Автор: Vilarso, крипто-эксперт

Заявление Ларри Финка в Давосе — это не просто прогноз, это дорожная карта трансформации глобальных финансов. Как эксперт, я выделяю несколько ключевых официальных фактов, которые дополняют картину «единого реестра» и объясняют, к чему мы идем.

Фрагмент выступления Ларри Финка в Давосе прикреплен к этой статье, а ниже в цитате его открытое мнение:

Миру необходимо ускорить переход к цифровым валютам на базе единого блокчейна для снижения уровня коррупции.

Все активы должны быть размещены в одной системе: акции, облигации, недвижимость, фонды денежного рынка и наличные деньги.

«Следующее поколение рынков, следующее поколение в финансовых ценных бумагах — это будет токенизация ценных бумаг», — Ларри Финк в одном из своих заявлений, подчеркивая неизбежность перехода.

1⃣ Институциональный фундамент и RWA уже здесь

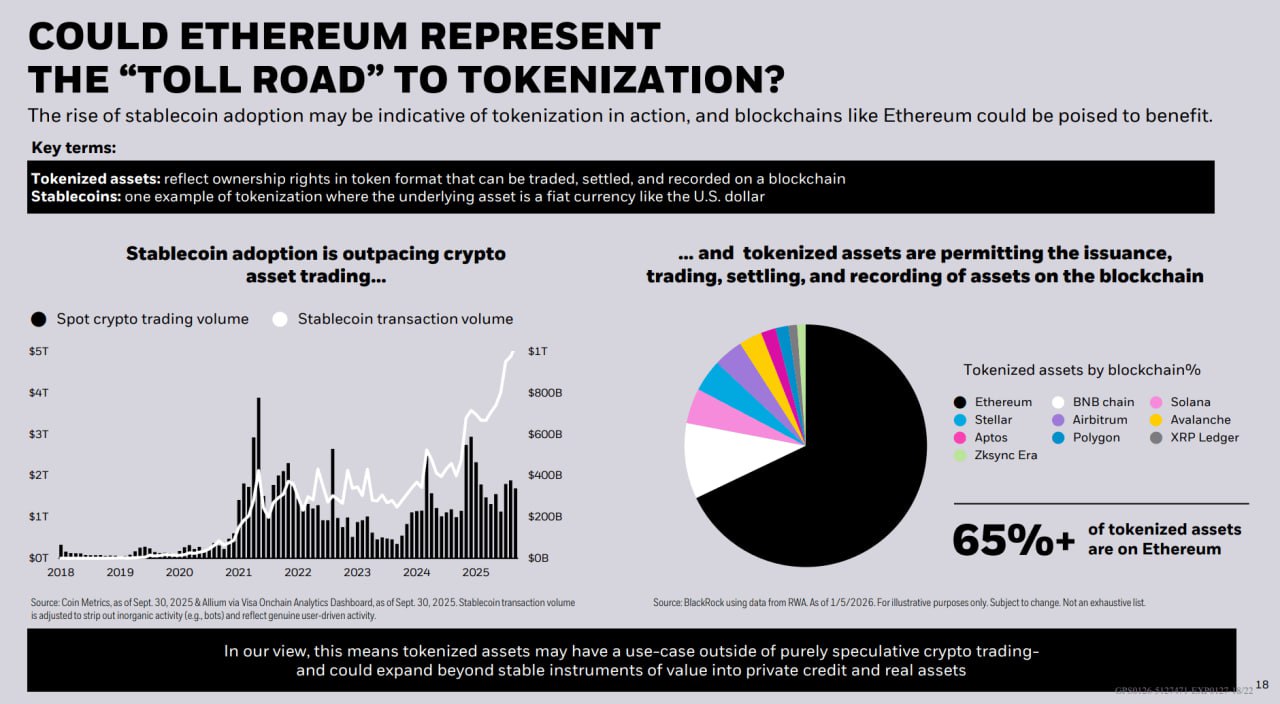

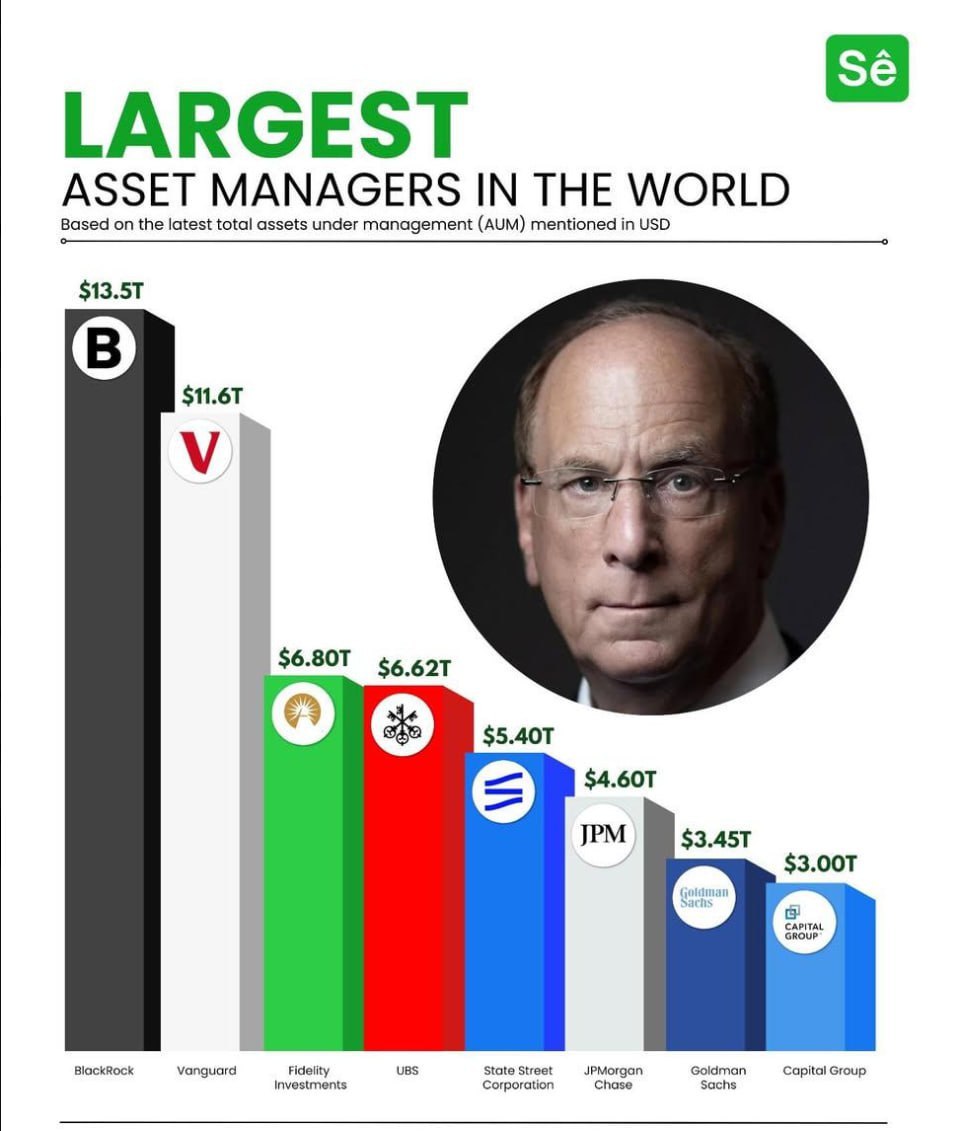

BlackRock уже перешел от слов к делу. Запуск фонда BUIDL на блокчейне Ethereum стал первым официальным шагом к токенизации активов реального мира (RWA - Real-World Assets). Это подтверждает, что крупнейший в мире управляющий активами (более $10 трлн под управлением) больше не рассматривает криптографию как эксперимент — теперь это инфраструктура. Рынок RWA уже достиг $35,9 млрд к концу 2025 года и, по прогнозам, вырастет до $9,43 трлн к 2030 году.

2⃣ Концепция Unified Ledger (Единого реестра) и роль XRP

Идея «Единого леджера» активно продвигается Банком международных расчетов (BIS). В эту архитектуру идеально вписывается XRP Ledger (XRPL). Ripple уже запустила специальную платформу для CBDC (цифровых валют центробанков), которая позволяет центральным банкам выпускать, управлять и распространять собственные цифровые валюты на частной версии XRPL. Такие страны, как Бутан и Палау, уже используют инфраструктуру XRPL для пилотных программ своих национальных цифровых валют.

3⃣ Программируемость как замена бюрократии

Главный посыл Ларри Финка, который я полностью разделяю: переход от Т+2 (двухдневный расчет сделок) к T+Instant (мгновенно). Токенизация позволяет автоматизировать процессы.

➖Токенизированная недвижимость: В Дубае уже работают платформы, такие как Stake и SmartCrowd, предлагающие долевое владение недвижимостью от $150, что значительно повышает ликвидность рынка. Департамент земельных ресурсов Дубая активно поддерживает эти инициативы.

➖Токенизированные акции и Forex: Крупные криптобиржи, такие как Kraken,

BingX,

Bitget уже предложили торговые решения так называемых "xStocks" (токенизированные акции). А Нью-Йоркская фондовая биржа (NYSE) разрабатывает собственную платформу для круглосуточной торговли токенизированными акциями. Это показывает, что эксперименты выходят на уровень традиционных финансовых гигантов.

💪 Мой вердикт:

Мы наблюдаем финал эпохи «бумажных» финансов. Когда лидеры масштаба BlackRock говорят о токенизации наличных и недвижимости в единой сети, это означает, что регуляция будет подстраиваться под технологию, а не наоборот. Об этом я информировал свою аудиторию

@VilarsoFree неоднократно еще более трех лет назад.

Глобальный реестр — это неизбежность.

Учитывая активную работу Ripple с центробанками и огромные объемы RWA на блокчейне Ethereum, которые уже выходят на рынок, становится очевидным, что инфраструктура для этого будущего активно строится прямо сейчас.

Следите за рынком, делитесь информацией с теми, кто еще спит наяву - будущее уже токенизировано.

Всегда ваш, Vilarso

#News #Vilarso #Crypto