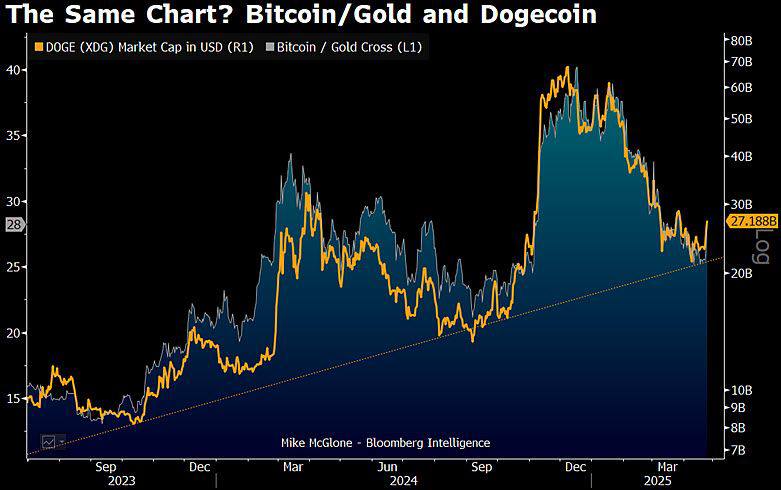

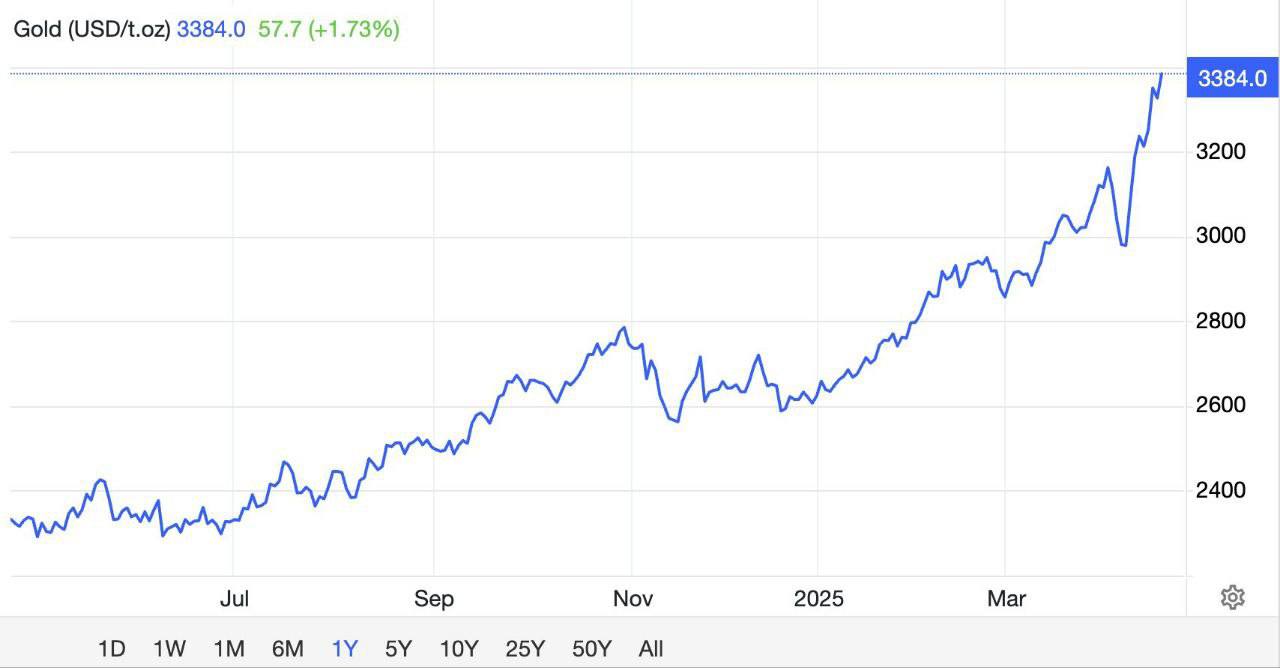

💰 Золото вырвалось вперёд и это может быть сигналом для #BTC

Пока все гадают, куда пойдёт рынок, золото уже делает то, на что Биткоин только настраивается. Но если подключить волновой анализ Эллиотта — картина становится яснее.

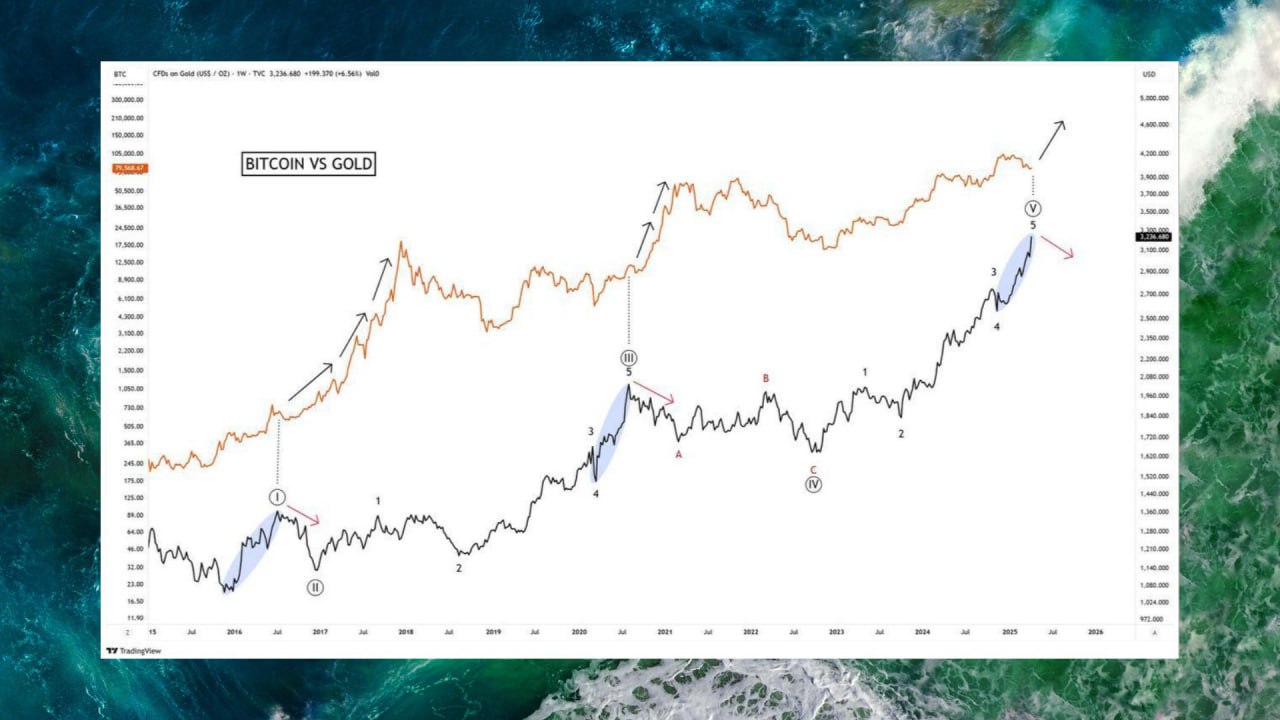

Волны, которые ведут к вершине

Разметка по BTC:

1️⃣ Волна I (2015–2017) — старт тренда, первое узнавание Биткоина массами.

2️⃣ Волна II (2018–2019) — закономерная коррекция и фаза сомнений.

3️⃣ Волна III (2020–2021) — эйфория, рост, массовое принятие и первые ETF.

4️⃣ Волна IV (2022–2023) — замедление, боковик, «рынок умер» и крах доверия.

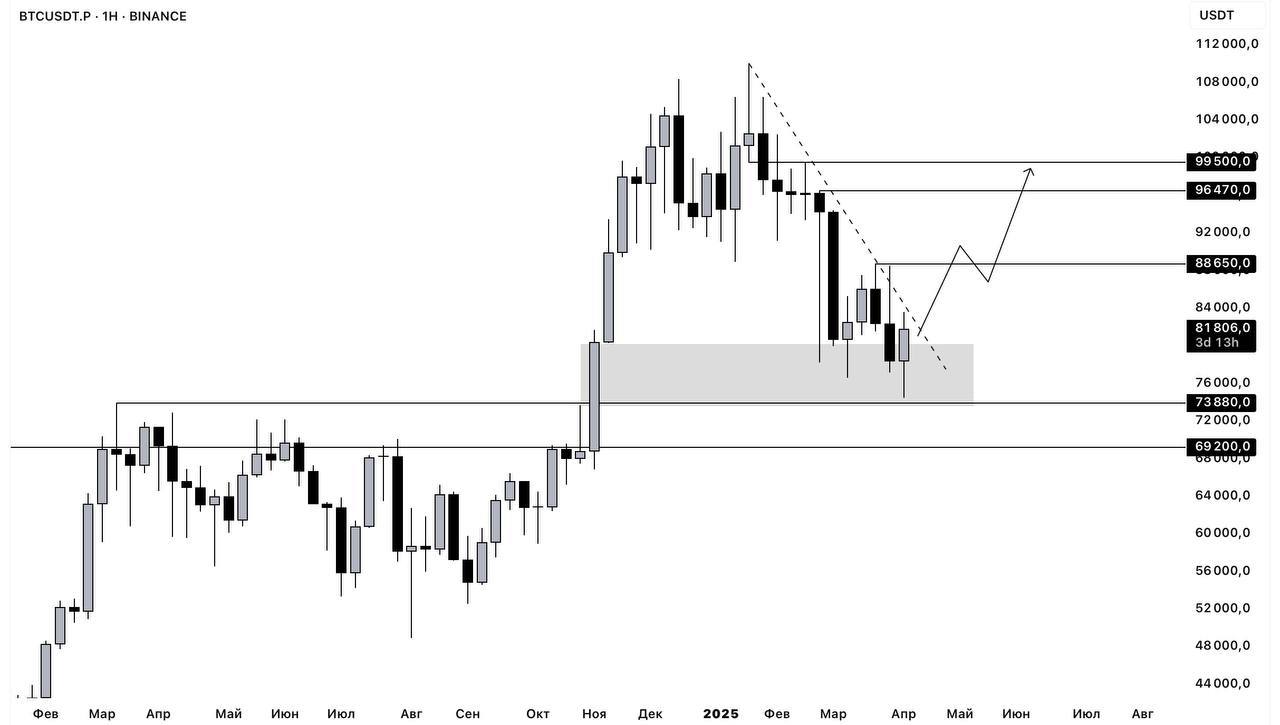

5️⃣ Волна V (сейчас?) — тот самый финальный рывок, где толпа ещё в сомнениях, а умные деньги уже закупаются.

Золото исторически считается тихой гаванью, и если оно уже на хаях — рынки начинают раскрываться. Золото не поддаётся хайпу, оно реагирует на реальные риски.

А Биткоин, как актив следующего поколения, просто повторяет его траекторию — с задержкой.

Если разметка верна — мы уже в волне V, а значит:

Рост до $100,000 и выше — это не фантастика, а потенциальный сценарий.

Волна 5 почти всегда сопровождается высокой волатильностью — будет трясти!

После пика волны V следует глубокая коррекция — и это естественно.

Золото уже показало маршрут. BTC сейчас только пристёгивает ремни в той же кабине.

И если вы не на борту — возможно, сейчас самое время хотя бы посмотреть расписание. Удачи на рынке!

Как думаете — мы уже в волне V? Или только на старте?

English 🇺🇸

Gold has pulled ahead and this could be a signal for BTC

While everyone is wondering where the market will go, gold is already doing what Bitcoin is just tuning in to. But if you connect Elliott wave analysis, the picture becomes clearer.

Waves that lead to the top

Markup by BTC:

Wave I (2015-2017) - the start of the trend, the first recognition of Bitcoin by the masses.

Wave II (2018-2019) is a regular correction and a phase of doubt.

Wave III (2020-2021) — euphoria, growth, mass adoption and the first ETFs.

Wave IV (2022-2023) - slowdown, sideways movement, "market dead" and collapse of confidence.

Wave V (now?) — that's the final breakthrough, where the crowd is still in doubt, but smart money is already being bought.

Gold has historically been considered a safe haven, and if it is already in the hay, the markets begin to open up. Gold does not lend itself to HYPE, it reacts to real risks.

And Bitcoin, as a next-generation asset, simply repeats its trajectory — with a delay.

If the markup is correct, we are already in wave V, which means:

Growth to $100,000 and above is not a fantasy, but a potential scenario.

Wave 5 is almost always accompanied by high volatility — it will shake!

After the peak of wave V, a deep correction follows — and this is natural.

Gold has already shown the route. BTC is just buckling its seat belts in the same cabin right now.

And if you're not on board, it might be a good time to at least look at the schedule. Good luck in the market!

Do you think we're already in wave V? Or just at the start?

⭐️

Crypto Chat |

Exchange |

ADS