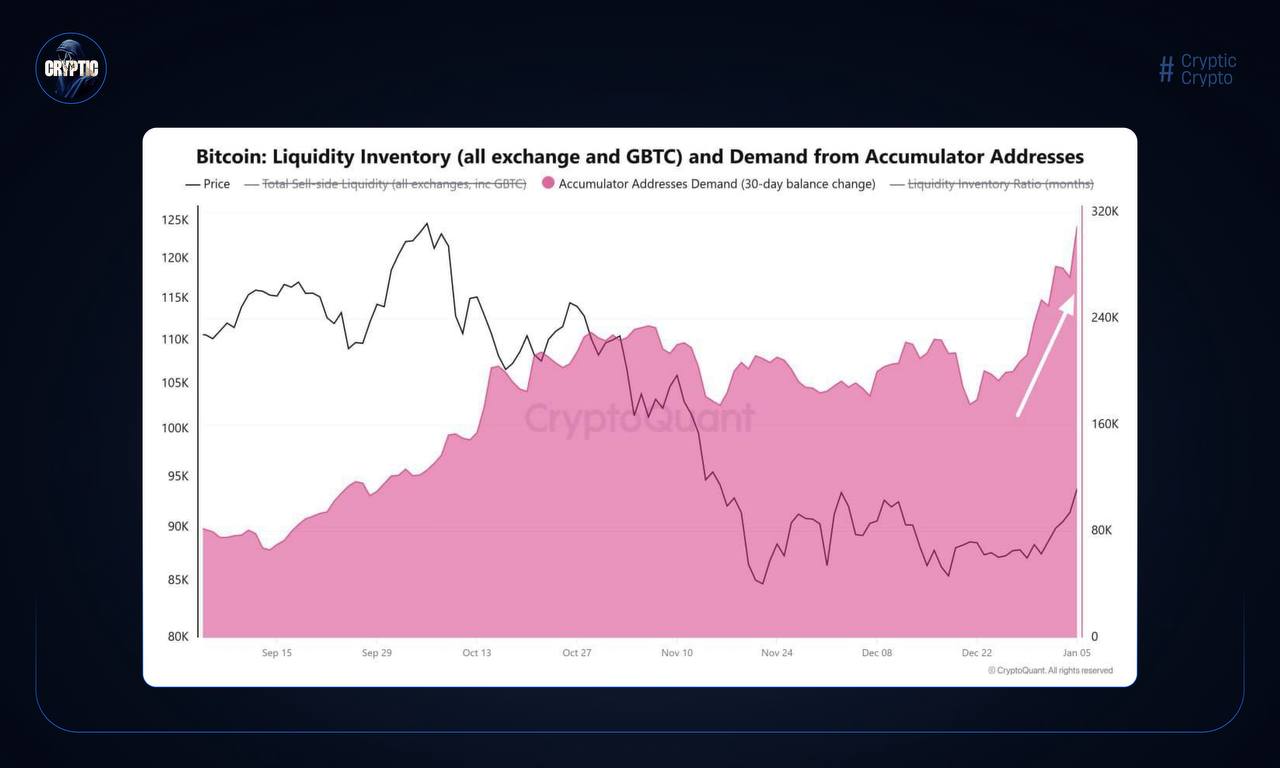

📈 Покупки #BTC уверенно ускоряются с конца декабря!

Согласно данным CryptoQuant:

Спрос на биткоин начал заметно расти именно в конце года. Причем рост выглядит поступательным, без резких всплесков и массового FOMO, что часто указывает на системное накопление.

Такие фазы обычно характерны для поведения крупных игроков, которые заходят заранее, пока рынок остается относительно спокойным. Исторически именно в подобных условиях формируется база для следующего импульса, особенно если параллельно снижается давление со стороны продавцов.

Это начало нового тренда или лишь локальное накопление перед паузой?

English 🇺🇸

#BTC purchases have been steadily accelerating since the end of December!

According to CryptoQuant:

The demand for bitcoin began to grow noticeably at the end of the year. Moreover, the growth looks progressive, without sharp spikes and massive FOMO, which often indicates systemic accumulation.

Such phases are usually characteristic of the behavior of large players who enter in advance while the market remains relatively calm. Historically, it is in such conditions that the base for the next impulse is formed, especially if the pressure from sellers decreases in parallel.

Is this the beginning of a new trend or just a local accumulation before a pause?