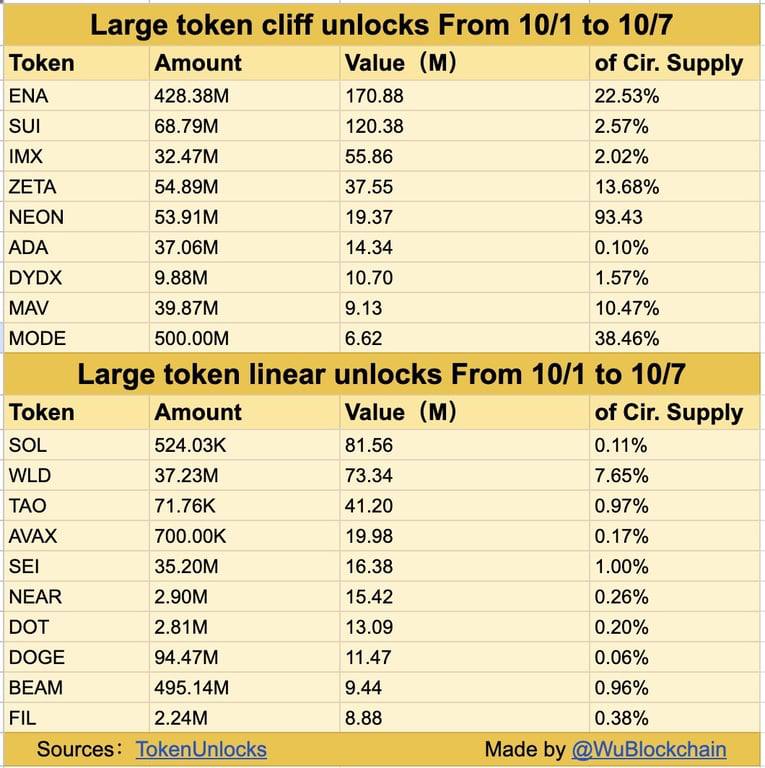

😰 Рынок остаётся в режиме сильного страха

Индекс страха и жадности показывает 15 пунктов, это зона экстремального страха.

На практике это выглядит так:

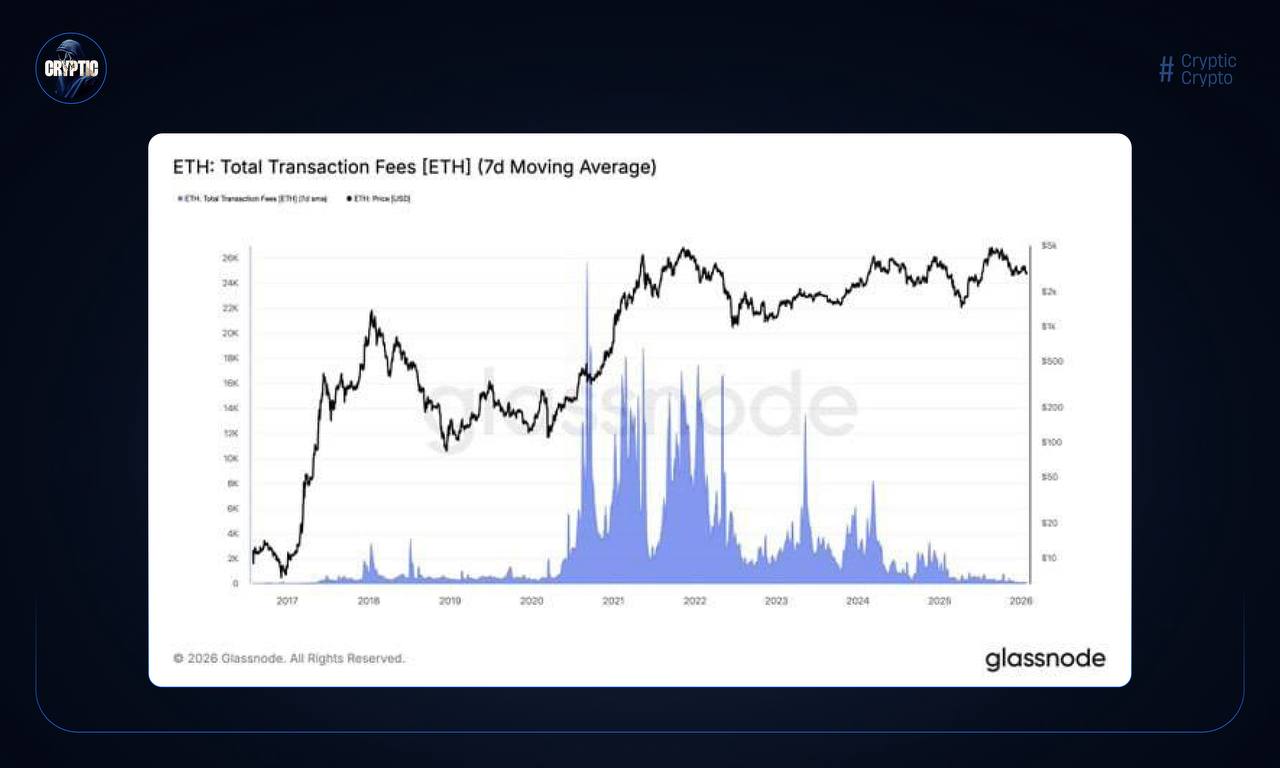

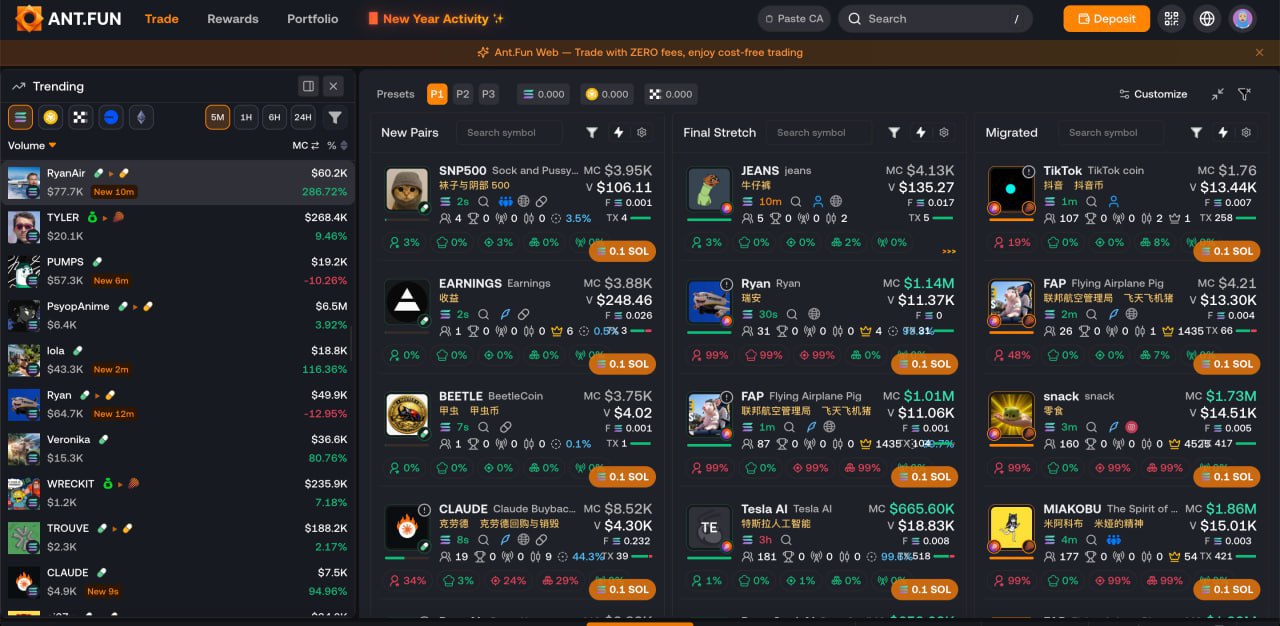

• Общая активность падает

• Объёмы сжимаются

• Альты обновляют локальные минимумы

• Панические распродажи периодически усиливаются

Позитивных триггеров пока нет. Сильных разворотных сигналов тоже...

Рынок в фазе, где эмоции управляют решениями. Именно в такие периоды большинство фиксирует убытки, а терпение становится главным активом!

Вы сейчас в какой позиции: накапливаете, торгуете краткосрок или полностью вышли в кэш и наблюдаете со стороны? 👇

English 🇺🇸

The market remains in severe fear mode

The fear and greed index shows 15 points, this is a zone of extreme fear.

In practice, it looks like this:

• Overall activity is falling

• Volumes are shrinking

• Alts update local minimums

• Panic sales are periodically intensifying

There are no positive triggers yet. Strong reversal signals too...

The market is in a phase where emotions drive decisions. It is during such periods that most people record losses, and patience becomes their main asset!

What position are you in right now: are you accumulating, trading for a short time, or have you completely entered the cache and are you watching from the sidelines?