📌 Про проект Gensyn много писали и ставили ноды еще с апреля '25 и вот вчера наконец-то был

анонсирован айрдроп токенсейл.

📆 Timeline:

🔵️ 09 Декабря: регистрация в сейл;

🔵️ 15 Декабря 18:00 МСК - 20 Декабря: проведение сейла (подача заявок);

🔵️ 25 Декабря: определение аллокации + открывается возможность отказаться и вернуть средства для EU участников;

🔵️ 08 Января: закрывается возможность рефанда для EU участников;

🔵️ Начало февраля '26: клейм 100% токенов $AI.

📃 Параметры токенсейла:

🤩Total supply: 10b $AI;

🔵️ В рамках сейла продают 300m $AI (3%) + еще 200m $AI (2%) выделено в виде бонусного мультипликатора;

🔵️ Сейл в формате Английского аукциона с максимальной ценой. Пример механики:

🔵️ Организатор устанавливает максимальную цену ($0,10) и хочет распределить 5000шт токенов;

🔵️ Участники делают ставки, кто сколько токенов готов купить и по какой цене:

⬛ A: 4000 шт по $0,07;

⬛ B: 2000 шт по $0,08;

⬛ C: 1000 шт по $0,10.

🔵️ Определяется cut-off цена - наименьшая цена, по которой можно распределить все доступные токены среди участников. В нашем примере это $0,07, по которой можно распределить все 5000 токенов.

🔵️ Все победители покупают токен по одной и той же cut-off цене, даже если предлагали больше:

⬛ C: купит все заявленные 1000 шт по $0,07 (переплата $0,03 вернется);

⬛ B: купит все заявленные 2000 шт по $0,07 (переплата $0,01 вернется);

⬛ A: купит оставшиеся 2000 шт из заявленных 4000 шт по $0,07;

⬛ Все кто делал заявки по цене менее $0,07 - ничего не получают

⬛ Если спрос будет настолько велик, что по максимальной цене $0,10 будут готовы выкупить все 5000 токенов, то победители на право покупки будут определены по X, Discord, Wallet активности.

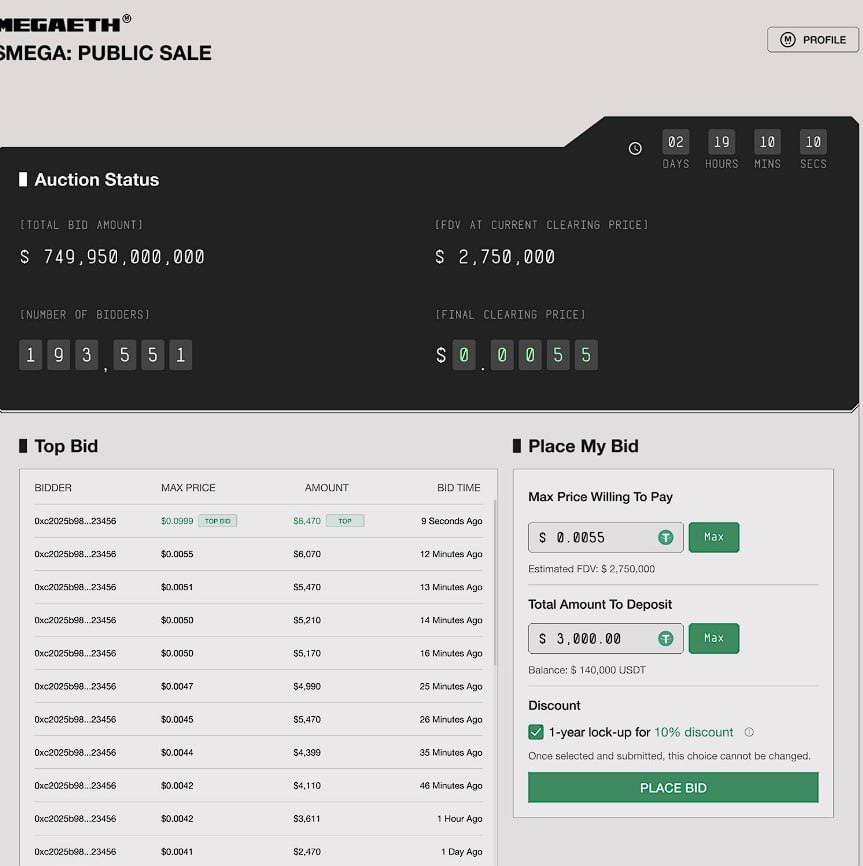

🔵️ Min цена в сейле: $0,0001 (FDV $1m), Max цена в сейле: $0,10 (FDV $1b);

🔵️ Min ставка $100, Max ставка не ограничена. Ставки принимаются в USDC / USDT (ERC20);

🔵️ Разлоки: 100% токенов доступны на TGE.

🔵️ Список

#eligibility">запрещенных стран (РФ, УКР не допущены).

✳ Как увеличить шанс на получение аллокации:

🤩Чтобы полностью выбрать всю аллокацию (300m $AI) по max цене ($0,10) потребуется $30m. Сумма небольшая, поэтому подаваться ниже чем по $0,10 нет смысла - даже по этой цене будет жесткий отбор. На увеличение шанса влияет:

🔵️ Testnet Participation: участие в тестнете.

🔵️ Community Engagement: активности в Discord, X

🔵️ Open Source ML Contributions: кто что-то делал в их open-source ML за последние 12 мес

🔵️ Lockup Selection: те, кто выберет добровольный лок на 12 мес

🔵️ Bid Timing: чем раньше подаете заявку в период сейла, тем больше шанс.

🔼 Как получить мультипликатор (доп токены) на купленную аллокацию:

🤩200m $AI (2%) выделено на бонусные токены, которые будут начислены отличившимся участникам сейла. Например: вам одобрили аллокацию на $500 и базово по $0,10 вы приобретаете 5000 $AI. Но если вы значимый участник, то вам могут присвоить мультипликатор например х3 и дать сверху еще +10000 $AI. Тогда получится, что вы купили токены не по $0,10, а уже по $0,033.

🔵️ Testnet users: участие в тестнете, учитываются все стадии и время участия.

🔵️ Lockup Selection: те, кто выберет добровольный лок токенов на 12 мес получат +10% токенов.

🤩Максимально возможный мультипликатор не известен.

🤩Если у вас несколько кошельков с тестнет активностью, то модеры советуют их все приконнектить к одному участвующему аккаунту.

🤓 Участвовать или нет?

🔵️ Если вы участвовали в тестнете, то я бы участвовал. Сделать хороший мейн аккаунт в расчете на мультипликатор и "нормальный" FDV участия - думаю имеет смысл.

🔵️ Если не участвовали в тестнете, то подавать заявки ради бейз реварда, я бы не стал:

🟦 нет намеков на бейз ревард, напротив пишут, что доп.токены только для сильных аккаунтов;

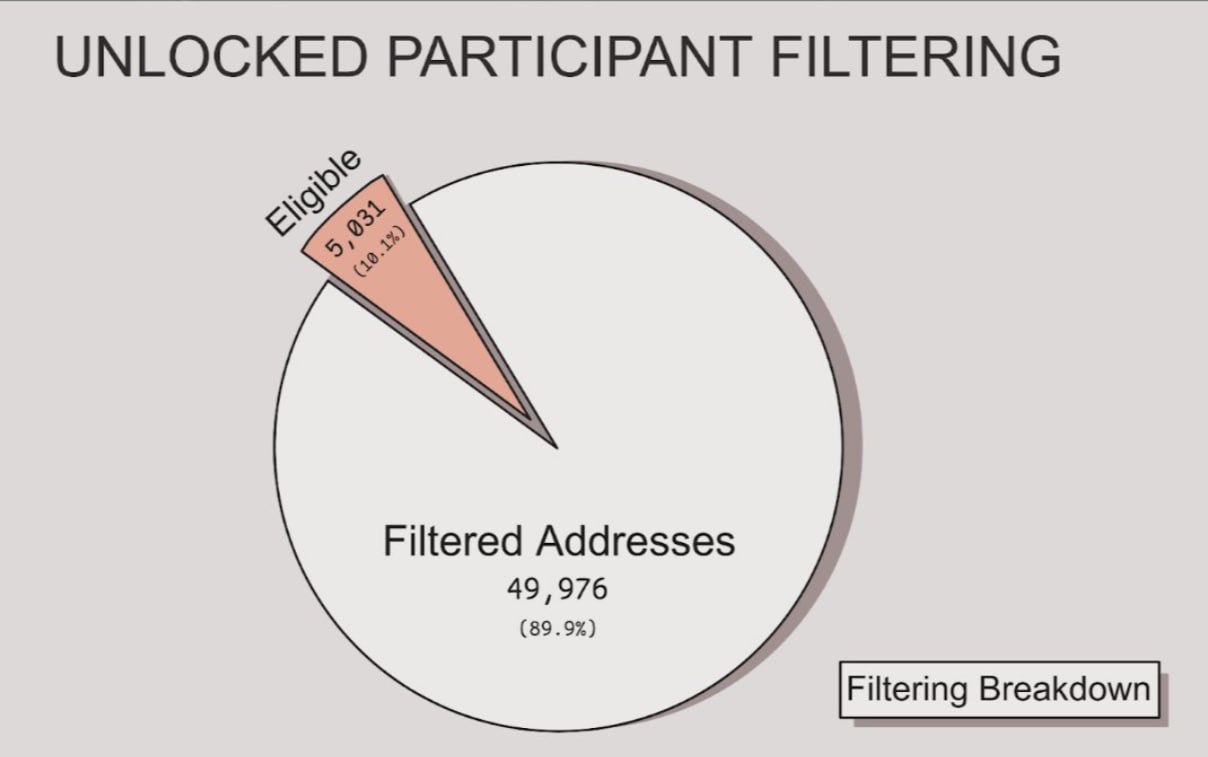

🟦 мало шансов, что слабый аккаунт без тестнета вообще получит аллокацию. Участников тестнета 157k+;

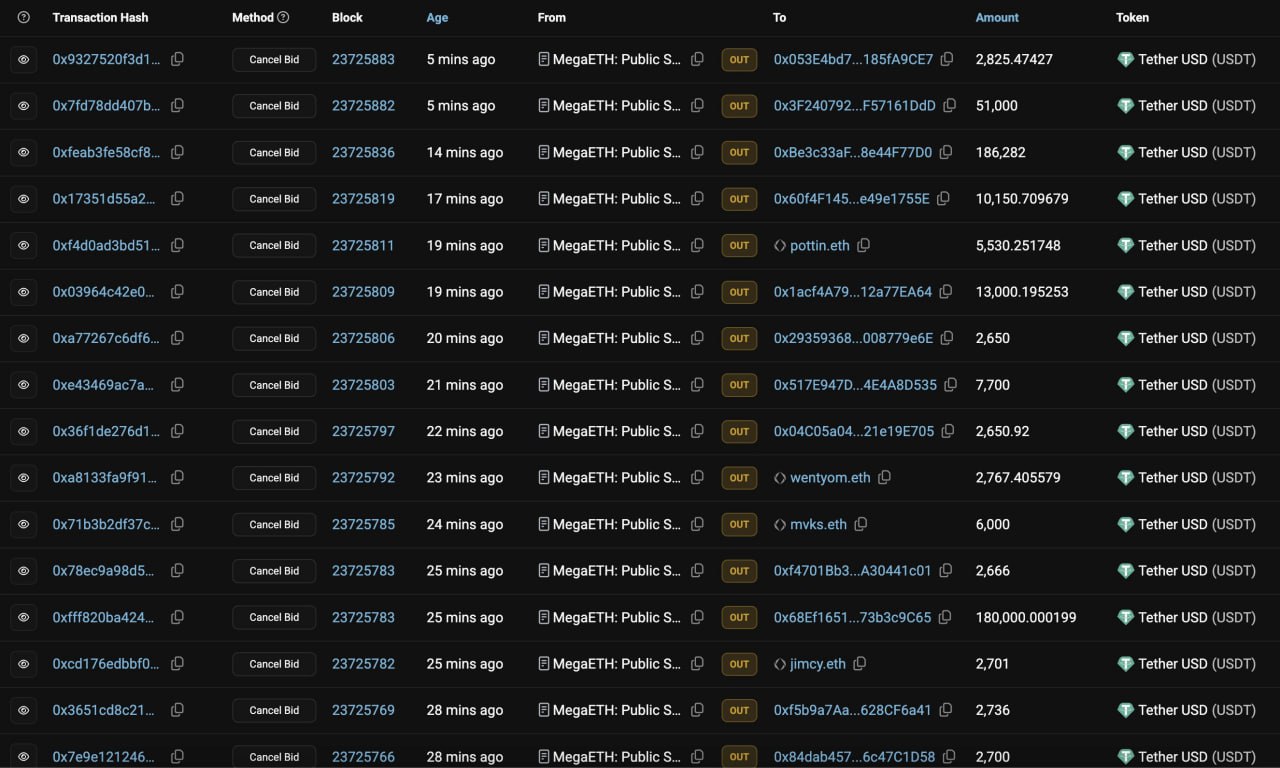

🟦 нет намеков, что все участники сейла получат какую-то роль в будущих ревард кампаниях (как у MegaETH);

🟦 если слабый аккаунт вдруг получит аллоку, то вы ее получите по FDV $1b. По такой цене иксов на TGE может и не быть вовсе.