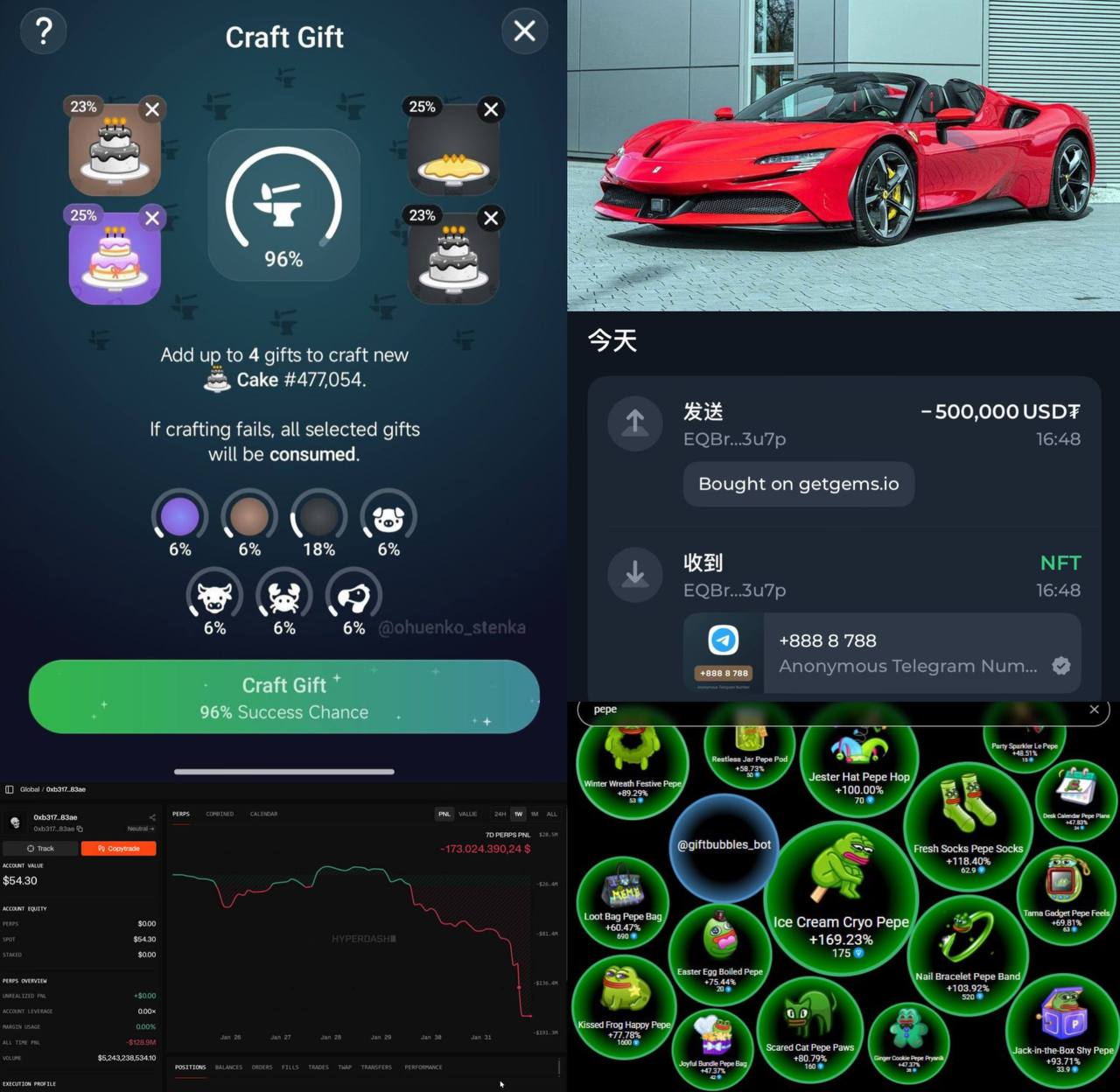

😎 Как из $278 млн сделать $54

— Был ликвидирован BitcoinOG (это тот самый «инсайдер», за которым следили все)

Получается копировать сделки даже у таких китов не всегда безопасно!

🚗 Верим в такой обмен?)

— Fuhao написал, что обменял Ferrari SF90 на анонимный номер +888 8 788

Нормальный такой номерок за $500.000, как считаете, выгодный обмен?

🎁 Лягушачьи скины показывают рост

— Пепе Фа хайпует не только на Plush Pepe

Еще подарки в стиле Pepe:

🎁 Neko Helmet — Turbo Frog (62 шт);

📎 Nail Bracelet — Pepe Band (70 шт);

🎁 Loot Bag — Pepe Bag (71 шт);

🐸 Kissed Frog — Happy Pepe (78 шт);

🪖 Heroic Helmet — Happy Frog (81 шт);

🎁 Plush Pepe — Hue Jester (95 шт);

🎁 Bonded Ring — Froge Ring (100 шт);

🧪 Magic Potion — Poison Toad (102 шт);

🎁 Bunny Muffin — Froggy (102 шт);

🎁 Star Notepad — Pepe Diary (125 шт);

🎁 Snow Globe — Pepe Frost (140 шт);

🗃 Joyful Bundle — Pepe Bag (148 шт);

🎁 Jester Hat — Pepe Hop (163 шт);

🎁 Tama Gadget — Pepe Feels (188 шт);

🎁 Winter Wreath — Festive Pepe (189 шт);

❤️ Cupid Charm — Pepe Love (242 шт);

🍫 Valentine Box — Froggie (246 шт);

🍄 Spy Agaric — Pepe Mania (406 шт);

❤️ Restless Jar — Pepe Pod (495 шт);

🐈⬛ Scared Cat — Pepe Paws (514 шт);

🎁 Ginger Cookie — Pepe Pryanik (546 шт);

🗓 Desk Calendar — Pepe Plans (652 шт);

🎁 Toy Bear — Little Pepe (708 шт);

🎁 Jack In The Box — Shy Pepe (975 шт);

🎁 Pet Snake — Froggy (900 шт);

🎁 Party Sparkler — Le Pepe (1002 шт);

🧦 Fresh Socks — Pepe Socks (1678 шт)

🎁 Easter Egg — Boiled Pepe (2782 шт).

🎁 Шут в коробке — Shy Pepe (975 шт);

🎁 Домашняя змея — Froggy (900 шт);

🎁 Бенгальский огонь — Le Pepe (1002 шт);

🧦 Свежие носки — Pepe Socks (1678 шт)

🎁 Пасхальное яйцо — Boiled Pepe (2782 шт).

🔨 Новости по крафту

— Будет отображаться шанс выпадения фона и узора!

Чтобы получить чёрный фон, нужно загружать подарки только с чёрным фоном

😭 Крипторынок сильно похудел за эти дни

📉 Курсы сейчас:

$BTC ~$77000

$ETH ~$2300

$BNB ~$750

$SOL ~$101

$XRP ~$1.59

$ADA ~$0.28

$NEAR ~$1.16

$MNT ~$0.68

$TON ~$1.32

Вы бы сильно расстроились, если потеряли $278 миллионов?)

🔥 вообще нет

🐳 расстроился бы

Чат • Portals • Mrkt • Купить Stars • Подарки за 0₽ • 📈 Биржи