GM! Где ожидаемые x20-x50? Или это не бычка? 🤔

Задаюсь вопросами, а кто вообще сказал, что рынок раздаёт деньги моментально? Это инвестиции, а не лотерея. На фондовом рынке люди ждут 10 лет, чтобы удвоить или утроить капитал. А в крипте, если за месяц не сделали x10, всё — "не бычка, рынок мёртв".

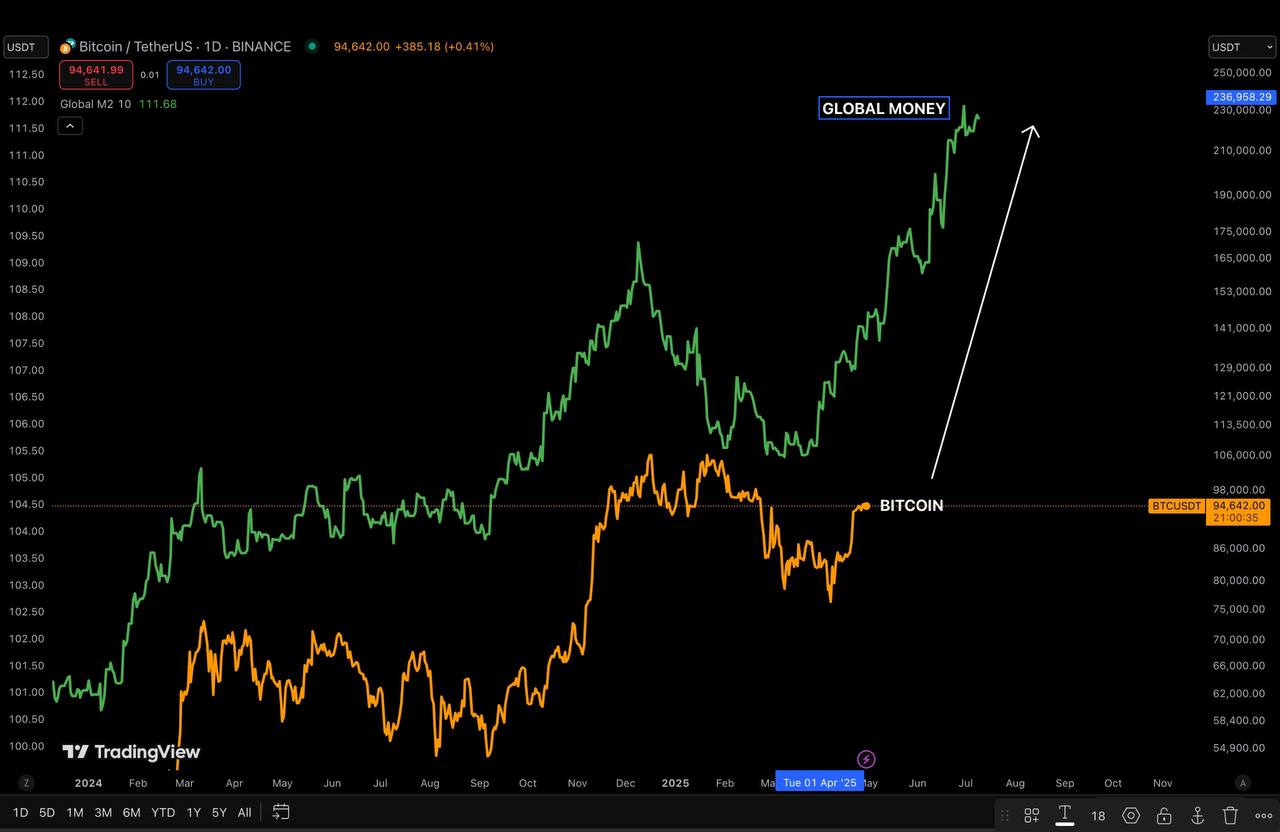

Да, ситуация нестандартная. Геополитика, экономическая нестабильность, медвежьи сигналы — вместо безумного роста видим сброс за сбросом.

Топовые альты, которые все так ждали, просели на 30–50%. Толпа капитулирует, новички в панике выходят из позиций с убытком, потому что устали ждать.

Но знаете, что объединяет все большие циклы? Рынок растёт, когда слабые руки вытряхиваются.

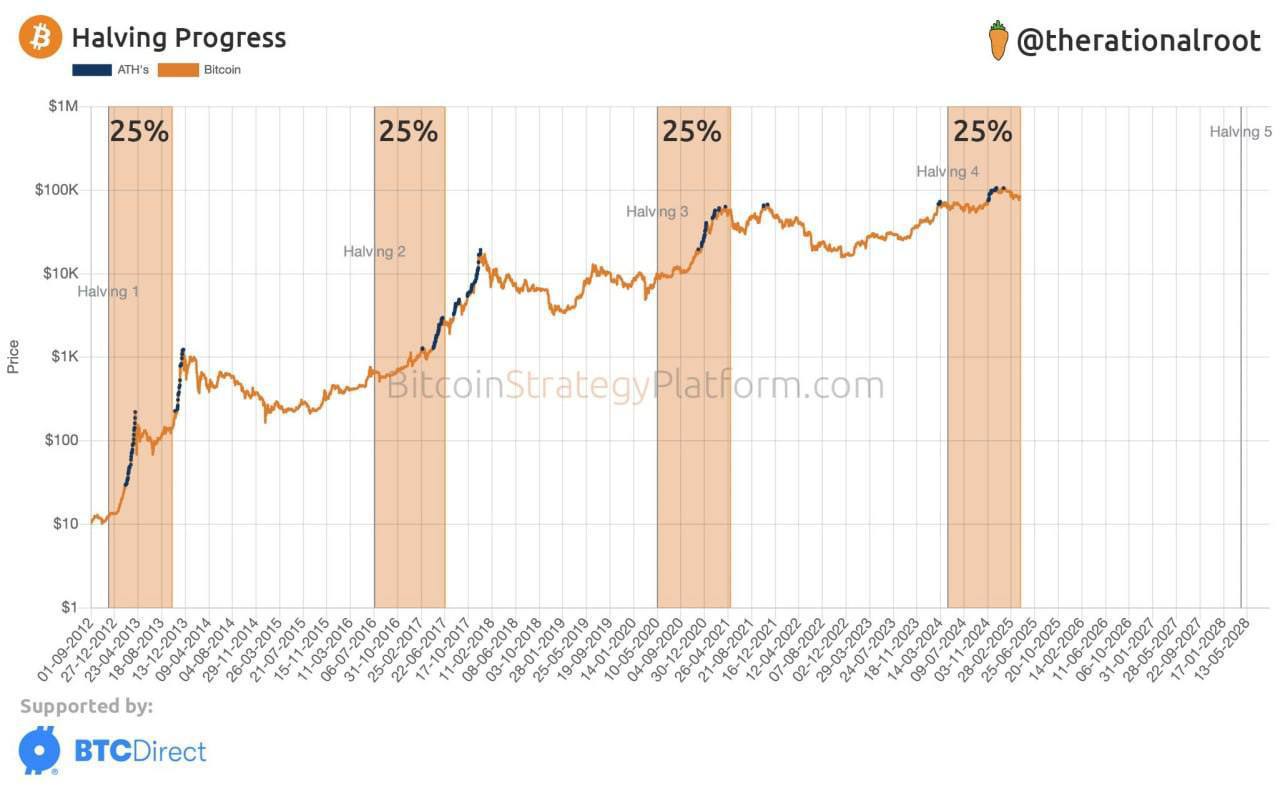

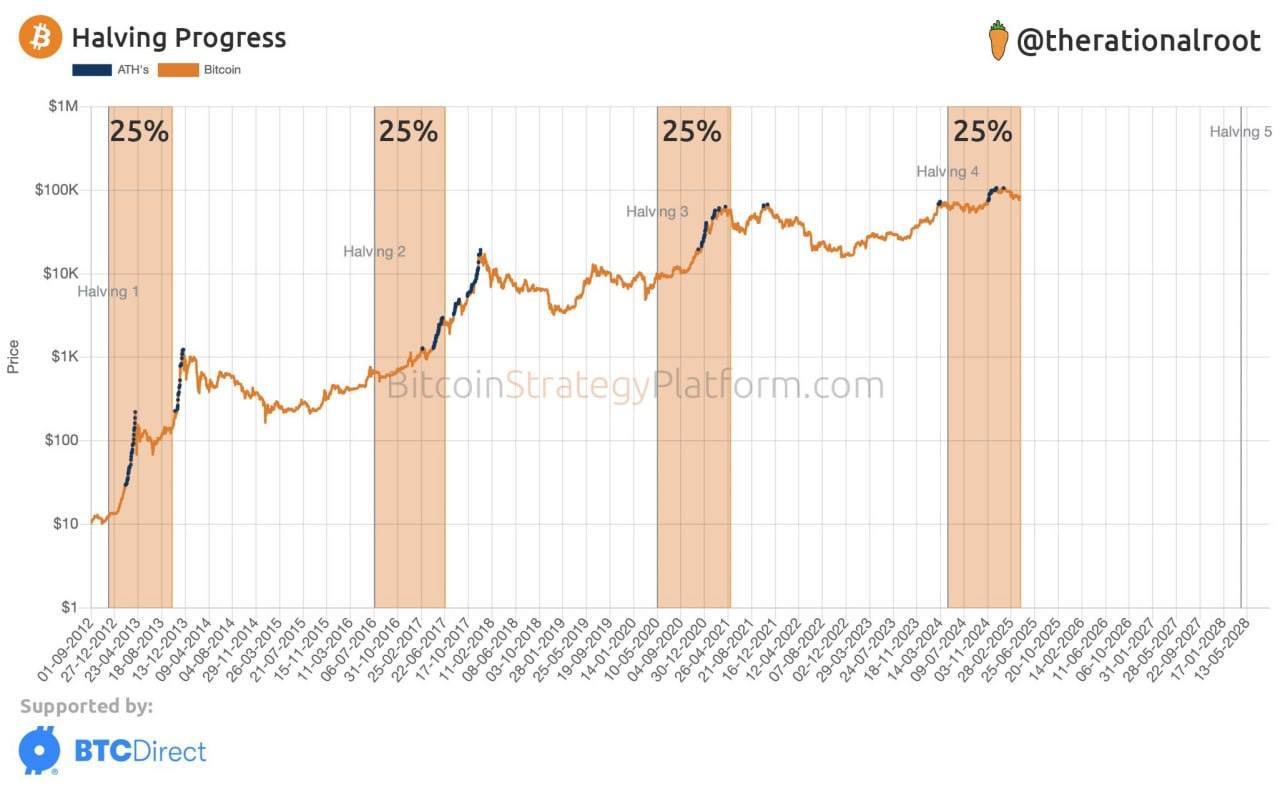

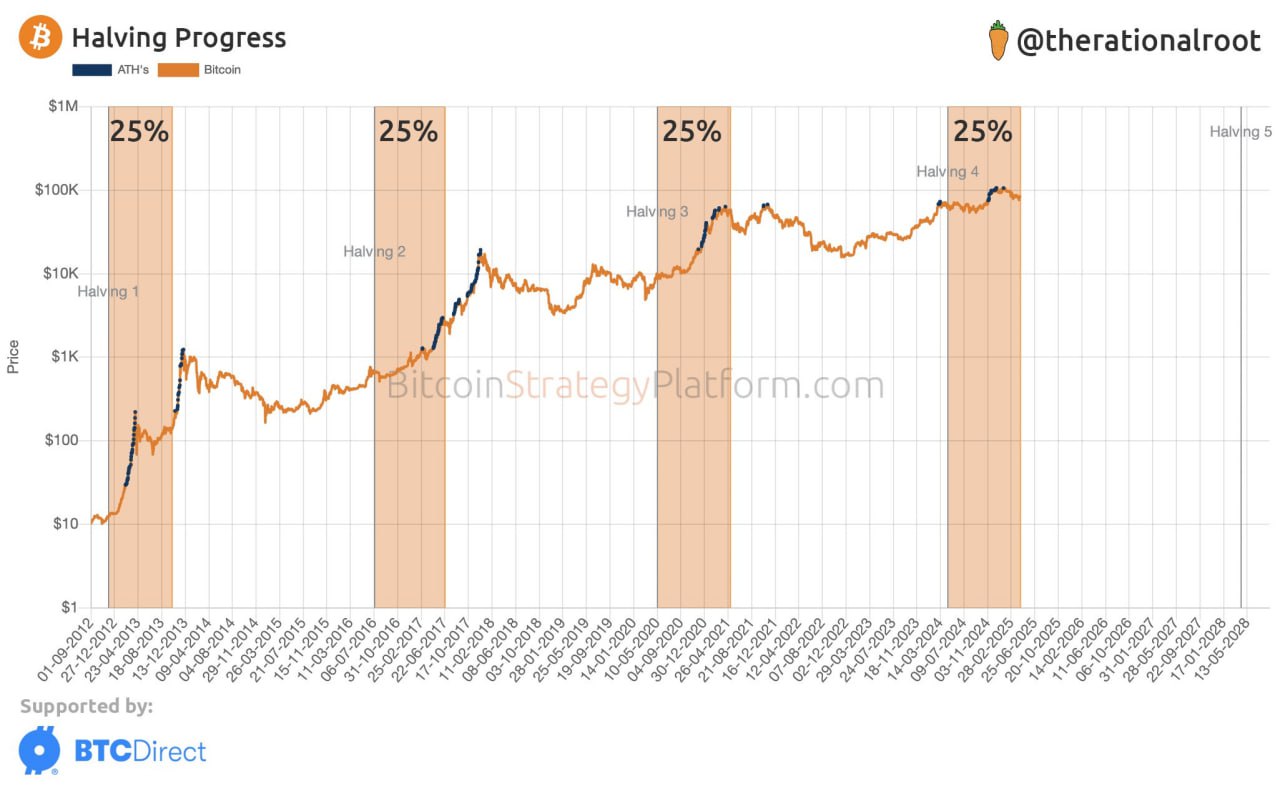

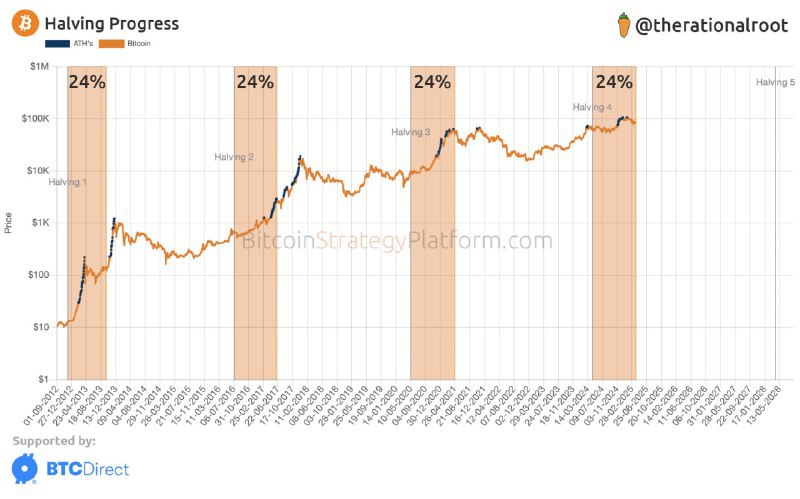

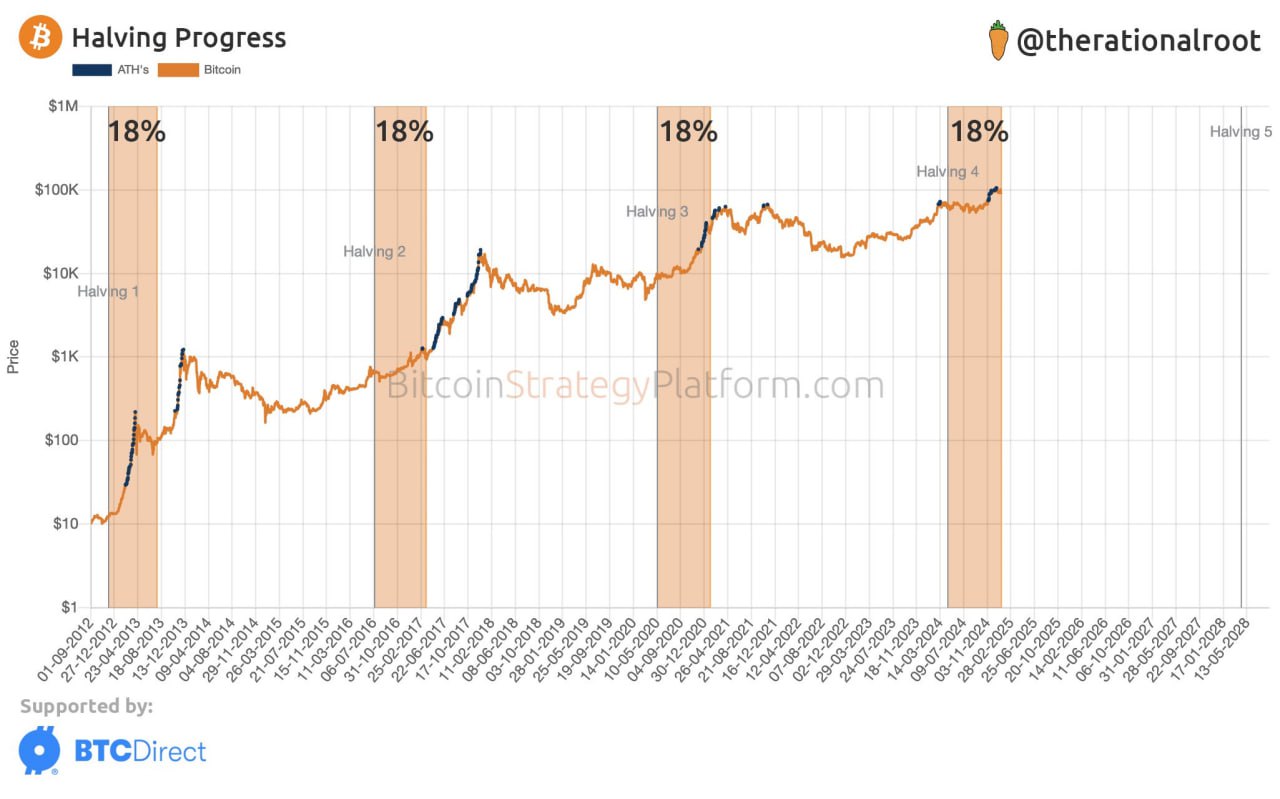

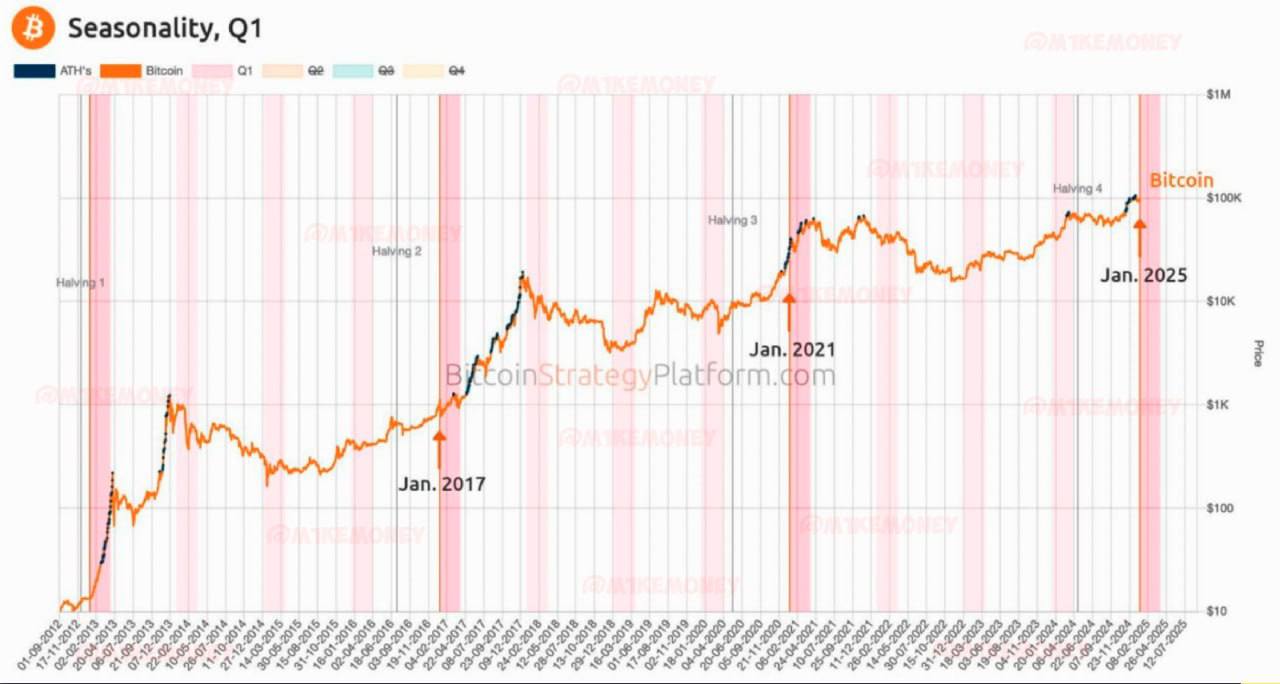

Вспомним прошлый цикл:

✔️ Халвинг прошёл весной

✔️ Летом рынок уснул

✔️ Осенью увидели рост

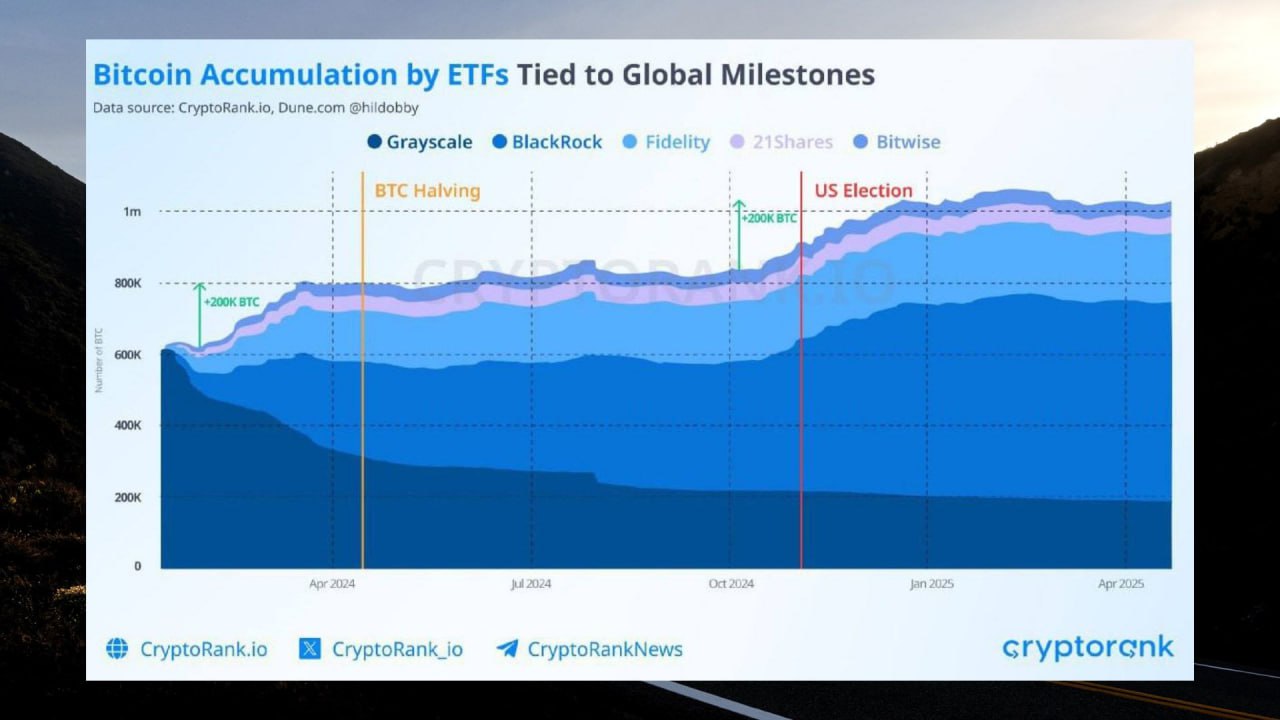

✔️ Зима — фаза накопления

✔️ Дальше? Догадайтесь сами

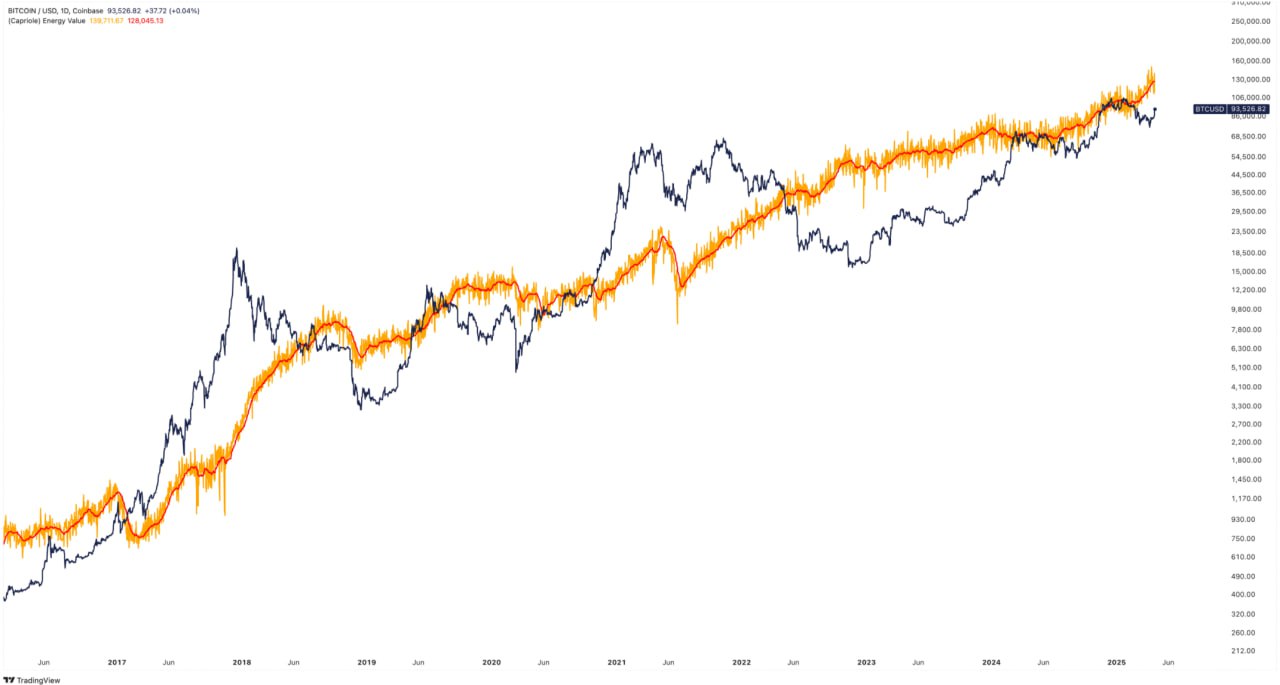

Большие деньги из воздуха не появляются. Кто не выдержит, тот сольётся. Кто останется — тот заберёт профит.

Так что тут только два варианта: либо ты терпеливо ждёшь, либо выходишь на эмоциях и потом наблюдаешь, как рынок улетает без тебя. Удачи и терпения💪

English 🇺🇸

GM! Where are the expected x20-x50? Or is it not a bull? 🤔

I wonder who said that the market distributes money instantly? This is an investment, not a lottery. In the stock market, people wait 10 years to double or triple their capital. And in the crypt, if you haven't made x10 in a month, everything is "not a bull, the market is dead."

Yes, the situation is unusual. Geopolitics, economic instability, bearish signals — instead of insane growth, we see reset after reset.

The top altos, which everyone had been waiting for, sank by 30-50%. The crowd capitulates, and the newcomers panic and exit their positions at a loss because they are tired of waiting.

But do you know what unites all the big cycles? The market grows when weak hands are shaken out.

Let's recall the last cycle:

✔️ Halving took place in the spring

✔️ The market went to sleep in the summer

✔️ Saw growth in the fall

✔️ Winter is the accumulation phase

✔️ Next? Guess for yourself

Big money doesn't come out of thin air. Whoever can't stand it will merge. Whoever stays will take the profit.

So there are only two options: either you're a turp

⭐️

Crypto Chat |

Exchange |

ADS