ИИ — это уже не просто тренд, а реальные помощники, которые ускоряют работу, учебу и творчество прямо с вашего смартфона! 📱✨

🔘

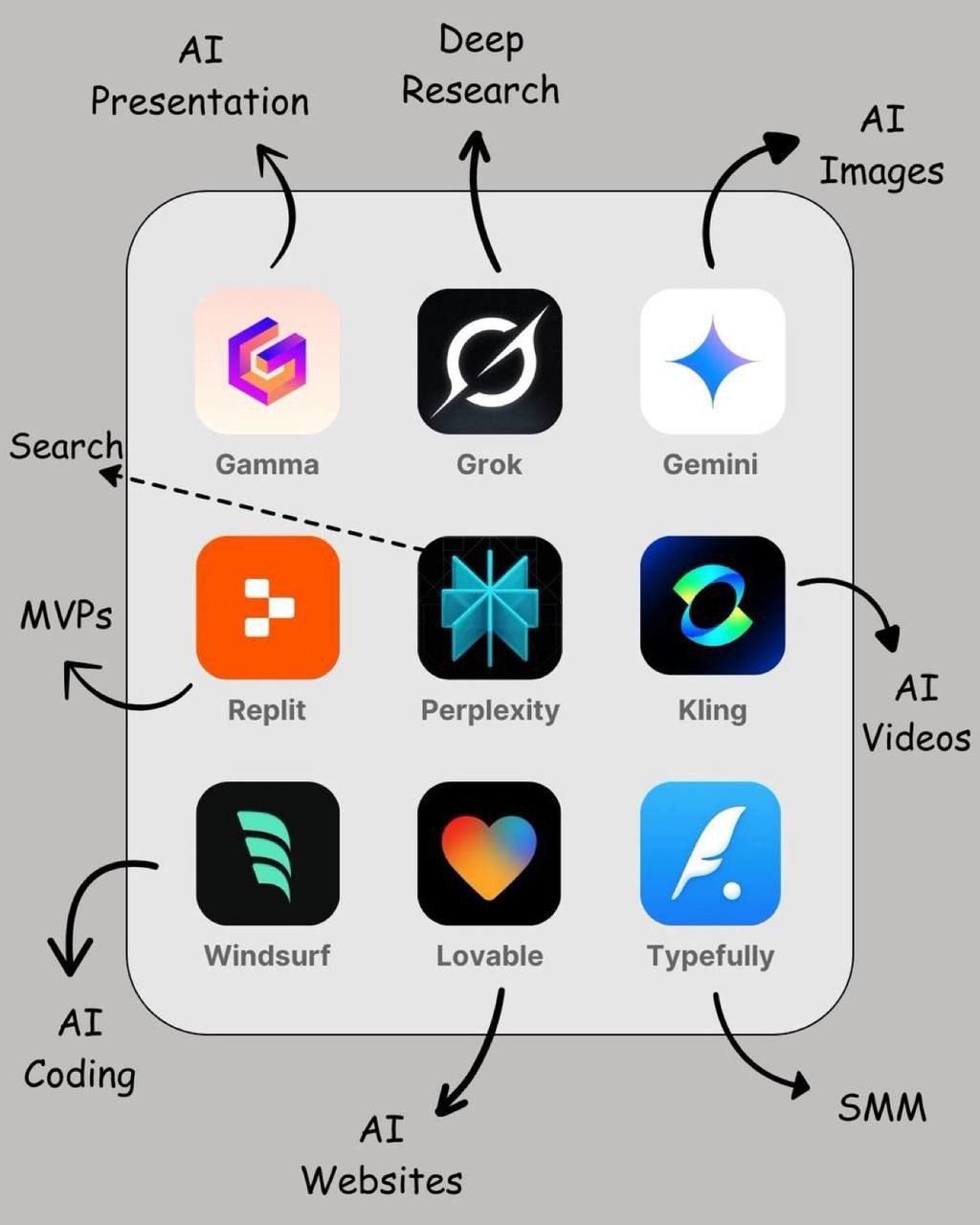

Gamma — создает презентации за пару минут по заданной теме

🟣

Grok — универсальный ассистент для ответов, задач и генерации контента

🟡

Gemini — ИИ от Google для поиска, идей и генерации изображений

🔘

Replit — кодинг с телефона с умными подсказками

🔴

Perplexity — умный поисковик, который точно отвечает на вопросы

🔘

Kling — превращает текст в видео по сценарию

🟣

Windsurf — помогает писать, улучшать и оптимизировать код

🟡

Lovable — генерирует стильные и удобные сайты за минуту

🔘

Typefully — инструмент для написания и оформления постов в соцсетях

💡 А теперь дополняем список ТОП-инструментами, которые усиливают продуктивность:

🔴

ChatGPT — классический ИИ-ассистент для всего: от текстов до кода

🔘

CodeGPT — продвинутый чатбот для помощи программистам

🟣

Synthesia и

Runway — генерация и редактирование видео на основе текста

🟡

Suno и

Udio — создают музыку под любой запрос

🔘

Grammarly и

Wordtune — улучшают тексты, стилистику и грамматику

🔴

MidJourney и

Lexica — генерация изображений по описанию

🔘

Canva Magic Studio — делает креативы и дизайн сам по себе

🟣

Bubble и

Bolt — создают веб-приложения без кода

🟡

Copilot — мощный ИИ от Microsoft с функциями ChatGPT и генерацией картинок

🔘

Qwen2-Math — решает сложную математику, идеально для учебы

🔴

Storm — пишет тексты и рефераты на основе проверенных данных

🔘

Whisper — переводит речь из аудио и видео в текст

🟣

Explain Like I’m Five — объясняет любые темы простым и понятным языком

📌 Сохраняйте себе и делитесь с друзьями, они скажут вам спасибо!

Если понравилась подборка, ставь 👍