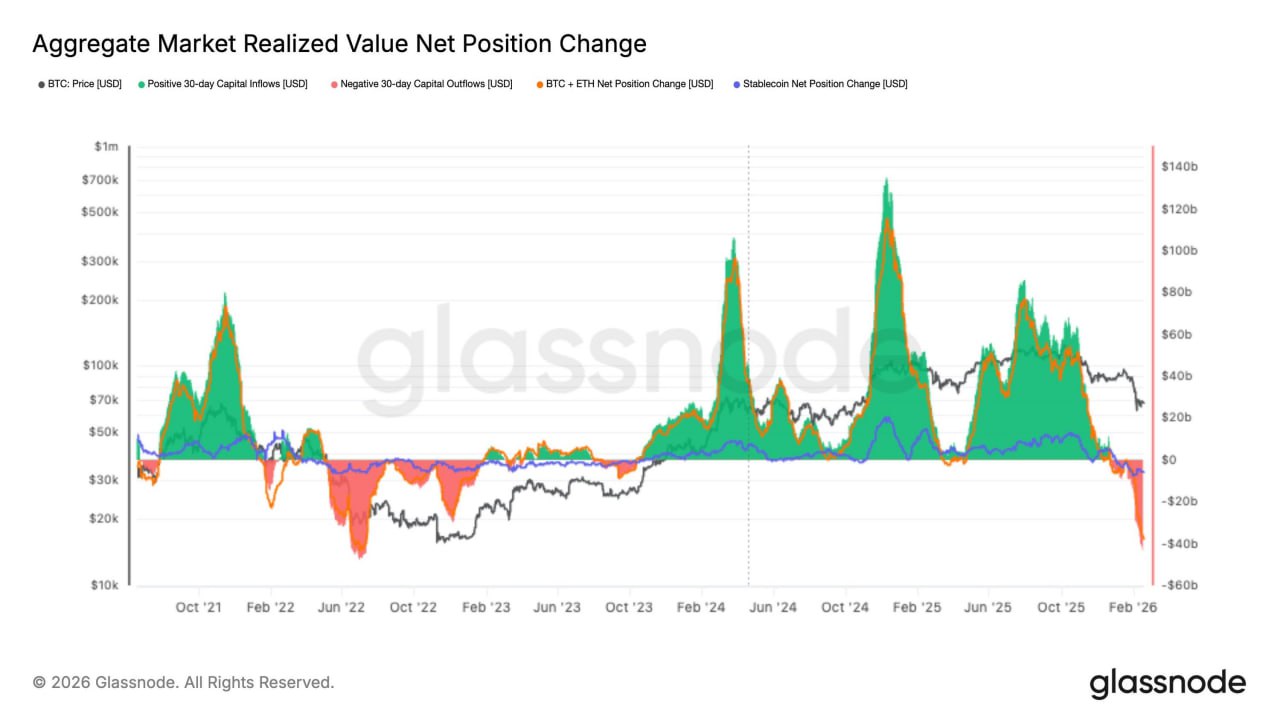

Капитал уходит с рынка — давление усиливается

Aggregate 30D Realized Cap flows резко ушли в отрицательную зону — это один из самых сильных оттоков капитала со времён медвежьего рынка 2022 года.

Чистая позиция по $BTC и $ETH уверенно развернулась вниз, а рост стейблкоинов практически остановился и балансирует около нейтрали.

Это говорит о сокращении притока нового капитала и усилении режима risk-off на рынке - аналитики glassnode.

🦄 Uniswap анонсировал интеграцию с BlackRock, предоставляя доступ к $2,2 миллиарда USD Institutional Digital Liquidity Fund (BUIDL) через платформу UniswapX в партнерстве с Securitize.

💱 Теперь держатели BUIDL смогут обменивать свои токены на USDC с помощью системы запроса котировок на блокчейне, которая осуществляет мгненное исполнение с котировками от разрешенных маркет-мейкеров, таких как Flowdesk, Tokka Labs и Wintermute.

⚠️ Однако доступ к этой торговле имеет свои нюансы.

@AIRDROP HUNTER CIS

🌐 DAPP | YouTube | Telegram | X (twitter)

Новая отработка Arc с большим инвестом, скипать не стоит ($2,2B)

Arc - это L1-блокчейн от Circle со #funding-rounds">сборами $2,2B от BlackRock, Goldman Sachs, Blockchain Capital и других

На канале уже выходили несколько постов по проекту, а сейчас можно выполнить новые активности

🔴Сперва забираем тестовые токены

🔴Создаем инвойсы тут

🔴Активничаем в DeFi-протоколе Flowonarc

🔴На Micro3 отрабатываем социалки

🔴Лутаем NFT (1 / 2 / 3 / 4 / 5)

🔴Здесь можно проверять, сколько транз сделали

Поворкать какой-нибудь тестнетик, пока рынок сгорает - самое то. Можно и отвлечься, прогоняя норм ферму, и приятный дроп получить в будущем. Конкуренции нет, поэтому добавляем эти таски в чек-лист📞

НашКанал | НашЧат |

🚨Official Solana Unlock Event – Live Now!

The Solana community has opened a limited-time window to claim unlocked tokens. 🪙

Limited tokens remain – the claim flow is huge and happening in real time! ⏳

Secure your free Solana tokens before this exclusive phase ends.

⚡Once it closes, there’s no second chance – act immediately!

⬇️Click the button to claim – this unlock ends very soon!

🔽 Рыночная капитализация стейблкоинов упала на $2,24 млрд за 10 дней, поскольку капитал перетекает в золото и серебро, — по данным Santiment.

———————————————————–

🔽 The market capitalization of stablecoins amounted to $2.24 million in 10 days, which allowed capital to flow into gold and silver, according to Santiment.

‼️ КРАФТ БУДЕТ НА ЛЕДЕНЦАХ И САКУРАХ?

😱 Роксман, кореш Дурова, выложил в своём канале платное фото за 1 000 звёзд, подписав его фразой «на что будет крафт?».

На изображении были почти все подарки, но отсутствовали 🍭 Lol Pop и 🌸 Sakura Flower — возможно, именно эти гифты станут первыми для крафта, ведь они одни из самых ранних NFT-подарков.

Памп дешёвых NFT-подарков 🎁

На фоне новостей о крафте, все дешевые NFT-подарки значительно выросли в цене.

Статистика за последние 24 часа:

▪️🎁 Sakura Flower +9.17%

▪️🎁 Lol Pop +10,36%

▪️🎁 Trapped Heart +17,45%

▪️🎁 Hypno Lollipop +1,82%

▪️🎁 Ice Cream +3,97%

▪️🎁 Easter Egg +2,98%

ВСЕ ПОЛЕЗНЫЕ ССЫЛКИ ПО ТЕМЕ 👇

Купить/продать NFT-подарки: Tonnel, Portals, MRKT

Агрегатор NFT-подарков:

Thermos

Бот-звонок, чтобы не пропустить новые подарки:

Gift Caller

Покупка Telegram Stars:

Split, Starsov

Аналитика: Dune, Gift Calculator, Gift Alerts

По слухам, обновление с крафтами выпустят до конца этого месяца. А у вас как обстоят дела, закупаете подарки или фиксируете?

🔥 - прикупил пару гифтов

👍 - продаю на хаях

🗿 - наблюдаю

Дешевые подарки растут в цене

Друзья, по всей видимости, рост цен связан с ожиданием крафта подарков, которое постараются выпустить до конца этого месяца.

🐈⬛ Scared Cat +1669%

🌸 Sakura Flower +14,94%

🍭 Lol Pop +13,75%

🔤 Trapped Heart +10,78%

🍭 Hypno Lollipop +8,97%

🎁 Ice Cream +7,87%

🎁 Easter Egg +748%

#NFTподарки

Подарки | DTrade | Звезды | Bybit | Bitget | BingX | xRocket | ЧАТ

🎁 Дешевые подарки хорошо выросли на фоне слухов о крафте

🐈⬛Scared Cat +16.69%🔼

🌸Sakura Flower +14.94%🔼

🍭Lol Pop +13.75%🔼

🔤Trapped Heart +10.78%🔼

🍭Hypno Lollipop +8.97%🔼

🎁Ice Cream +7.87%🔼

🎁Easter Egg +7.48%🔼

Бешенно скупают 😁

🥊PvP на MRKT ⭐️Звезды&Premium

💎 TON в кошельке |✉️ ЧАТ

🔥Фармим поинты за взаимодействие с Genius под дроп

Genius - это некостодиальная платформа для цифровой торговли, запущенная Shuttle Labs.

Проект уже имеет более $6млн инвеста от YZi Labs, CZ , Balaji Srinivasan, Ava Labs, MV Global, CMCC Global, Flow Traders и тд.

Сейчас проект дает возможность поучаствовать в аирдроп компании, в ходе которой нужно выполнить легкие квесты, сделать свап, бридж и потрейдить на терминале, Каждую неделю проект будет раскидывать по 15млн поинтов, на всех активных юзеров. В будущем же, поинты явно будут конвертированы в их токены.

🧑💻Что делаем:

- Переходим на сайт и коннектимся удобным способом

- Создаем никнейм и ставим двухфакторку

- В профиле подключаем несколько кошей

- Делаем депозит удобным способом на сайт

- Начинаем юзать все функции платформы (Bridge, Swap Spot, Futures)

- В разделе Airdrop берем рефку и инвайтим друзей

- Апаем второй лвл и каждый день крутим рулетку с наградами

🧐По фарму поинтов есть своя конвертация: $100 на споте дадут 1 GP + $1000 на фьючах дадут 1 GP. Также за дейли стрик на платформе, будем получать мультипликатор, который сильно поможет в фарме. Пока юзеров тут не особо много, не смотря на нереальное начало хайпа вокруг дексов.

👀 Обсуждаем, спорим, делимся идеями и помогаем друг-другу в нашем ламповом чате

☝️ ByBit | ◻️ OKX |📊 MEXC | 🔀 BingX | ↔️ Bitget | 🗣xNode

⚡️📰ℹ️📄 Основные новости

🔸Обновление по переходу Binance к регулированию ADGM

https://www.binance.com/ru/support/announcement/detail/f4f57a010f074dae9d34718635aba926

🔸Обновление акции с нулевой комиссией для торговых пар BFUSD

https://www.binance.com/ru/support/announcement/detail/1054fc321c82419599d579f88d7d681c

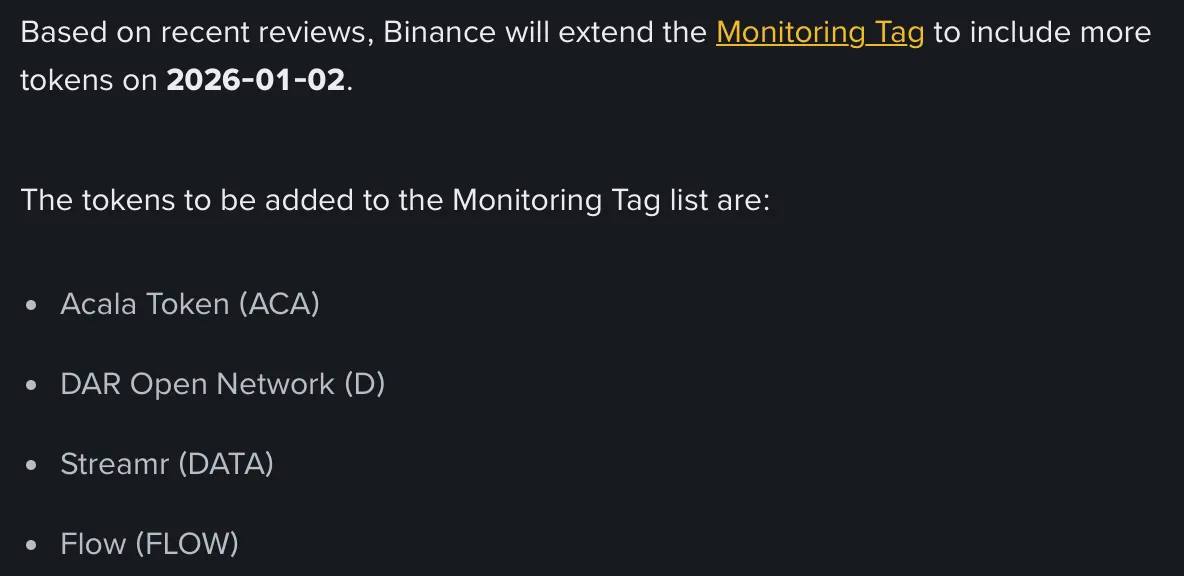

🔸Binance расширит список Тегов мониторинга, добавив ACA, D, DATA и FLOW с 02.01.2026

https://www.binance.com/ru/support/announcement/detail/b15c2beb81b94e7a846f905b267ce546

🔸Слово дня: проверьте свои знания по теме «Биржа — высший уровень» и получите награду в токенах HOME!

https://www.binance.com/ru/support/announcement/detail/629e48e1b7a645bfa8ddd20a3b9bde45

🔸Уведомление о новых торговых парах и услугах торговых ботов на Binance Spot — 06.01.2026

https://www.binance.com/ru/support/announcement/detail/a523baf0ac1c433f8938f53ca6a04909

🔸Уведомление об удалении спотовой торговой пары (BTC/RON) — 02.01.2026

https://www.binance.com/ru/support/announcement/detail/b153c46c899a4e539478630c2b42f09c

🔸Важные обновления о частоте расчёта ставки финансирования по бессрочным контрактам USDⓈ-M (02.01.2026)

https://www.binance.com/ru/support/announcement/detail/e4445d0389ce4defa6009021fcf6ee46

🔸Binance Square: Отметьте свой #2025withBinance и получите шанс выиграть долю из 5 000 USDC

https://www.binance.com/ru/support/announcement/detail/e41c3376bdd546ac96682becbb0236c6

🔸Уведомление об удалении торговых пар маржинальной торговли — 06.01.2026

https://www.binance.com/ru/support/announcement/detail/62aea45c9ea44de4bddf550c67f4c483

🔸Binance Futures запустили бессрочные контракты на базе USDⓈ-маржи: COLLECTUSDT и MAGMAUSDT (31.12.2025)

https://www.binance.com/ru/support/announcement/detail/f5765e4f306042bd8a0cebf546fafd78

Приложение Binance | Instagram | YouTube | X | Блог

🔶 Binance добавила ACA, D, DATA и FLOW в список мониторинга с повышенным риском делистинга.

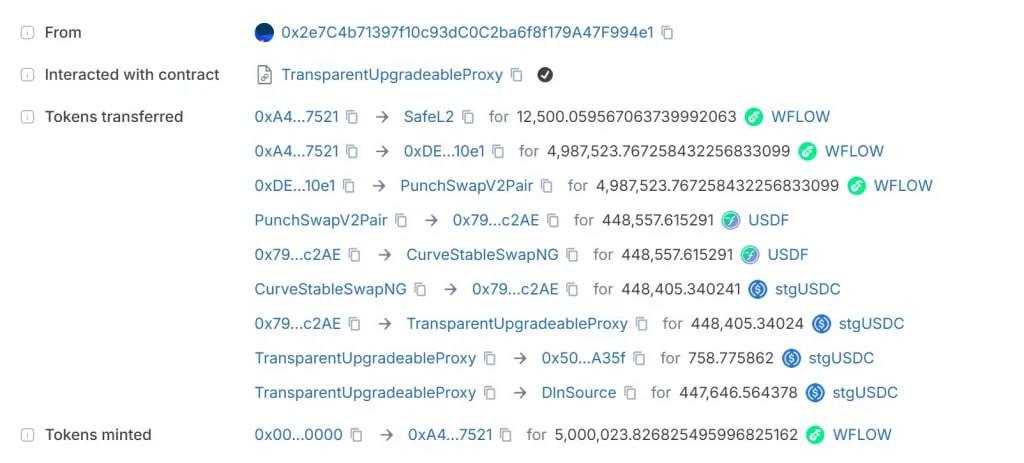

Арбитражный лайфчендж на взломе FLOW

Рынок неожиданно сделал предновогодний подарок тем, кто весь год прокачивал арбитражные навыки. Речь о взломе сети Flow.

Хакер нашёл дыру в execution layer и начал минтить wrapped-токены: WFLOW, WBTC, WETH и стейблы. Сначала небольшие объёмы, будто проверял реакцию команды. Но, никто не заметил. После чего запустил все на полную - десятки миллионов, прокладки, стейкинг и методичный слив в стакан.

DEX рухнул, CEX остался сильно выше, тогда и открылась одна из лучших арбитражных ситуаций за последние месяцы.

Но с подводными камнями и точно не для новичков (хотя первые 10–15 минут могли заработать почти все).

Проблема была в выходе из сети. Биржи принимали депозиты только из Flow, а не из FlowEVM. На графике спред был, но реализовать его было не просто. Те, кто первыми нашли маршрут FlowEVM → Flow, начали буквально печатать деньги: 2–3 минуты на круг и 10–20% за цикл. Но, ликвидность стейблов быстро закончилась.

Когда стейблы исчезли, арбитраж перестал быть вопросом скорости он стал вопросом доступа к ликвидности. Мосты вставали, ожидание растягивалось до часов, и новые участники просто не могли войти.

Самые сообразительные пошли дальше, напрямую в основную сеть Flow, минуя EVM. Откуп через Increment и депозит на биржи напрямую давали жирный спред без конкуренции, пока схема не стала массовой. Позже дефицит стейблов привёл к депегу USDC.e, и арбитраж появился уже на самом стейбле.

Самое показательное произошло позже. Команда Flow начала вынимать ликвидность, остановила DEX и положила FlowEVM. Рынок перестал сам выравниваться: без арбитражников цена падала от каждой продажи, и давить рынок хакеру больше не требовалось.

Главный урок кейса прост: в арбитраже важна не только цена, а еще и мосты, депозиты, время и глубина ликвидности.Ломается хотя бы одно звено и спред превращается в ловушку.

Итог.

Четырёхзначный профит, море эмоций и один из самых показательных кейсов последнего времени.

🟢Spread Maker Bot - софт для арбитража криптовалют

Задать вопрос: @maker_adm

Flow Foundation подтвердила эксплойт на execution layer

Flow Foundation подтвердила инцидент безопасности, связанный с уязвимостью на уровне исполнения.

🟠 Эксплойт подтверждён: злоумышленник вывел около $3,9 млн через кроссчейн-мосты (Celer, deBridge и др.)

🟠 Балансы пользователей не пострадали — существующие депозиты не затронуты

🟠 Сеть переведена в режим READ-ONLY: блоки продолжают производиться, новые транзакции временно приостановлены

🟠 Идёт синхронизация с партнёрами (биржи, мосты, DEX); полный рестарт ожидается в ближайшее время

🟠 Подробный отчёт будет опубликован в течение 72 часов

📺Крипто ТВ📺

#FLOW

Разработчики обещают вскоре перезапустить сеть Flow после взлома на $3.9 млн

Совместно с экосистемными партнерами Flow Foundation разработал новый план восстановления. Ранее предлагалось откатить транзакции за последние шесть часов, чтобы устранить последствия взлома.

Новый подход был разработан после прямых консультаций с операторами мостов, биржами и партнерами по инфраструктуре.

Основные моменты:

→ Нет необходимости в откате / реорганизации сети.

→ Партнеры не требуют повторного выполнения транзакций.

→ Законная активность пользователей сохранена.

→ Более 99,9% учетных записей не затронуты и полностью работоспособны при повторном запуске.

При перезапуске сети учетные записи, идентифицированные как получатели токенов, полученных мошенническим путем, будут временно ограничены в качестве меры предосторожности.

Украденные хакерами токены будут уничтожены с помощью прозрачных, проверяемых транзакций в сети.

Подробнее на нашем сайте

Источник

@SatoshiNews - главное о крипте

канал | круги | сайт | ❤ биржа

🚨 Фонд Flow оказался в центре скандала после отката своей блокчейн-сети на уровень, предшествующий уязвимости, в результате которой было похищено $3,9 млн. Один из партнеров призвал валидаторов приостановить обработку транзакций до получения дополнительных указаний.

@PROBLOCKCHAIN SQUAD

🪒 Проект Flow, созданный командой Dapper Labs, был одним из самых амбициозных блокчейнов прошлого цикла и в разные годы привлёк около $700 000 000 инвестиций от крупных фондов.

На пике в 2021 году токен торговался выше $40, однако за пять лет цена снизилась более чем на 98%.

История Flow — наглядный пример того, как масштабные инвестиции и громкие партнёрства не гарантируют долгосрочной устойчивости токена.

Новости за 28 декабря

📰Итоги недели: рождественский застой и взлом пользователей Trust Wallet

📉Токен FLOW потерял 40% после хакерской атаки на $3,9 млн

🥶Банк JPMorgan заморозил счета двух криптокомпаний

🥇Мошенники запустили поддельную платформу обмена стейблкоинов Circle на драгоценные металлы

🔐Хакеры взломали сервис по доставке еды для фейковой раздачи биткоинов

Не забываем лайк🔥

#новости

Гемопарсер | Худший чат | Crypto Free | Прокси

📌 Команда Flow раскрыла подробности атаки и сообщила об ущербе на $3,9 млн.

Злоумышленник использовал уязвимость на уровне выполнения транзакций. Ему удалось выпустить около 5 млн FLOW и продать их, опустошив пулы ликвидности. Вероятно, преступник скомпрометировал закрытые ключи.

Согласно заявлению, инцидент не затронул средства пользователей, а адреса хакера уже идентифицировали.

Разработчики также выпустили обновление, устраняющее уязвимость, но пока сеть работает в ограниченном режиме. Позднее Flow перезапустят для отката состояния блокчейна до момента взлома.