💵 Доллар завершает 2025 год важным медвежьим сигналом

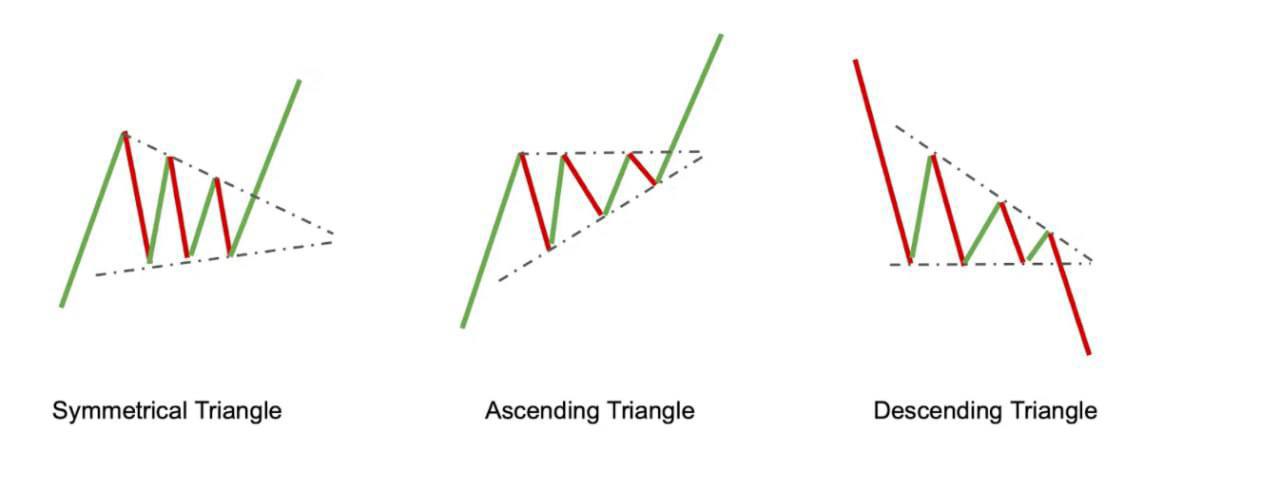

На годовом графике индекса DXY сформировался ключевой технический паттерн, указывающий на разворот тренда.

📉 Годовой разворот (Bearish Reversal):

1. Новый максимум: индекс обновил пик, превысив уровень 2024 года.

2. Открытие выше закрытия 2024 года: покупатели изначально контролировали ситуацию.

3. Ключевое изменение: сильный спад к концу года → вероятное закрытие ниже уровней открытия и закрытия 2024 года. Это сигнал о том, что контроль перешёл к продавцам.

📊 Долгосрочный контекст:

• 2022 год: начало потери бычьего импульса (длинная верхняя тень на графике).

• 2023: медвежий год.

• 2024: локальный бычий отскок, подготовивший пик в январе 2025 на уровне 110.17.

• После пика: 6-месячное падение до 96.373.

• Июль–декабрь 2025: боковой диапазон 96.224–100.39, но слабость в ноябре-декабре склонила чашу весов в сторону медведей.

🎯 Долгосрочные цели по Фибоначчи

(от движения 70.698 → 114.78 с 2008 по 2022 гг.):

• 50% коррекция: 92.74

• 61.8% коррекция: 87.54

Это основные уровни, к которым может стремиться индекс в случае продолжения нисходящего тренда.

Итог:

Годовой паттерн указывает на исчерпание бычьей силы и высокую вероятность продолжения снижения в 2026 году. Ближайшая значимая цель — 92.74.