💰 ▫️

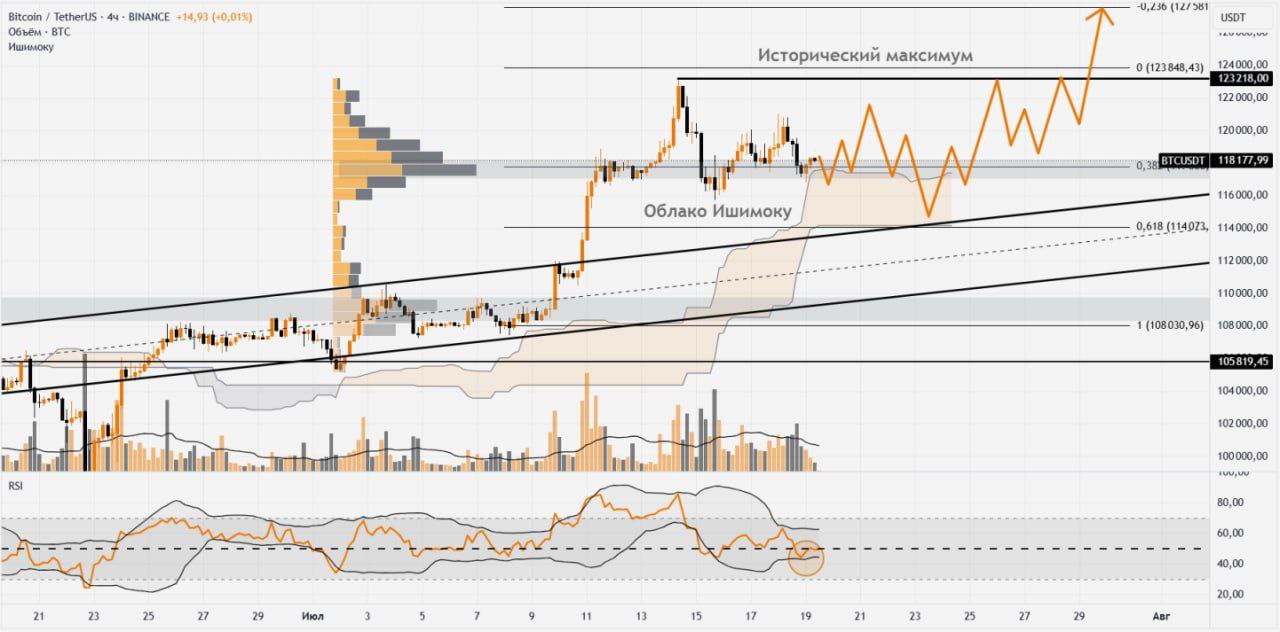

#BTC (4H):

На откате биткоин снизился к $116 900, где активизировались покупатели. Цена вновь поднялась выше ключевого объемного уровня $117 600, который остаётся пограничной зоной между локальными «быками» и «медведями». Удержание этого уровня и возврат RSI выше отметки 50 подтвердят преобладание покупателей. Такой сигнал может открыть путь к новому импульсу в зону $122 000.

Учтите, что за последние 3 дня наибольшая ликвидность скопилась под $116 650 (данные CoinGlass). Если продавцы продавят цену ниже $117 600, биткоин рискует уйти в коррекцию к $115 500. Далее поддержку обеспечивают нижняя граница Облака Ишимоку и верх канала на $114 400.

💰

#ETH:

Эфир, как ожидалось, откатился к $3 500. На уровне $3 615 усилилось давление продавцов. Если в ближайшее время актив не пробьёт эту зону, вероятен тест поддержки у $3 440.

▫️Доля децентрализованных площадок (DEX) в торговых объёмах за второй квартал 2025 г. увеличилась на 25,3 %, достигнув рекордных $876,3 млрд. (

1) При этом централизованные биржи за тот же период потеряли 27,7 % объёмов, их оборот сократился до $3,9 трлн.

В сегменте спотовой торговли лидером стала PancakeSwap, после интеграции с Binance Alpha ее объёмы взлетели на 539,2 %, что составило $392,6 млрд. Площадке обошла аналогичные решения на Ethereum и Solana. Среди деривативных платформ безоговорочным лидером стала Hyperliquid, которая теперь контролирует 72,7 % рынка при квартальных оборотах в $653,2 млрд. Благодаря этому DEX вошёл в восьмёрку крупнейших мировых бирж фьючерсов и опционов среди всех торговых площадок.

Спотовые объёмы на CEX сокращаются уже второй квартал подряд, несмотря на рост цен на криптоактивы. Метрики указывают, что это сопровождается повышенным интересом к децентрализованным решениям, предлагающим большую свободу и прозрачность торговли. В мае их доля впервые достигла 25 % против централизованных бирж. Общая рыночная капитализация криптовалют выросла за второй квартал на 24%, вернувшись к отметке $3,5 трлн. и компенсировав $663,6 млрд., утерянных в первом квартале.

Думаю, что DEX продолжат укреплять свои позиции в ближайшей перспективе. Ускорить этот процесс может внедрение полноценных лимитных‑ордеров, маржинальной торговли и и улучшение пользовательского интерфейса DEX. Со временем децентрализованные протоколы сформируют единое DeFi‑пространство с кроссчейн- мостами, где один кошелёк даст доступ к спотовым рынкам, фьючерсам, займам, стейкингу и широкому кругу активов. Пользователи получат возможность быстро переключаться между разными продуктами и оптимизировать их доходность. Благодаря этому DeFi‑экосистема превратится в универсальную финансовую платформу, объединяющую лучшие практики традиционных и цифровых рынков.

▫️Альты: анонс о том, что проект Chainbase (

#C) стал участником программы HODLer Airdrop от биржи Binance привел к удорожанию

#C на 99% (к

#USDT).

На фоне интеграции Blackhole (

#BLACK) c платформой DeBank стоимость

#BLACK увеличилась на 24% (к

#USDT).

Повышение ставок доходности в DeFi-протоколе Elixir (

#ELX) стало причиной роста

#ELX на 22% (к

#USDT).

▫️Американский фондовый рынок в пятницу завершил торги разнонаправленно. Выросли бумаги коммунальных предприятий, производителей потребительских товаров и сырьевых компаний, давление оказывали сектора нефти и газа, здравоохранения и телекоммуникаций. По итогам торгов на NYSE индекс Dow Jones снизился на 0,32%, S&P 500 потерял 0,01%, а NASDAQ Composite прибавил 0,05%.

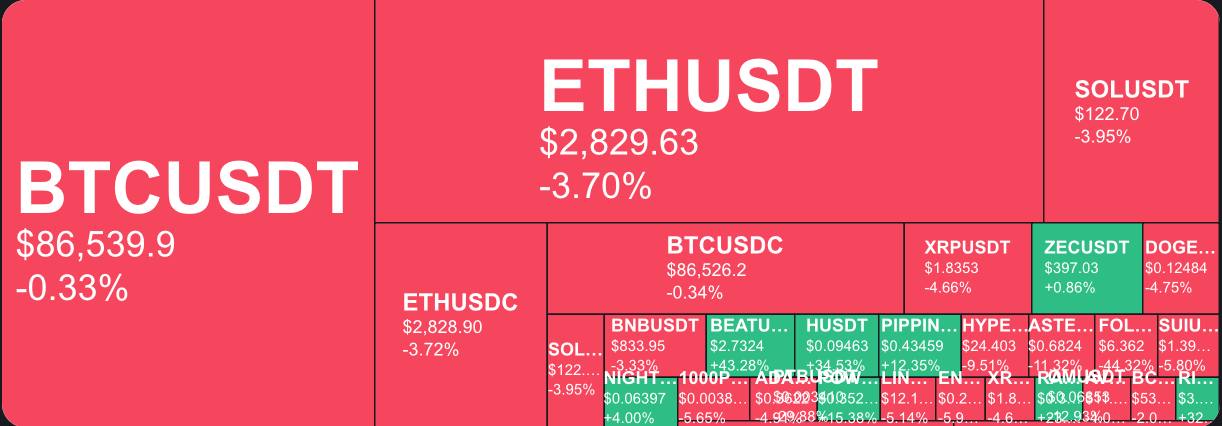

▫️Капитализация криптовалютного рынка опустилась на 0,65% за прошедшие сутки, доминация

#BTC прибавила 0,25%. Биткоину важно закрыть сегодняшнюю дневную свечу выше отметки $117 600, что создаст необходимый плацдарм для продолжения восходящего импульса.