Ежедневный апдейт по проектам и новостям

🔵️Реварды от Binance за холд USD1

Сегодня биржа распределила WLFI за холд стейблов, по доходности вышло около 15% APR. Следующее распределение состоится 6 февраля, подробнее читаем в посте.

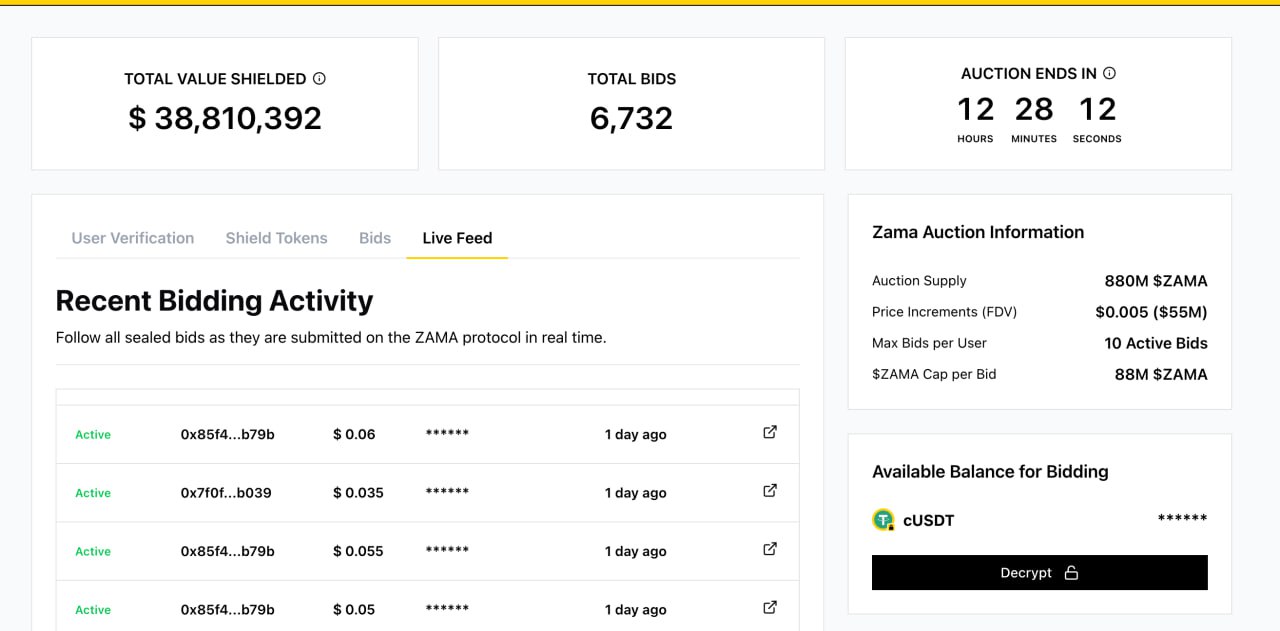

🔵️Листинги ZAMA

Сегодня в 15:00 по Киеву токен проекта залистят на Binance и других биржах, тогда как клейм откроют в 14:00 на этом сайте. Напоминаю, что Clearing Price составила 0.05$, на данный момент цена на пре-маркет фьючах держится в районе $0.04.

🔵️Аукцион Rainbow

Проект объявил об аукционе, который стартует сегодня в 17:00 по Киеву (стадия пре-бидов) на Uniswap и продлится до 5 февраля. Условия: стартовая цена $0.1 ($100 млн. FDV), выделено 0.5% от сплая, заносить можно USDC в сети Base. По завершении аукциона запустятся пулы на Uniswap V4, начнётся клейм дропа и сами торги. Кстати, чтобы без проблем заклеймить дроп, нужно обновить мобильное приложение до последней верссии.

🔵️Намёки на TGE от Espresso

Проект прогревает аудиторию подобным твитом спустя более месяца после открытия регистрации на дроп. К слову, она всё ещё активна, проверить свои кошелки и зарегистрироваться можно на сайте.

🔵️Продолжение падения рынка

Ночью BTC опускался ниже $75к и на данный момент торгуется по $76к. ETH же держится в районе $2200. Капитализация всего рынка на данный момент составляет $2.59 трлн.

😎 HinkoK | Telegram | Chat | HinkoK Soft | Best Proxy