🔽 ALTCOINS vs BTC: Дно найдено или дно в подарок?

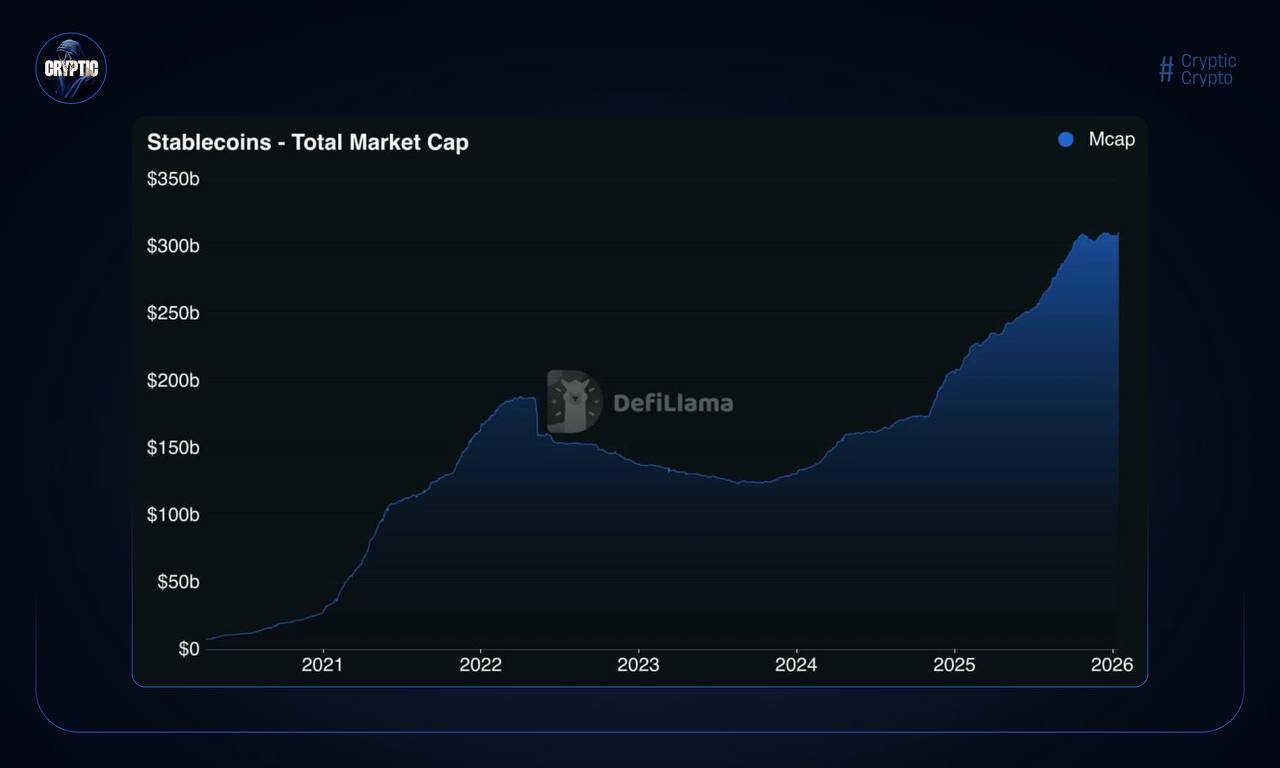

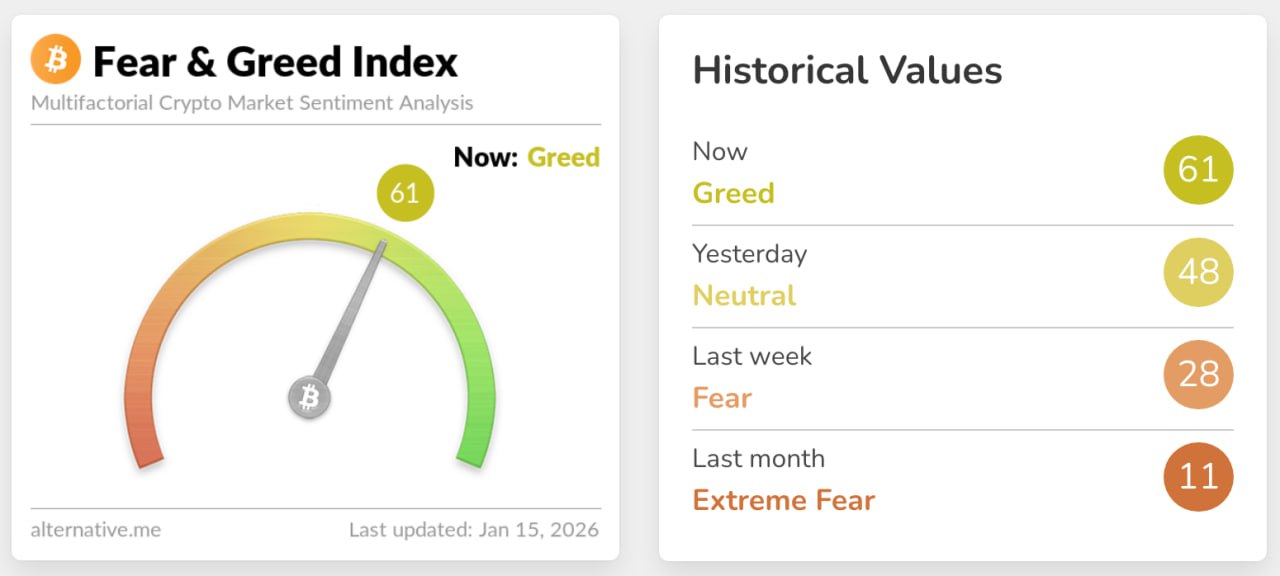

Заметила, что пока все ловят панику от субботнего пролива, один из самых важных графиков — Ratio альткоинов к биткоину — кричит о возможностях. Мы снова в той самой зоне, где исторически формировалось дно перед взрывным альтсезоном. Именно сейчас, когда толпа игнорирует альты, умные деньги начинают присматриваться к позициям.

Почему я считаю, что это «альтовый» гем?

• Долгосрочный бычий тренд всё ещё в силе.

• Мы буквально лежим на исторической поддержке, ниже которой только пустота (что маловероятно).

• Соотношение риск/прибыль сейчас на стороне альтов: падать особо некуда, а вот потенциал роста к BTC просто запредельный.

Я не призываю залетать на всю котлету прямо сегодня, альтсезон не включается по щелчку. Но помните: настоящие иксы рождаются в тишине и страхе, а не тогда, когда из каждого утюга кричат про профит. Я уже выбрала несколько монет для накопления — в таких точках и рождаются легендарные сделки.

#altseason #trading

➡️ Торговать лучше на ByBit 📈

➡️ Bybit.com/b/CryptoLadyX

📱 Youtube 📱 Telegram 📱 X 📱 TikTok