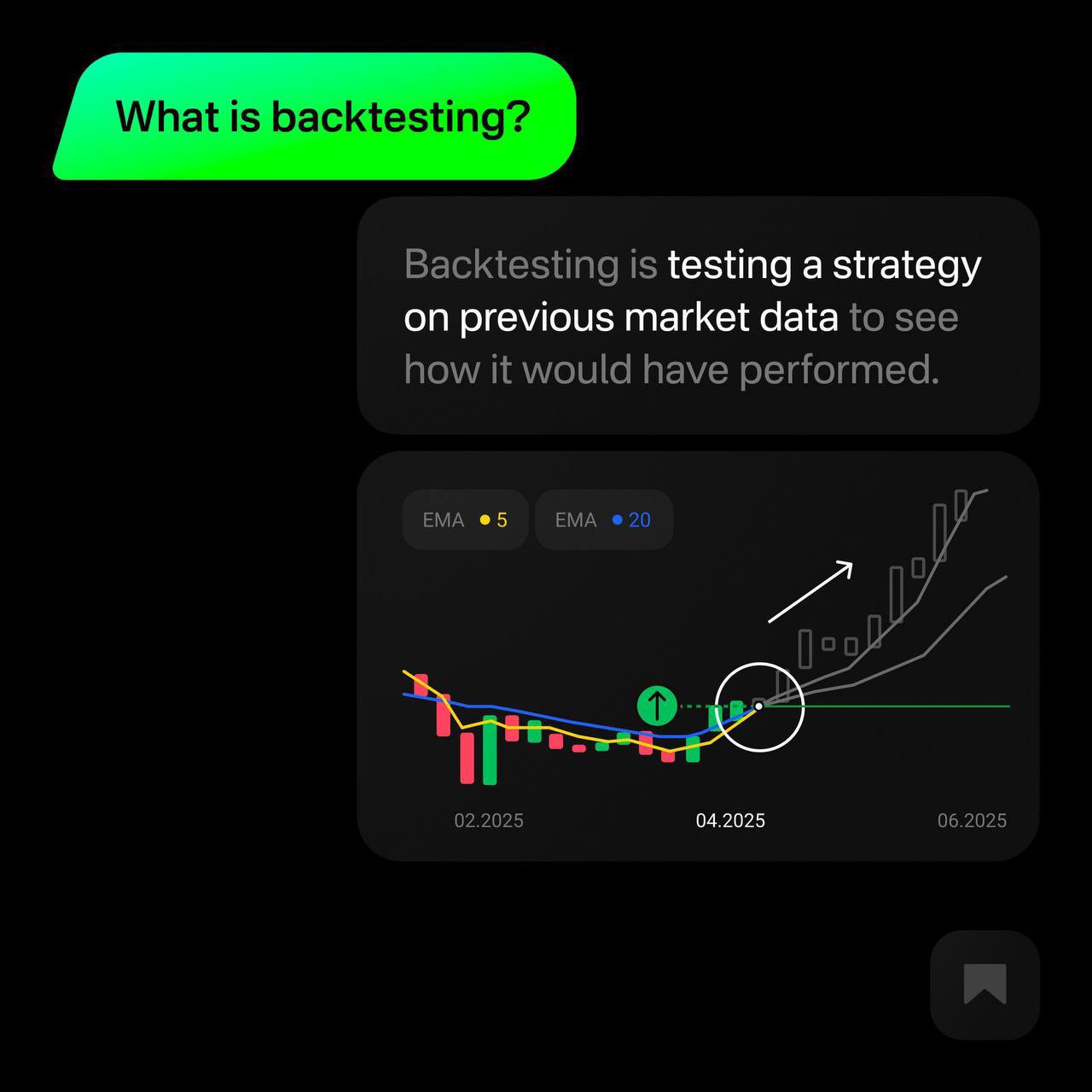

Backtesting helps you:

✔️ Test and refine strategies on historical market data, risk-free

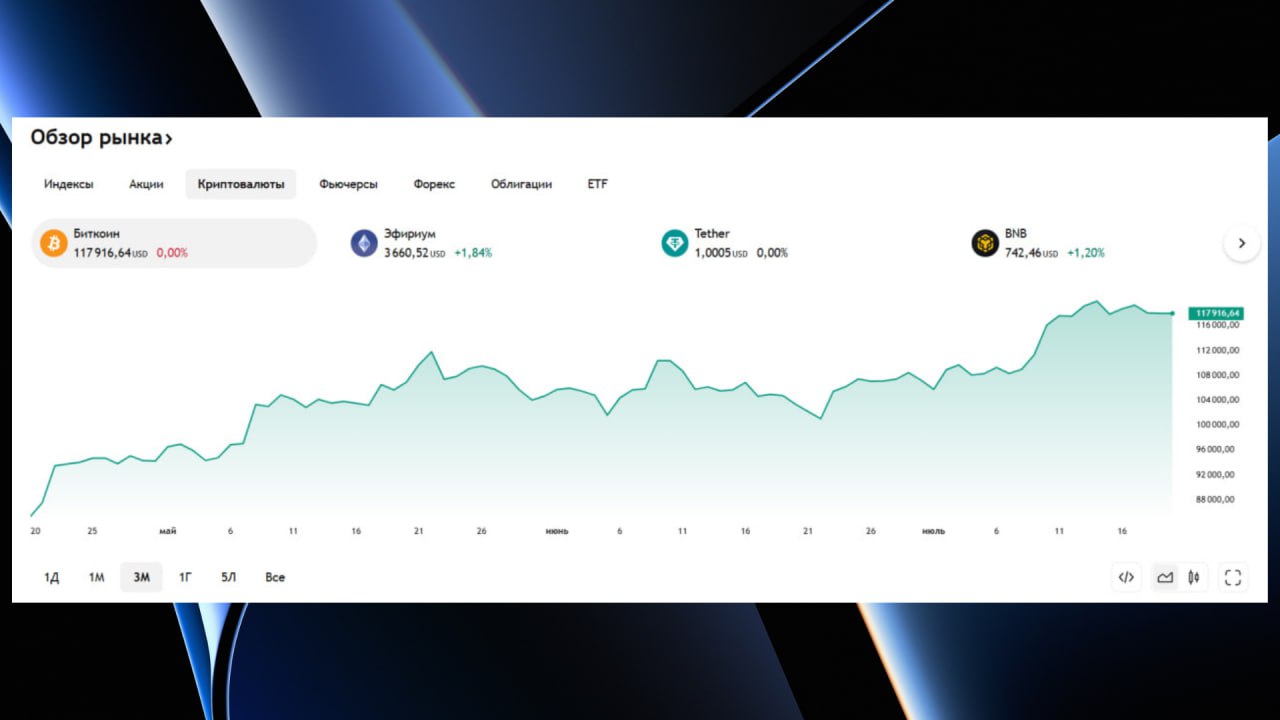

✔️ See how your setup performs in different market conditions

How to backtest a strategy:

1️⃣ Choose a strategy.

Example:

🟢 Buy when EMA 5 crosses above EMA 20

🔴 Sell when EMA 5 crosses below EMA 20

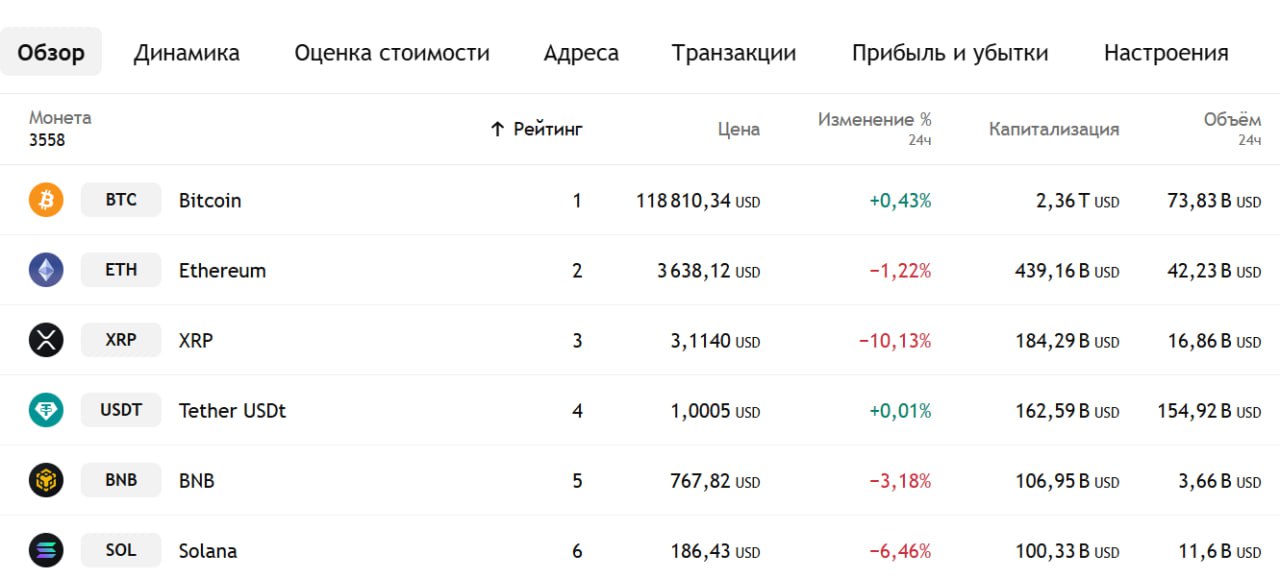

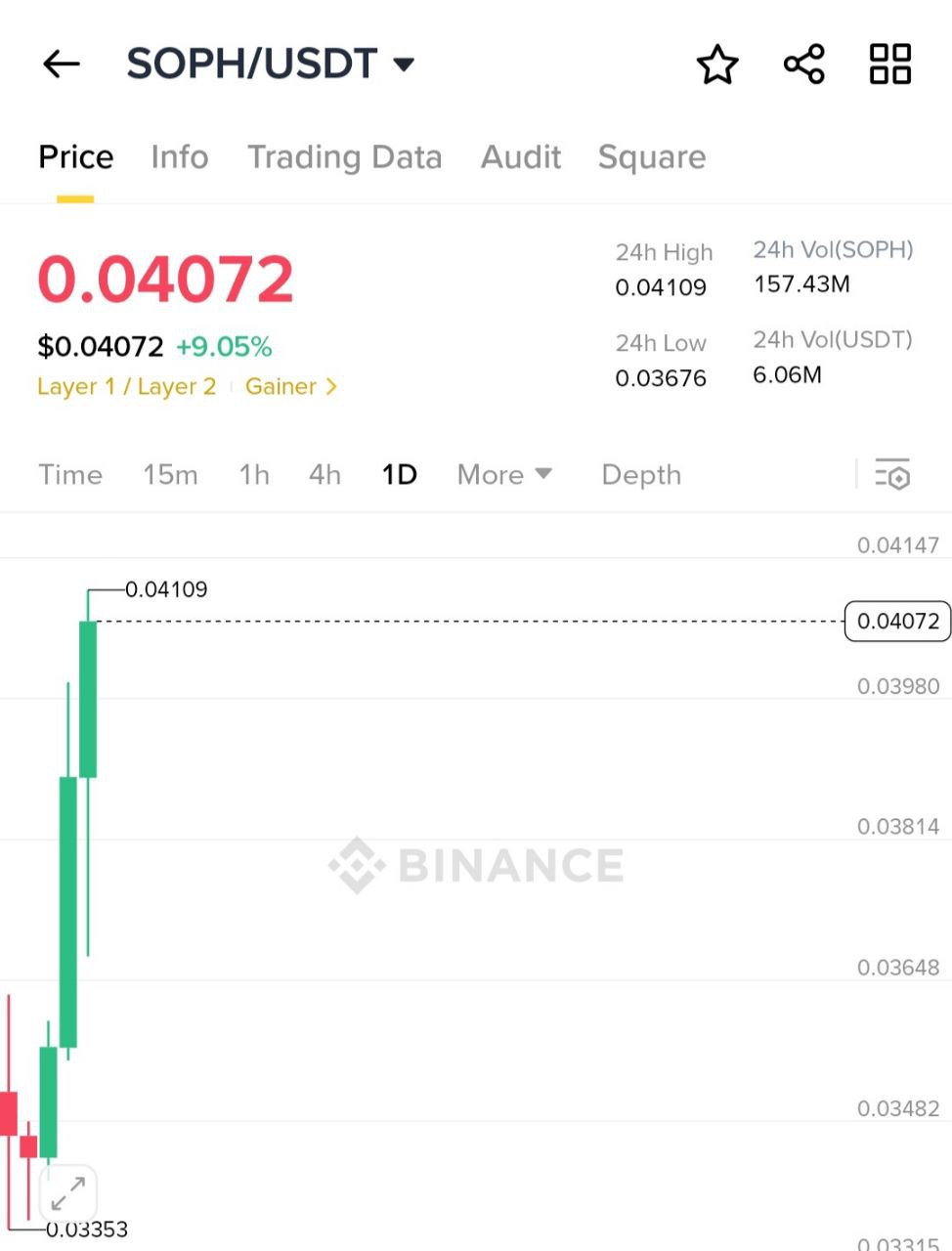

2️⃣ Select an asset and timeframe.

Example:

Gold, 1-minute candles, 24 hours

3️⃣ Scroll back in time to hide future price moves.

4️⃣ Go through the chart one candle at a time.

When your conditions are met, mark entry/exit points based on your strategy.

5️⃣ Use tools like Excel or Notion to log key metrics:

- Entry and exit prices

- Net profit or loss (P&L)

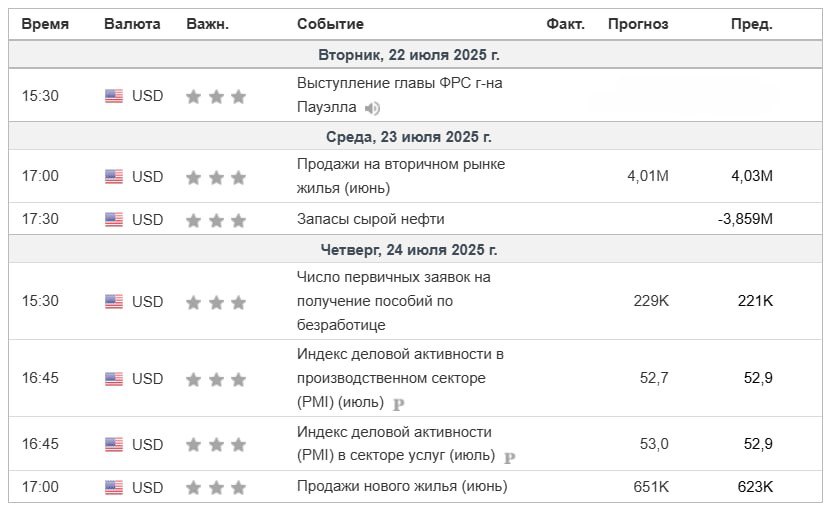

- Market conditions

6️⃣ Review performance.

Analyze metrics like success rate, average profit/loss and drawdown to spot areas for improvement.

💡 Backtest your strategy in trending, ranging and volatile markets.

💡 Don’t peek at future prices to avoid hindsight bias.

🔗Click here to register 👉 https://olymp.gl/BuOqg

⚡️ @olymptradersignal