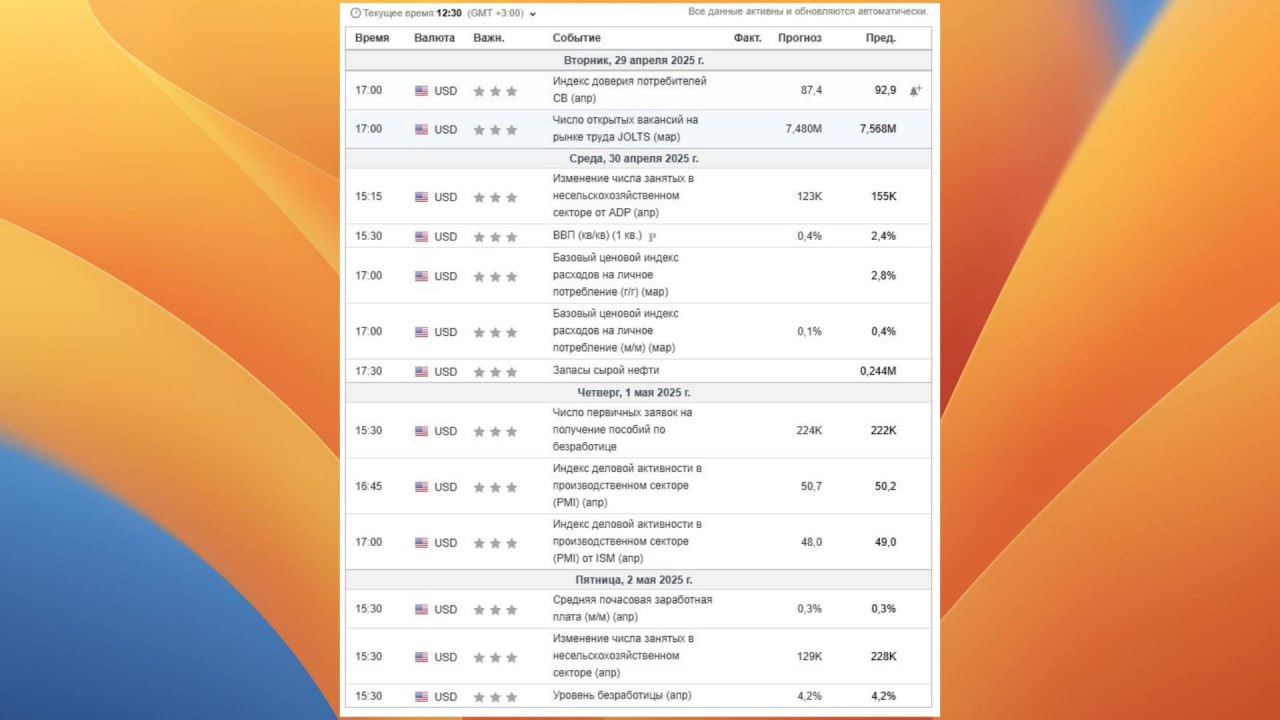

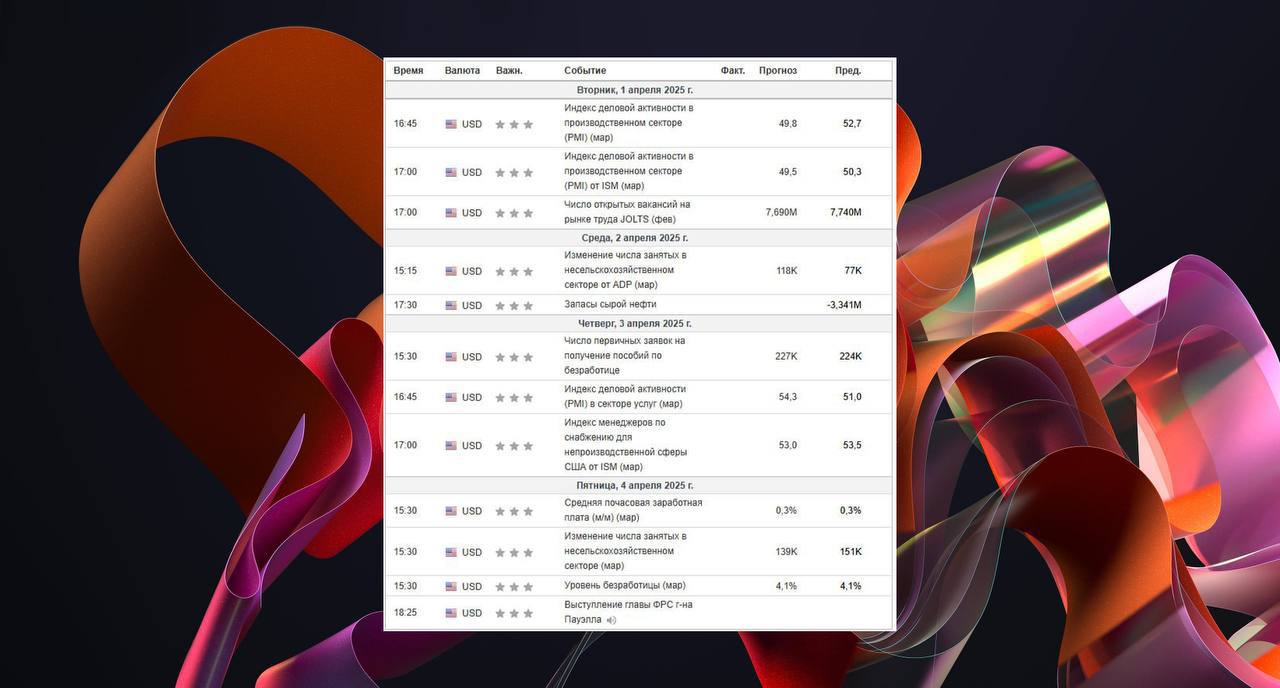

📆 Календарь важнейших событий недели!

На этой неделе рынки ждёт настоящая буря новостей. Будьте готовы — волатильность обещает быть высокой!

Понедельник, 28 апреля

Спокойный старт недели — ключевых событий нет.

Вторник, 29 апреля

Открытые вакансии (17:00)

Много вакансий → экономика сильная → ставка может дольше оставаться высокой.

Мало вакансий → признаки замедления экономики → шансы на снижение ставки растут.

Среда, 30 апреля

Занятость в частном секторе (15:15)

Падение занятости — тревожный звонок для рынка.

ВВП США за 1 квартал (15:30)

Ниже ожиданий? Риски рецессии усиливаются.

Лучше ожиданий? Время на рост ещё есть.

Базовый индекс расходов на личное потребление (инфляция) (17:00)

Один из любимых индикаторов ФРС. Определит тон заседания 7 мая.

Четверг, 1 мая

Решение по ставке Банка Японии (06:00)

Индекс деловой активности в производстве (16:45)

Ниже 50 — экономика буксует. Выше 50 — пока держимся.

Пятница, 2 мая

Уровень безработицы в США + занятость в частном секторе (15:30)

Один из самых волатильных дней недели!

Эта неделя закладывает фундамент для решения ФРС 7 мая.

Основной драйвер движений — пятничные отчеты.

Высокие тарифы еще не отразились в данных — это может создать ложное чувство стабильности.

В момент публикации отчётов — резкие движения почти гарантированы. Работайте аккуратно, особенно если используете плечи!

Желаю продуктивной недели!

English 🇺🇸

Calendar of the most important events of the week

A real storm of news awaits the markets this week. Be prepared — the volatility promises to be high!

Monday, April 28th

A calm start to the week — there are no key events.

, Tuesday, April 29th

Open vacancies (17:00)

There are many vacancies → the economy is strong → the rate may remain high for longer.

Few vacancies → signs of a slowdown in the economy → the chances of a rate cut are growing.

Wednesday, April 30th

Employment in the private sector (15:15)

Falling employment is a wake—up call for the market.

US GDP for the 1st quarter (15:30)

Below expectations? The risks of recession are increasing.

Better than expected? There is still time for growth.

Basic index of personal consumption expenditures (inflation) (17:00)

One of the Fed's favorite indicators. It will determine the tone of the meeting on May 7.

, Thursday, May 1st

Bank of Japan rate decision (06:00)

Manufacturing Business Activity Index (16:45)

Below 50, the economy is stalling. Above 50, we are holding on for now.

Friday, May 2nd

US unemployment rate + private sector employment (15:30)

One of the most volatile days of the week!

This week lays the foundation for the Fed's decision on May 7.

The main driver of the movements is Friday's reports.

High tariffs have not yet been reflected in the data — this can create a false sense of stability.

At the time of publication of the reports, sudden movements are almost guaranteed. Work carefully, especially if you use your shoulders!

I wish you a productive week! Good luck!

⭐️ Crypto Chat | Exchange | ADS