🥴 Fabric / OpenMind на Kaito 🥴

Про Fabric / OpenMind писал ТУТ 👈🏻

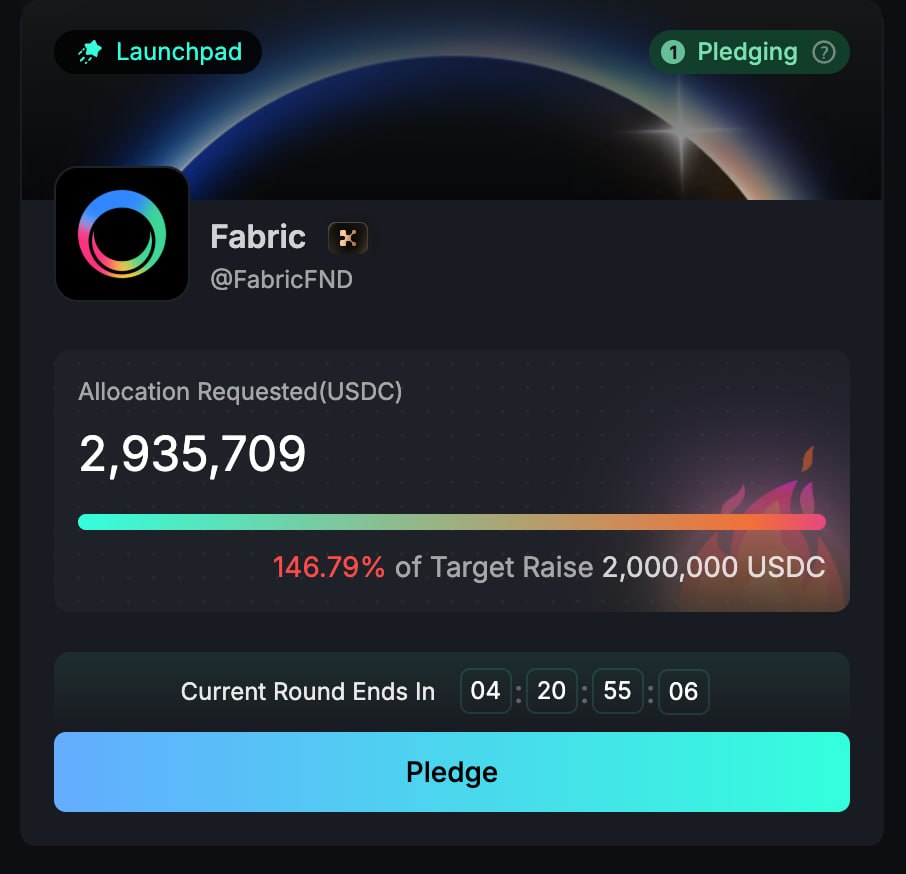

Fabric запустили публичный сейл на Kaito Capital Launchpad. Проект из нарратива AI + робототехники

Собрали ранее: $22M от Pantera Capital, Coinbase Ventures, DCG, Ribbit Capital, и других

ROBO: Нативный токен сети Fabric

🟢Инцентивы для агентов, девелоперов и контрибьюторов

🟢Экосистемная координация

🟢Будущий governance протокола

Параметры сейла:

🟢 FDV: $400M (было $200M)

🟢 Цель: $2M

🟢 Оффер: 0.5% от всего предложения

🟢 Вестинг: 100% на TGE

🟢 Мин / Макс: $1,000 - $250,000

🟢 ТГЕ: Q1 2026

Приоритетные аллокации (40% при оверсабе):

🟢 15% - Fabric Коммьюнити (Platinum rank, Backpack / OG / Dev / Researcher badges)

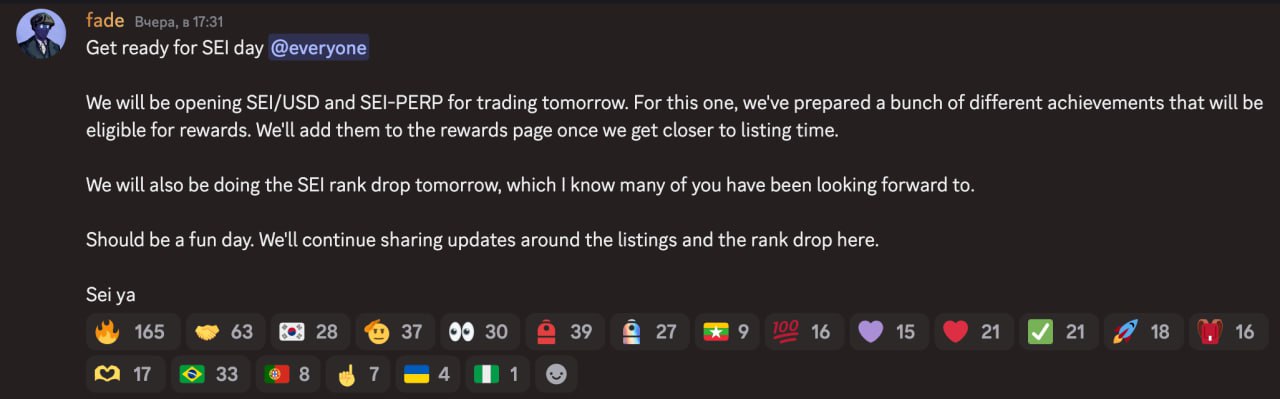

🟢 10% - Kaito Коммьюнити (sKAITO, Yapybara, топ CT аккаунты, CN / KR)

🟢 5% - Рефералы

🟢 5% - Virtuals (Стейк 100+ veVirtuals)

🟢 5% - Surf (NFT Pass holders)

Собрали уже 3млн$, на полимаркете чуток загрузил, что всего соберут тотал 4млн$. До конца сбора 5 дней. +14% можно забрать со ставочки 🍸

Мне ОЧЕНЬ нравится OpenMind, но какого хрена они собирают по 400млн FDV...(

На бычке по 400млн FDV многие стремались заносить (например, DoubleZero), а тут тима на тамком ущербном рынке с такой оценкой собрать хочет...

Финальное решение по заносу пока для себя не принял

Саламчик | Мульты | Twitter | ОКХ | Чат | Софты | Тут деньги | Лайф