🤖 Weekly insights from a Capitalist on the current market

Mr. Capitalist is back with an update. Bitcoin just hit a new all-time high - $118,000. And this isn’t the top.

🔼Altcoins are waking up, capital is flowing back into the market, and liquidity is moving across chains.

It might look like a perfect moment — but as always, it’s not that simple. Let’s break it down 👇

Positives you can’t ignore:

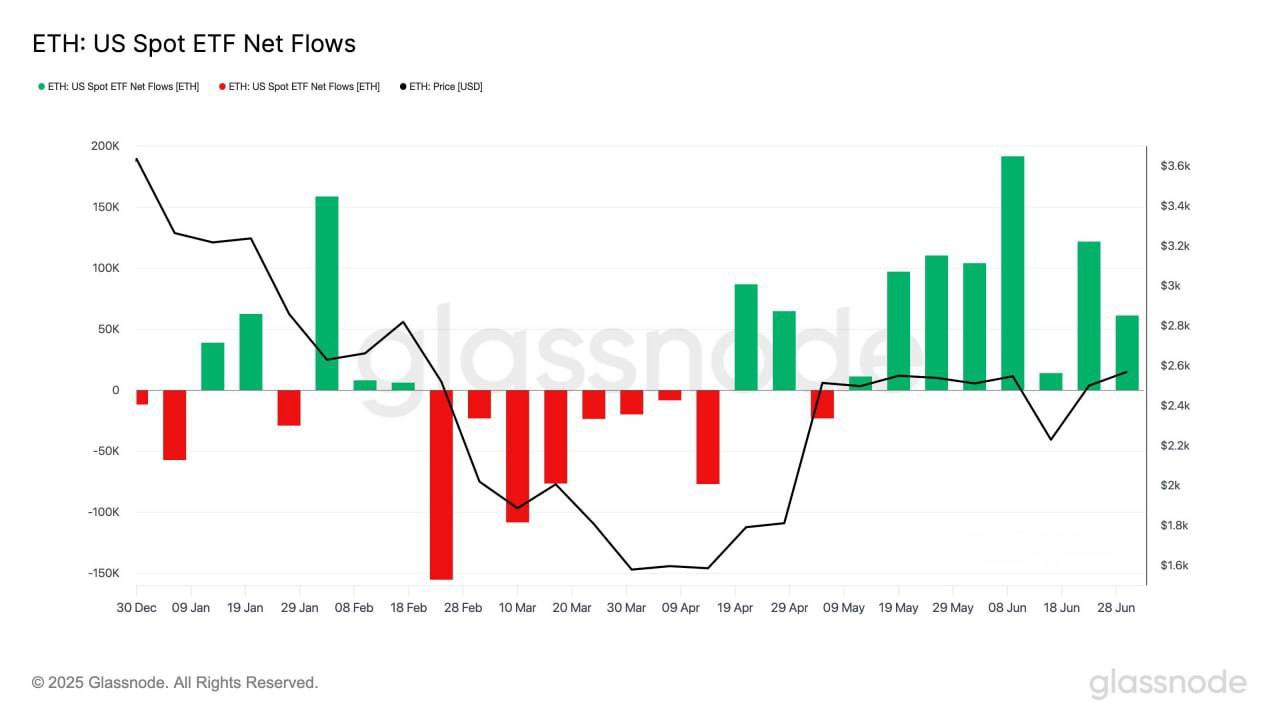

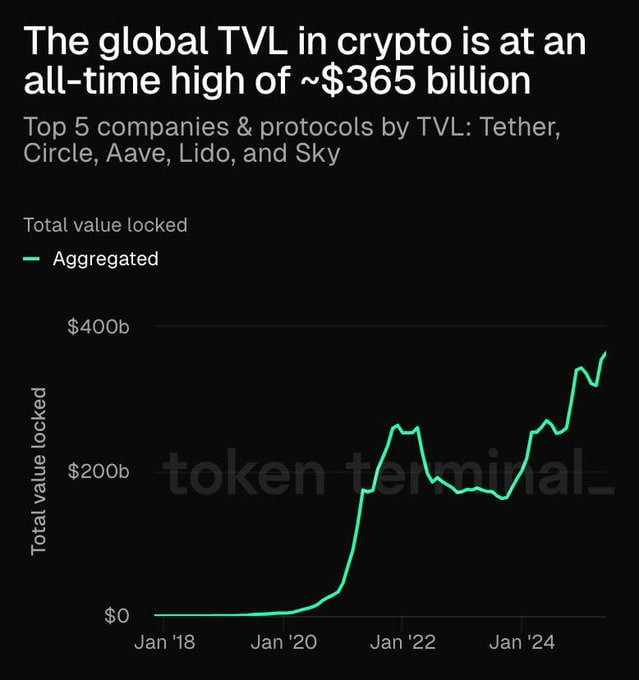

🟧Institutions aren’t just watching — they’re going all in. ETFs, funds, derivatives — crypto is becoming mainstream

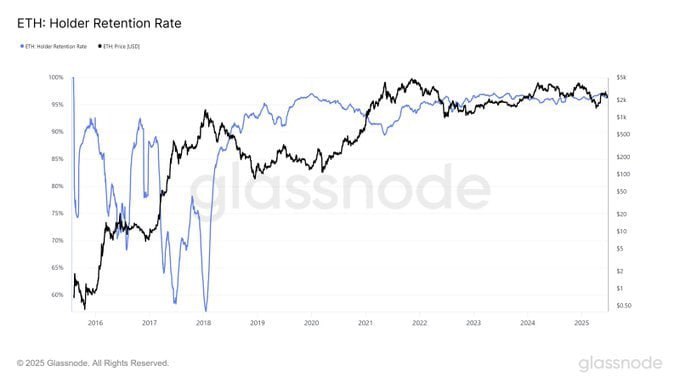

🟧On-chain metrics confirm growth: networks are overloaded, activity is higher than in the 2021 bull run

🟧AI, RWA, and Layer-2s are the three core engines of this cycle

🟧Users are coming back, not just for a quick “x10,” but for actual tools and infrastructure

Now, a few risks I’ve warned about before:

🟧Geopolitics is not just background noise — it’s a trigger. One tweet and the market could swing hard

🟧Corrections are coming — likely sudden and sharp

🟧Regulatory tug-of-war: the U.S., EU, and Asia still don’t agree on what to do with DeFi

🟧Many alts are overheated — and some will inevitably crash hard

What to do in this environment:

◾️Diversify — don’t bet everything on one trend

◾️Use on-chain analytics — follow the money, not the noise (that’s where Pumpy helps)

◾️Focus on fundamentals, not just the price chart

◾️Take profits in parts — nobody ever went broke locking in gains

Mr. Capitalist’s takeaway:

Yes, the market is offering opportunities. Yes, this might be the beginning of a true supercycle. Track the metrics. Study the networks. Don’t fall for the noise. $118K Bitcoin isn’t the finish line — it’s the starting point.